Instructions For Form 8453-E (1998)

ADVERTISEMENT

2

Form 8453-E (1998)

Page

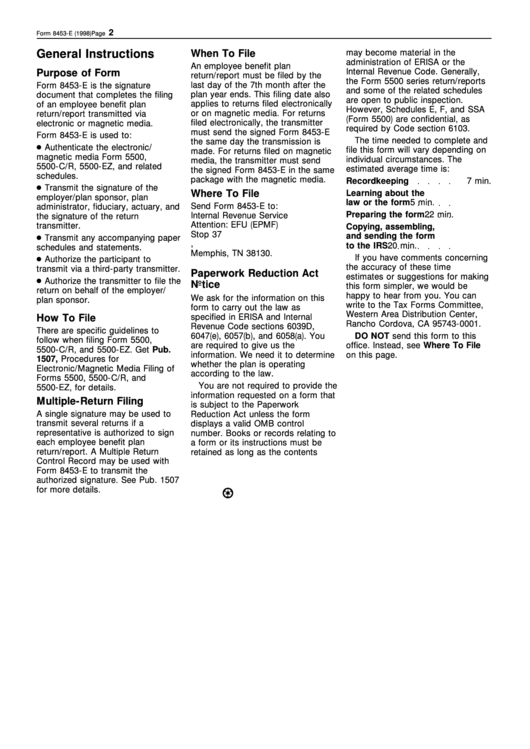

General Instructions

When To File

may become material in the

administration of ERISA or the

An employee benefit plan

Internal Revenue Code. Generally,

Purpose of Form

return/report must be filed by the

the Form 5500 series return/reports

last day of the 7th month after the

Form 8453-E is the signature

and some of the related schedules

plan year ends. This filing date also

document that completes the filing

are open to public inspection.

applies to returns filed electronically

of an employee benefit plan

However, Schedules E, F, and SSA

or on magnetic media. For returns

return/report transmitted via

(Form 5500) are confidential, as

filed electronically, the transmitter

electronic or magnetic media.

required by Code section 6103.

must send the signed Form 8453-E

Form 8453-E is used to:

The time needed to complete and

the same day the transmission is

Authenticate the electronic/

file this form will vary depending on

made. For returns filed on magnetic

magnetic media Form 5500,

individual circumstances. The

media, the transmitter must send

5500-C/R, 5500-EZ, and related

estimated average time is:

the signed Form 8453-E in the same

schedules.

package with the magnetic media.

Recordkeeping

7 min.

Transmit the signature of the

Where To File

Learning about the

employer/plan sponsor, plan

law or the form

5 min.

Send Form 8453-E to:

administrator, fiduciary, actuary, and

Preparing the form

22 min.

Internal Revenue Service

the signature of the return

Attention: EFU (EPMF)

transmitter.

Copying, assembling,

Stop 37

and sending the form

Transmit any accompanying paper

P.O. Box 30309, A.M.F.

to the IRS

20 min.

schedules and statements.

Memphis, TN 38130.

If you have comments concerning

Authorize the participant to

the accuracy of these time

transmit via a third-party transmitter.

Paperwork Reduction Act

estimates or suggestions for making

Authorize the transmitter to file the

Notice

this form simpler, we would be

return on behalf of the employer/

happy to hear from you. You can

We ask for the information on this

plan sponsor.

write to the Tax Forms Committee,

form to carry out the law as

Western Area Distribution Center,

specified in ERISA and Internal

How To File

Rancho Cordova, CA 95743-0001.

Revenue Code sections 6039D,

There are specific guidelines to

6047(e), 6057(b), and 6058(a). You

DO NOT send this form to this

follow when filing Form 5500,

are required to give us the

office. Instead, see Where To File

5500-C/R, and 5500-EZ. Get Pub.

information. We need it to determine

on this page.

1507, Procedures for

whether the plan is operating

Electronic/Magnetic Media Filing of

according to the law.

Forms 5500, 5500-C/R, and

You are not required to provide the

5500-EZ, for details.

information requested on a form that

Multiple-Return Filing

is subject to the Paperwork

A single signature may be used to

Reduction Act unless the form

transmit several returns if a

displays a valid OMB control

representative is authorized to sign

number. Books or records relating to

each employee benefit plan

a form or its instructions must be

return/report. A Multiple Return

retained as long as the contents

Control Record may be used with

Form 8453-E to transmit the

authorized signature. See Pub. 1507

for more details.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1