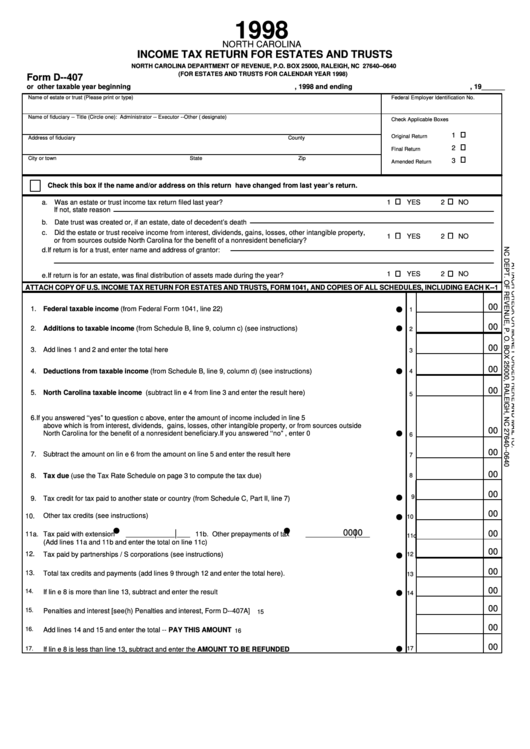

1998

NORTH CAROLINA

INCOME TAX RETURN FOR ESTATES AND TRUSTS

NORTH CAROLINA DEPARTMENT OF REVENUE, P.O. BOX 25000, RALEIGH, NC 27640--0640

(FOR ESTATES AND TRUSTS FOR CALENDAR YEAR 1998)

Form D--407

or other taxable year beginning

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

, 1998 and ending

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

, 19______

Name of estate or trust (Please print or type)

Federal Employer Identification No.

Name of fiduciary -- Title (Circle one): Administrator -- Executor -- Other ( designate)

Check Applicable Boxes

1

Original Return

Address of fiduciary

County

2

Final Return

City or town

State

Zip

3

Amended Return

Check this box if the name and/or address on this return have changed from last year’ s return.

a. Was an estate or trust income tax return filed last year?

1

YES

2

NO

If not, state reason

b. Date trust was created or, if an estate, date of decedent’ s death

c. Did the estate or trust receive income from interest, dividends, gains, losses, other intangible property,

1

YES

2

NO

or from sources outside North Carolina for the benefit of a nonresident beneficiary?

d. If return is for a trust, enter name and address of grantor:

1

YES

2

NO

e. If return is for an estate, was final distribution of assets made during the year?

ATTACH COPY OF U.S. INCOME TAX RETURN FOR ESTATES AND TRUSTS, FORM 1041, AND COPIES OF ALL SCHEDULES, INCLUDING EACH K--1

00

D

1. Federal taxable income (from Federal Form 1041, line 22) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1

00

D

2. Additions to taxable income (from Schedule B, line 9, column c) (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . .

2

00

3. Add lines 1 and 2 and enter the total here . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

00

D

4. Deductions from taxable income (from Schedule B, line 9, column d) (see instructions) . . . . . . . . . . . . . . . . . . . . . . .

4

00

5. North Carolina taxable income (subtract line 4 from line 3 and enter the result here) . . . . . . . . . . . . . . . . . . . . . . . . . .

5

6. If you answered ‘ ‘ yes”to question c above, enter the amount of income included in line 5

above which is from interest, dividends, gains, losses, other intangible property, or from sources outside

00

D

North Carolina for the benefit of a nonresident beneficiary. If you answered ‘ ‘ no”, enter 0 . . . . . . . . . . . . . . . . . . . . . . .

6

00

7. Subtract the amount on line 6 from the amount on line 5 and enter the result here . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7

00

8. Tax due (use the Tax Rate Schedule on page 3 to compute the tax due) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8

00

D

9

9. Tax credit for tax paid to another state or country (from Schedule C, Part II, line 7) . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

00

Other tax credits (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

10.

D

10

D

D

|

00

|

00

00

Tax paid with extension

11b. Other prepayments of tax

. . . . . . . . . . .

11a.

_______________

____

_______________

____

11c

(Add lines 11a and 11b and enter the total on line 11c)

00

12.

Tax paid by partnerships / S corporations (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

D

12

00

13.

Total tax credits and payments (add lines 9 through 12 and enter the total here). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

13

00

14.

If line 8 is more than line 13, subtract and enter the result . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

D

14

00

15.

Penalties and interest [see(h) Penalties and interest, Form D--407A] . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

15

00

16.

Add lines 14 and 15 and enter the total -- PAY THIS AMOUNT . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

16

00

D

17

17.

If line 8 is less than line 13, subtract and enter the AMOUNT TO BE REFUNDED . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1

1 2

2 3

3