Instructions For Schedule Os-E - Wisconsin Department Of Revenue - 2007

ADVERTISEMENT

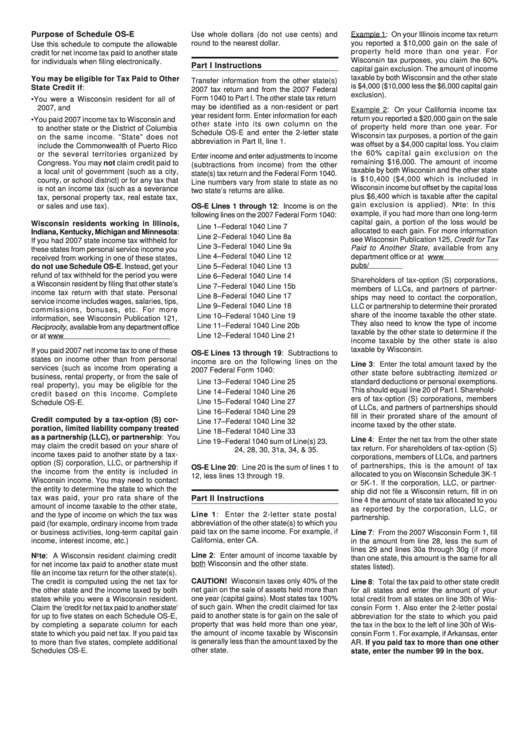

Purpose of Schedule OS-E

Use whole dollars (do not use cents) and

Example 1: On your Illinois income tax return

round to the nearest dollar.

you reported a $10,000 gain on the sale of

Use this schedule to compute the allowable

property held more than one year. For

credit for net income tax paid to another state

Wisconsin tax purposes, you claim the 60%

for individuals when filing electronically.

Part I Instructions

capital gain exclusion. The amount of income

taxable by both Wisconsin and the other state

You may be eligible for Tax Paid to Other

Transfer information from the other state(s)

is $4,000 ($10,000 less the $6,000 capital gain

State Credit if:

2007 tax return and from the 2007 Federal

exclusion).

Form 1040 to Part I. The other state tax return

• You were a Wisconsin resident for all of

may be identified as a non-resident or part

2007, and

Example 2: On your California income tax

year resident form. Enter information for each

return you reported a $20,000 gain on the sale

• You paid 2007 income tax to Wisconsin and

other state into its own column on the

of property held more than one year. For

to another state or the District of Columbia

Schedule OS-E and enter the 2-letter state

Wisconsin tax purposes, a portion of the gain

on the same income. “State” does not

abbreviation in Part II, line 1.

was offset by a $4,000 capital loss. You claim

include the Commonwealth of Puerto Rico

the 60% capital gain exclusion on the

or the several territories organized by

Enter income and enter adjustments to income

remaining $16,000. The amount of income

Congress. You may not claim credit paid to

(subtractions from income) from the other

taxable by both Wisconsin and the other state

a local unit of government (such as a city,

state(s) tax return and the Federal Form 1040.

is $10,400 ($4,000 which is included in

county, or school district) or for any tax that

Line numbers vary from state to state as no

Wisconsin income but offset by the capital loss

is not an income tax (such as a severance

two state’s returns are alike.

plus $6,400 which is taxable after the capital

tax, personal property tax, real estate tax,

gain exclusion is applied). Note: In this

or sales and use tax).

OS-E Lines 1 through 12: Income is on the

example, if you had more than one long-term

following lines on the 2007 Federal Form 1040:

capital gain, a portion of the loss would be

Wisconsin residents working in Illinois,

Line 1

– Federal 1040 Line 7

allocated to each gain. For more information

Indiana, Kentucky, Michigan and Minnesota:

Line 2

– Federal 1040 Line 8a

see Wisconsin Publication 125, Credit for Tax

If you had 2007 state income tax withheld for

Line 3

– Federal 1040 Line 9a

Paid to Another State, available from any

these states from personal service income you

Line 4

– Federal 1040 Line 12

department office or at

received from working in one of these states,

pubs/pb125.pdf.

