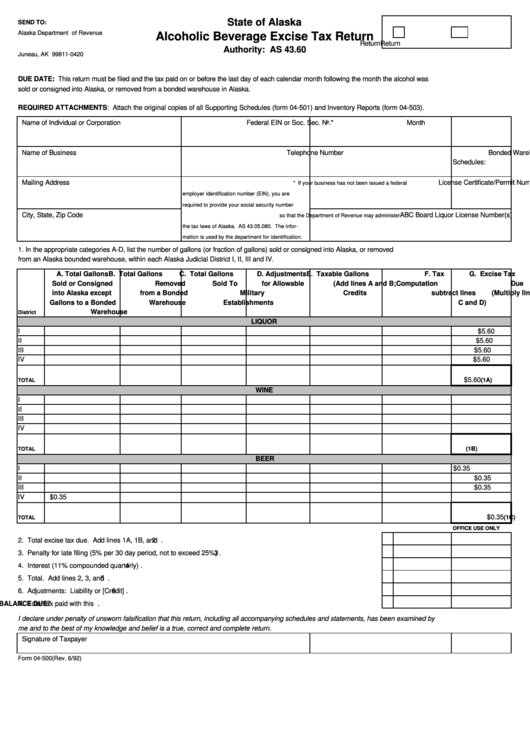

State of Alaska

Check one:

SEND TO:

Original

Amended

Alaska Department of Revenue

Alcoholic Beverage Excise Tax Return

Return

Return

P.O. Box 110420

Authority: AS 43.60

Juneau, AK 99811-0420

DUE DATE: This return must be filed and the tax paid on or before the last day of each calendar month following the month the alcohol was

sold or consigned into Alaska, or removed from a bonded warehouse in Alaska.

REQUIRED ATTACHMENTS: Attach the original copies of all Supporting Schedules (form 04-501) and Inventory Reports (form 04-503).

Name of Individual or Corporation

Federal EIN or Soc. Sec. No.*

Month

Year

Name of Business

Telephone Number

Bonded Warehouse License No.

No. of Supporting

Schedules:

Mailing Address

License Certificate/Permit Number

No. of Inventory

* If your business has not been issued a federal

Reports:

employer identification number (EIN), you are

required to provide your social security number

City, State, Zip Code

ABC Board Liquor License Number(s)

so that the Department of Revenue may administer

the tax laws of Alaska. AS 43.05.080. The infor-

mation is used by the department for identification.

1. In the appropriate categories A-D, list the number of gallons (or fraction of gallons) sold or consigned into Alaska, or removed

from an Alaska bounded warehouse, within each Alaska Judicial District I, II, III and IV.

A. Total Gallons

B. Total Gallons

C. Total Gallons

D. Adjustments

E. Taxable Gallons

F. Tax

G. Excise Tax

Sold or Consigned

Removed

Sold To

for Allowable

(Add lines A and B;

Computation

Due

into Alaska except

from a Bonded

Military

Credits

subtract lines

(Multiply line E by

Gallons to a Bonded

Warehouse

Establishments

C and D)

the appropriate

Warehouse

tax rate)

District

LIQUOR

I

$5.60

II

$5.60

III

$5.60

IV

$5.60

$5.60

(1A)

TOTAL

WINE

I

II

III

IV

(1B)

TOTAL

BEER

I

$0.35

II

$0.35

III

$0.35

IV

$0.35

$0.35

(1C)

TOTAL

OFFICE USE ONLY

2. Total excise tax due. Add lines 1A, 1B, and 1C............................................................................................................................

2

3. Penalty for late filing (5% per 30 day period, not to exceed 25%)................................................................................................ 3

4. Interest (11% compounded quarterly)...............................................................................................................................................

4

5. Total. Add lines 2, 3, and 4..........................................................................................................................................................

5

6. Adjustments: Liability or [Credit]......................................................................................................................................................

6

7. Total tax paid with this return................................................................................................................................................................

BALANCE DUE

7

I declare under penalty of unsworn falsification that this return, including all accompanying schedules and statements, has been examined by

me and to the best of my knowledge and belief is a true, correct and complete return.

Signature of Taxpayer

Title

Date

Form 04-500(Rev. 6/92)

1

1