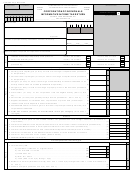

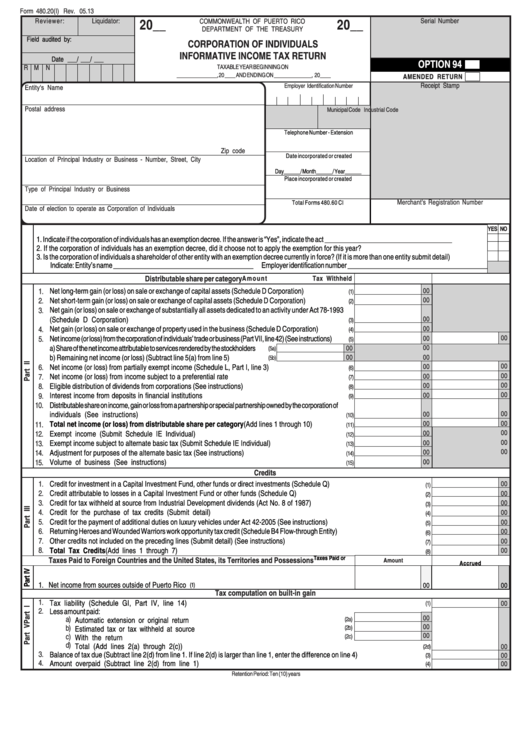

Form 480.20 - Corporation Of Individuals Informative Income Tax Return

ADVERTISEMENT

Form 480.20(I) Rev. 05.13

20__

20__

Serial Number

Reviewer:

Liquidator:

COMMONWEALTH OF PUERTO RICO

DEPARTMENT OF THE TREASURY

Field audited by:

CORPORATION OF INDIVIDUALS

INFORMATIVE INCOME TAX RETURN

Date ___/ ___/ ___

OPTION 94

R

M N

TAXABLE YEAR BEGINNING ON

_______________, 20 ____ AND ENDING ON ______________, 20____

AMENDED RETURN

Receipt Stamp

Employer Identification Number

Entity's Name

Postal address

Industrial Code

Municipal Code

Telephone Number - Extension

Zip code

Date incorporated or created

Location of Principal Industry or Business - Number, Street, City

Day______/ Month______/ Year______

Place incorporated or created

Type of Principal Industry or Business

Merchant's Registration Number

Total Forms 480.60 CI

Date of election to operate as Corporation of Individuals

YES NO

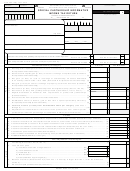

1. Indicate if the corporation of individuals has an exemption decree. If the answer is “Yes”, indicate the act ____________________________________ .................

2. If the corporation of individuals has an exemption decree, did it choose not to apply the exemption for this year? ..................................................................

3. Is the corporation of individuals a shareholder of other entity with an exemption decree currently in force? (If it is more than one entity submit detail) ..................

Indicate: Entity’s name ________________________________________ Employer identification number ________________________________________

Distributable share per category

Amount

Tax Withheld

Net long-term gain (or loss) on sale or exchange of capital assets (Schedule D Corporation) .....................

1.

00

(1)

2.

Net short-term gain (or loss) on sale or exchange of capital assets (Schedule D Corporation) ....................

00

(2)

Net gain (or loss) on sale or exchange of substantially all assets dedicated to an activity under Act 78-1993

3.

(Schedule D Corporation) ...............................................................................................................

00

(3)

Net gain (or loss) on sale or exchange of property used in the business (Schedule D Corporation) .............

00

4.

(4)

00

5.

Net income (or loss) from the corporation of individuals’ trade or business (Part VII, line 42) (See instructions) ......

00

(5)

a) Share of the net income attributable to services rendered by the stockholders ....

00

00

(5a)

b) Remaining net income (or loss) (Subtract line 5(a) from line 5) ..................

00

00

(5b)

00

6.

Net income (or loss) from partially exempt income (Schedule L, Part I, line 3) ........................................

00

(6)

Net income (or loss) from income subject to a preferential rate ..............................................................

00

00

7.

(7)

00

8.

Eligible distribution of dividends from corporations (See instructions) ......................................................

00

(8)

00

9.

Interest income from deposits in financial institutions ............................................................................

00

(9)

Distributable share on income, gain or loss from a partnership or special partnership owned by the corporation of

10.

00

individuals (See instructions) ..........................................................................................................

00

(10)

Total net income (or loss) from distributable share per category (Add lines 1 through 10) ...............

00

00

11.

(11)

00

12.

Exempt income (Submit Schedule IE Individual) ...............................................................................

00

(12)

Exempt income subject to alternate basic tax (Submit Schedule IE Individual) .......................................

00

00

13.

(13)

00

14.

Adjustment for purposes of the alternate basic tax (See instructions) .....................................................

00

(14)

15.

Volume of business (See instructions) ..............................................................................................

00

(15)

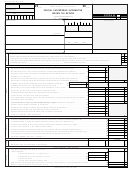

Credits

1.

Credit for investment in a Capital Investment Fund, other funds or direct investments (Schedule Q) ..................................................

00

(1)

2.

Credit attributable to losses in a Capital Investment Fund or other funds (Schedule Q) ....................................................................

00

(2)

3.

Credit for tax withheld at source from Industrial Development dividends (Act No. 8 of 1987) ............................................................

00

(3)

4.

Credit for the purchase of tax credits (Submit detail) ..................................................................................................................

00

(4)

5.

Credit for the payment of additional duties on luxury vehicles under Act 42-2005 (See instructions) ...................................................

00

(5)

6.

Returning Heroes and Wounded Warriors work opportunity tax credit (Schedule B4 Flow-through Entity) ..............................................

00

(6)

7.

Other credits not included on the preceding lines (Submit detail) (See instructions) ..........................................................................

00

(7)

8.

Total Tax Credits (Add lines 1 through 7) ..................................................................................................................................

00

(8)

Taxes Paid or

Taxes Paid to Foreign Countries and the United States, its Territories and Possessions

Amount

Accrued

1. Net income from sources outside of Puerto Rico ......................................................................................

00

(1)

00

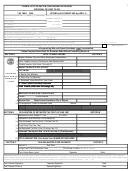

Tax computation on built-in gain

1.

Tax liability (Schedule GI, Part IV, line 14) ..........................................................................................................................

00

(1)

2.

Less amount paid:

00

a)

(2a)

Automatic extension or original return ................................................................................

00

b)

Estimated tax or tax withheld at source .............................................................................

(2b)

00

c)

With the return ...............................................................................................................

(2c)

d)

Total (Add lines 2(a) through 2(c)) ..............................................................................................................................

00

(2d)

3.

Balance of tax due (Subtract line 2(d) from line 1. If line 2(d) is larger than line 1, enter the difference on line 4) ..................................

00

(3)

4.

Amount overpaid (Subtract line 2(d) from line 1) .......................................................................................................................

(4)

00

Retention Period: Ten (10) years

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4