Michigan Individual Income Tax Declaration For Electronic Filing (Form Mi-8453)

ADVERTISEMENT

MICHIGAN INDIVIDUAL INCOME TAX DECLARATION

FOR ELECTRONIC FILING (FORM MI-8453)

You must complete your Michigan Income Tax Return (form

Line 8: The account number can be up to 17 characters (both

MI-1040) before completing form MI-8453. If you file a

numbers and letters). Include hyphens but omit spaces and

property tax credit claim, it must be filed with your MI-1040.

special symbols. Enter the number from left to right and leave

You cannot file electronically if you file a Michigan Income Tax

unused boxes blank.

Easy Return (form MI-1040EZ). The MI-8453 must be

Note: If you are filing a home heating credit claim (form MI-

completed before taxpayers, electronic return originators

1040CR-7) you may request direct deposit of the home heating

(ERO's) and preparers sign it.

credit only if you are receiving a check.

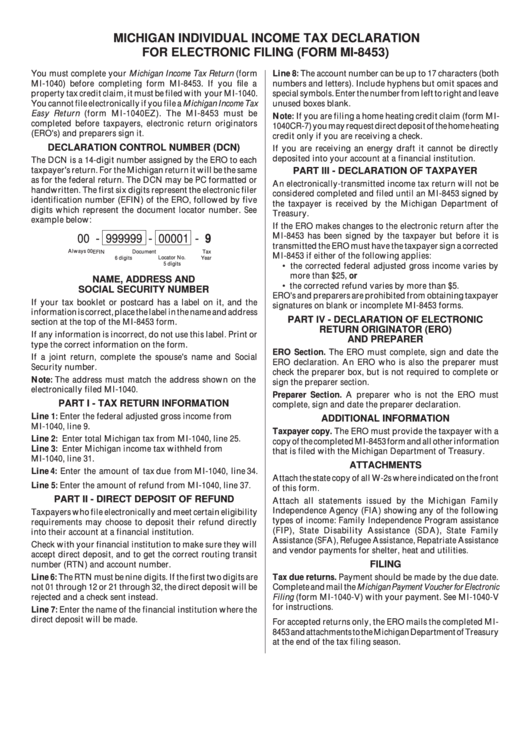

DECLARATION CONTROL NUMBER (DCN)

If you are receiving an energy draft it cannot be directly

deposited into your account at a financial institution.

The DCN is a 14-digit number assigned by the ERO to each

taxpayer's return. For the Michigan return it will be the same

PART III - DECLARATION OF TAXPAYER

as for the federal return. The DCN may be PC formatted or

An electronically-transmitted income tax return will not be

handwritten. The first six digits represent the electronic filer

considered completed and filed until an MI-8453 signed by

identification number (EFIN) of the ERO, followed by five

the taxpayer is received by the Michigan Department of

digits which represent the document locator number. See

Treasury.

example below:

If the ERO makes changes to the electronic return after the

MI-8453 has been signed by the taxpayer but before it is

00 - 999999 - 00001 - 9

transmitted the ERO must have the taxpayer sign a corrected

Always 00

Document

EFIN

Tax

MI-8453 if either of the following applies:

Locator No.

6 digits

Year

5 digits

• the corrected federal adjusted gross income varies by

more than $25, or

NAME, ADDRESS AND

• the corrected refund varies by more than $5.

SOCIAL SECURITY NUMBER

ERO's and preparers are prohibited from obtaining taxpayer

If your tax booklet or postcard has a label on it, and the

signatures on blank or incomplete MI-8453 forms.

information is correct, place the label in the name and address

PART IV - DECLARATION OF ELECTRONIC

section at the top of the MI-8453 form.

RETURN ORIGINATOR (ERO)

If any information is incorrect, do not use this label. Print or

AND PREPARER

type the correct information on the form.

ERO Section. The ERO must complete, sign and date the

If a joint return, complete the spouse's name and Social

ERO declaration. An ERO who is also the preparer must

Security number.

check the preparer box, but is not required to complete or

Note: The address must match the address shown on the

sign the preparer section.

electronically filed MI-1040.

Preparer Section. A preparer who is not the ERO must

PART I - TAX RETURN INFORMATION

complete, sign and date the preparer declaration.

Line 1: Enter the federal adjusted gross income from

ADDITIONAL INFORMATION

MI-1040, line 9.

Taxpayer copy. The ERO must provide the taxpayer with a

Line 2: Enter total Michigan tax from MI-1040, line 25.

copy of the completed MI-8453 form and all other information

Line 3: Enter Michigan income tax withheld from

that is filed with the Michigan Department of Treasury.

MI-1040, line 31.

ATTACHMENTS

Line 4: Enter the amount of tax due from MI-1040, line 34.

Attach the state copy of all W-2s where indicated on the front

Line 5: Enter the amount of refund from MI-1040, line 37.

of this form.

PART II - DIRECT DEPOSIT OF REFUND

Attach all statements issued by the Michigan Family

Independence Agency (FIA) showing any of the following

Taxpayers who file electronically and meet certain eligibility

types of income: Family Independence Program assistance

requirements may choose to deposit their refund directly

(FIP), State Disability Assistance (SDA), State Family

into their account at a financial institution.

Assistance (SFA), Refugee Assistance, Repatriate Assistance

Check with your financial institution to make sure they will

and vendor payments for shelter, heat and utilities.

accept direct deposit, and to get the correct routing transit

FILING

number (RTN) and account number.

Line 6: The RTN must be nine digits. If the first two digits are

Tax due returns. Payment should be made by the due date.

not 01 through 12 or 21 through 32, the direct deposit will be

Complete and mail the Michigan Payment Voucher for Electronic

rejected and a check sent instead.

Filing (form MI-1040-V) with your payment. See MI-1040-V

for instructions.

Line 7: Enter the name of the financial institution where the

direct deposit will be made.

For accepted returns only, the ERO mails the completed MI-

8453 and attachments to the Michigan Department of Treasury

at the end of the tax filing season.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1