Line 5

– Federal 1040 Line 13

do not use Schedule OS-E. Instead, get your

refund of tax withheld for the period you were

Line 6

– Federal 1040 Line 14

Shareholders of tax-option (S) corporations,

a Wisconsin resident by filing that other state’s

Line 7

– Federal 1040 Line 15b

members of LLCs, and partners of partner-

income tax return with that state. Personal

Line 8

– Federal 1040 Line 17

ships may need to contact the corporation,

service income includes wages, salaries, tips,

Line 9

– Federal 1040 Line 18

LLC or partnership to determine their prorated

commissions, bonuses, etc. For more

share of the income taxable the other state.

Line 10 – Federal 1040 Line 19

information, see Wisconsin Publication 121,

They also need to know the type of income

Line 11 – Federal 1040 Line 20b

Reciprocity, available from any department office

taxable by the other state to determine if the

or at pubs/pb121.pdf.

Line 12 – Federal 1040 Line 21

income taxable by the other state is also

taxable by Wisconsin.

If you paid 2007 net income tax to one of these

OS-E Lines 13 through 19: Subtractions to

states on income other than from personal

income are on the following lines on the

Line 3: Enter the total amount taxed by the

services (such as income from operating a

2007 Federal Form 1040:

other state before subtracting itemized or

business, rental property, or from the sale of

standard deductions or personal exemptions.

Line 13 – Federal 1040 Line 25

real property), you may be eligible for the

This should equal line 20 of Part I. Sharehold-

Line 14 – Federal 1040 Line 26

credit based on this income. Complete

ers of tax-option (S) corporations, members

Line 15 – Federal 1040 Line 27

Schedule OS-E.

of LLCs, and partners of partnerships should

Line 16 – Federal 1040 Line 29

fill in their prorated share of the amount of

Credit computed by a tax-option (S) cor-

Line 17 – Federal 1040 Line 32

income taxed by the other state.

poration, limited liability company treated

Line 18 – Federal 1040 Line 33

as a partnership (LLC), or partnership: You

Line 4: Enter the net tax from the other state

Line 19 – Federal 1040 sum of Line(s) 23,

may claim the credit based on your share of

tax return. For shareholders of tax-option (S)

24, 28, 30, 31a, 34, & 35.

income taxes paid to another state by a tax-

corporations, members of LLCs, and partners

option (S) corporation, LLC, or partnership if

of partnerships, this is the amount of tax

OS-E Line 20: Line 20 is the sum of lines 1 to

the income from the entity is included in

allocated to you on Wisconsin Schedule 3K-1

12, less lines 13 through 19.

Wisconsin income. You may need to contact

or 5K-1. If the corporation, LLC, or partner-

the entity to determine the state to which the

ship did not file a Wisconsin return, fill in on

tax was paid, your pro rata share of the

Part II Instructions

line 4 the amount of state tax allocated to you

amount of income taxable to the other state,

as reported by the corporation, LLC, or

Line 1: Enter the 2-letter state postal

and the type of income on which the tax was

partnership.

abbreviation of the other state(s) to which you

paid (for example, ordinary income from trade

paid tax on the same income. For example, if

or business activities, long-term capital gain

Line 7: From the 2007 Wisconsin Form 1, fill

California, enter CA.

income, interest income, etc.)

in the amount from line 28, less the sum of

lines 29 and lines 30a through 30g (if more

Line 2: Enter amount of income taxable by

Note: A Wisconsin resident claiming credit

than one state, this amount is the same for all

both Wisconsin and the other state.

for net income tax paid to another state must

states listed).

file an income tax return for the other state(s).

CAUTION! Wisconsin taxes only 40% of the

The credit is computed using the net tax for

Line 8: Total the tax paid to other state credit

net gain on the sale of assets held more than

the other state and the income taxed by both

for all states and enter the amount of your

one year (capital gains). Most states tax 100%

states while you were a Wisconsin resident.

total credit from all states on line 30h of Wis-

of such gain. When the credit claimed for tax

Claim the ‘credit for net tax paid to another state’

consin Form 1. Also enter the 2-letter postal

paid to another state is for gain on the sale of

for up to five states on each Schedule OS-E,

abbreviation for the state to which you paid

property that was held more than one year,

by completing a separate column for each

the tax in the box to the left of line 30h of Wis-

the amount of income taxable by Wisconsin

state to which you paid net tax. If you paid tax

consin Form 1. For example, if Arkansas, enter

is generally less than the amount taxed by the

to more than five states, complete additional

AR. If you paid tax to more than one other

other state.

Schedules OS-E.

state, enter the number 99 in the box.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1