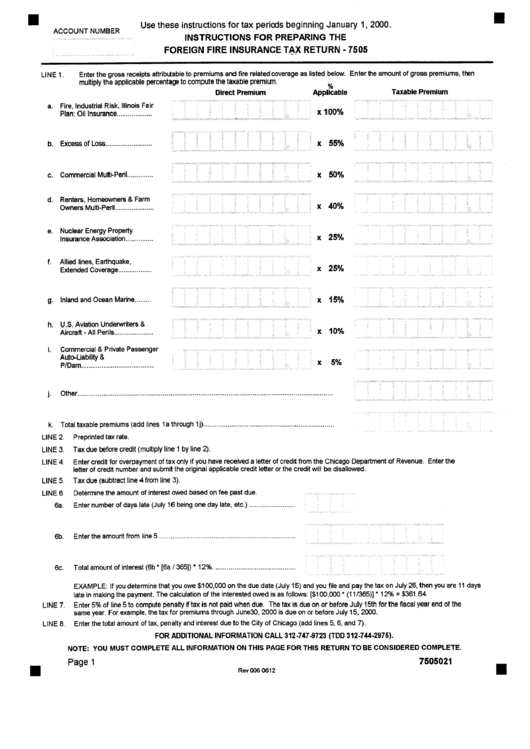

Instructions For Preparing The Foreign Fire Insurance Tax Return (Form 7505) - Chicago Department Of Finance

ADVERTISEMENT

B

ACCOUNTNUMBER

.

. . .

, . ,

. , , . . , , , . , . . . . . . ,

, . . , .

, ,

.

. .

i i

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

U s e t h e s e i n s t r u c t i o n s f o r t a x p e r i o d s b e g i n n i n g

J a n u a r y

1, 2 0 0 0 .

I N S T R U C T I O N S

F O R P R E P A R I N G

T H E

F O R E I G N

F I R E I N S U R A N C E

T A X R E T U R N

- 7 5 0 5

B

LINE 1.

Enter the gross receipts attribLtable to premiums and fire related coverage as listed below. Enter me amount of gross premiums, then

multiply the applicable percentage to compute the taxable premium.

%

Direct Premium

Applicable

Taxable Premium

. . . . . . . . . . .

. . • . . . . , . - . •

. . . . . , . . . . , . , . .

, . . . , . . . . ,

. . ,

. . . . , . , . . . . . ,

, . . ,

. . . , . . , . . . . ,

. . . . ,

. . . . . .

a.

Fire, Industrial Risk, Illinois Fair

Plan; Oil Insurance . . . . . . . . . . . . . . . . . . . . . . . . . . .

x 1 0 0 %

~

:

. . . . . , . . . , , . . , . . . . , . , . , . . . . . . . . . . . , . ,

. . , . , ,

. . , , , .

, , ,

, , , , , . , . . , , , , , , . .

, , ,

. . ,

, , , . . . ,

. , . ,

, , . . .

,

.

.

.

.

.

.

.

.

.

.

.

.

.

,

.

.

-

.

-

-

.

.

.

.

.

,

.

,

.

.

.

.

.

.

.

.

•

. . . . . . .

, . .

.............. :; .... ii ...... ~! ...... ii ..... • .... ii ....... il .... ii ..... ~i ..... :i

b.

Excess of Loss .........................

x

5 5 %

' : ' i ii i : i , ' i

ii

c.

Commercial Multi-Peril ..............

i:

!:

::

i:

i

ii

x

5 0 %

. ,

. . . . . ,

, . , . . . , .

, . , . ,

, , , . , ,

. . , ,

. , ,

, .

, . , . ,

. . . . . . . , ,

, , . . . . , . . . , , , . ,

, , , .

, , , , . ,

, , . . . . . . . .

, , , . , . ,

, . . , . ,

, , , .

• •

d.

Renters, Homeowners & Farm

Owners Multi-Peril .....................

x

4 0 %

e.

Nuclear Energy Property

Insurance Association ...............

x

2 5 %

Allied lines, Earthquake,

Extended Coverage ..................

x

2 5 %

g.

Inland and Ocean Marine .........

x

1 5 %

- . ,

, . . , . . . . . . . . . .

h.

U.S. Aviation Underwriters &

Aircraft - All Perils .....................

Commercial & Private Passenger

Auto-Liability &

P/Dam .......................................

x

1 0 %

•

. . . . , . . . . . . , . , . . . . . , . . . . ,

. . , . ,

. , . .

::

;i

x

5 %

:

•

:

: .

j.

Other

.........................................................................................................................................

. . . . . . . . . . • , . . ,

, . . •

. . . . . , , ` . ,

, . • . . . . . .

, . . . . . . . . . . • . . . . . . , . , . . , . . . . . .

, . . . . . . . . . . . . .

k .

LINE 2.

LINE 3.

LINE 4.

LINE 5.

LINE 6.

6a.

6b.

Total taxable premiums (add lines 1 a through l j) .....................................................................

Preprinted tax rate.

Tax due before credit (multiply line 1 by line 2).

Enter credit for overpayment of tax only if you have received a letter of credit from the Chicago Department of Revenue. Enter the

letter of credit number and submit the original applicable credit letter or the credit will be disallowed.

Tax due (subtract line 4 from line 3).

Determine the amount of interest owed based on fee past due

.

.

.

.

.

.

.

.

.

.

.

.

i .........

Enter number of days late (July 16 being one day late, etc.) .........................

. . . . . .

.

.

.

.

,

.

,

.

,

,

. , , , , ,

. - . . ,

•

- , . ,

Enter the amount from line 5 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

......... i ............ : ............. i ..........................................................................

6c.

LINE 7.

LINE 8.

II

Total amount of interest (6b * [6a / 365]) * 12%.

.

. . ....... ...............

........... ...... ::.. .....

EXAMPLE: If you determine that you owe $100,000 on the due date (July t5) and you file and pay the tax on July 26, then you are 11 days

late in making the payment. The calculation of the interested owed is as follows: [$100,000 * (11/365)] * 12% = $361.64•

Enter 5% of line 5 to compute penalty if tax is not paid when due. The tax is due on or before July 15th for the fiscal year end of the

same year. For example, the tax for premiums through June30, 2000 is due on or before July 15, 2000.

Enter the total amount of tax, penalty and interest due to the City of Chicago (add lines 5, 6, and 7).

FOR ADDITIONAL INFORMATION CALL 312-747-9723 (TDD 312-744-2975).

NOTE: YOU MUST COMPLETE ALL INFORMATION ON THIS PAGE FOR THIS RETURN TO BE CONSIDERED COMPLETE.

P a g e 1

7 5 0 5 0 2 1

Rev 006 0612

II

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1