Instructions And Guidelines For Preparing Small Business Capital Reports

ADVERTISEMENT

I

A

G

F

P

NSTRUCTIONS

ND

UIDELINES

OR

REPARING

S

B

C

R

MALL

USINESS

APITAL

EPORTS

T

68 S

2357.60 - 2357.65 A

R

710:50-15-86

ITLE

ECTION

ND

ULE

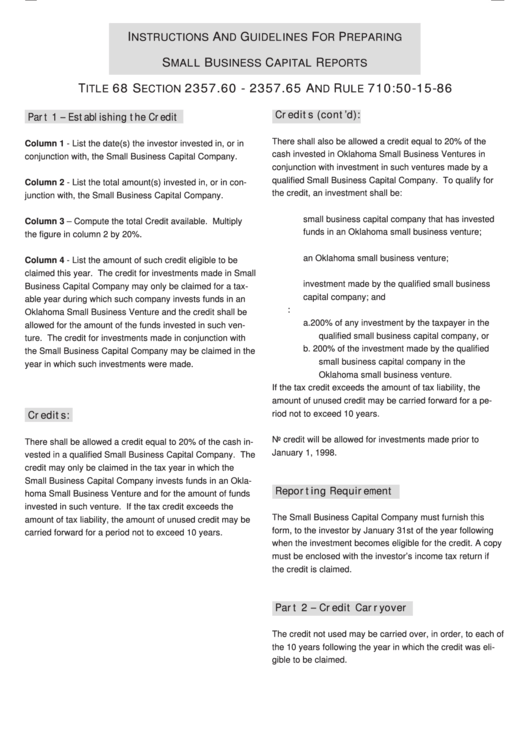

Credits (cont’d):

Part 1 – Establishing the Credit

There shall also be allowed a credit equal to 20% of the

Column 1 - List the date(s) the investor invested in, or in

cash invested in Oklahoma Small Business Ventures in

conjunction with, the Small Business Capital Company.

conjunction with investment in such ventures made by a

qualified Small Business Capital Company. To qualify for

Column 2 - List the total amount(s) invested in, or in con-

the credit, an investment shall be:

junction with, the Small Business Capital Company.

1. Made by a shareholder or partner of a qualified

small business capital company that has invested

Column 3 – Compute the total Credit available. Multiply

funds in an Oklahoma small business venture;

the figure in column 2 by 20%.

2. Invested in the purchase of equity or near-equity in

an Oklahoma small business venture;

Column 4 - List the amount of such credit eligible to be

3. Made under the same terms and conditions as the

claimed this year. The credit for investments made in Small

investment made by the qualified small business

Business Capital Company may only be claimed for a tax-

capital company; and

able year during which such company invests funds in an

4. Limited to the lesser of:

Oklahoma Small Business Venture and the credit shall be

a. 200% of any investment by the taxpayer in the

allowed for the amount of the funds invested in such ven-

qualified small business capital company, or

ture. The credit for investments made in conjunction with

b.

200% of the investment made by the qualified

the Small Business Capital Company may be claimed in the

small business capital company in the

year in which such investments were made.

Oklahoma small business venture.

If the tax credit exceeds the amount of tax liability, the

amount of unused credit may be carried forward for a pe-

riod not to exceed 10 years.

Credits:

No credit will be allowed for investments made prior to

There shall be allowed a credit equal to 20% of the cash in-

January 1, 1998.

vested in a qualified Small Business Capital Company. The

credit may only be claimed in the tax year in which the

Small Business Capital Company invests funds in an Okla-

Reporting Requirement

homa Small Business Venture and for the amount of funds

invested in such venture. If the tax credit exceeds the

The Small Business Capital Company must furnish this

amount of tax liability, the amount of unused credit may be

form, to the investor by January 31st of the year following

carried forward for a period not to exceed 10 years.

when the investment becomes eligible for the credit. A copy

must be enclosed with the investor’s income tax return if

the credit is claimed.

Part 2 – Credit Carryover

The credit not used may be carried over, in order, to each of

the 10 years following the year in which the credit was eli-

gible to be claimed.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1