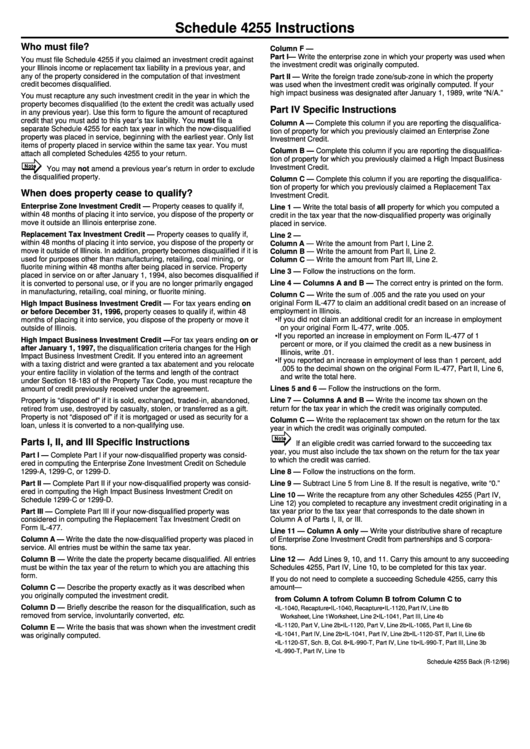

Schedule 4255 Instructions

ADVERTISEMENT

Schedule 4255 Instructions

Who must file?

Column F —

Part I — Write the enterprise zone in which your property was used when

You must file Schedule 4255 if you claimed an investment credit against

the investment credit was originally computed.

your Illinois income or replacement tax liability in a previous year, and

any of the property considered in the computation of that investment

Part II — Write the foreign trade zone/sub-zone in which the property

credit becomes disqualified.

was used when the investment credit was originally computed. If your

high impact business was designated after January 1, 1989, write “N/A.”

You must recapture any such investment credit in the year in which the

property becomes disqualified (to the extent the credit was actually used

Part IV Specific Instructions

in any previous year). Use this form to figure the amount of recaptured

credit that you must add to this year’s tax liability. You must file a

Column A — Complete this column if you are reporting the disqualifica-

separate Schedule 4255 for each tax year in which the now-disqualified

tion of property for which you previously claimed an Enterprise Zone

property was placed in service, beginning with the earliest year. Only list

Investment Credit.

items of property placed in service within the same tax year. You must

Column B — Complete this column if you are reporting the disqualifica-

attach all completed Schedules 4255 to your return.

tion of property for which you previously claimed a High Impact Business

Investment Credit.

You may not amend a previous year’s return in order to exclude

the disqualified property.

Column C — Complete this column if you are reporting the disqualifica-

tion of property for which you previously claimed a Replacement Tax

When does property cease to qualify?

Investment Credit.

Enterprise Zone Investment Credit — Property ceases to qualify if,

Line 1 — Write the total basis of all property for which you computed a

within 48 months of placing it into service, you dispose of the property or

credit in the tax year that the now-disqualified property was originally

move it outside an Illinois enterprise zone.

placed in service.

Replacement Tax Investment Credit — Property ceases to qualify if,

Line 2 —

within 48 months of placing it into service, you dispose of the property or

Column A — Write the amount from Part I, Line 2.

move it outside of Illinois. In addition, property becomes disqualified if it is

Column B — Write the amount from Part II, Line 2.

used for purposes other than manufacturing, retailing, coal mining, or

Column C — Write the amount from Part III, Line 2.

fluorite mining within 48 months after being placed in service. Property

Line 3 — Follow the instructions on the form.

placed in service on or after January 1, 1994, also becomes disqualified if

Line 4 — Columns A and B — The correct entry is printed on the form.

it is converted to personal use, or if you are no longer primarily engaged

in manufacturing, retailing, coal mining, or fluorite mining.

Column C — Write the sum of .005 and the rate you used on your

original Form IL-477 to claim an additional credit based on an increase of

High Impact Business Investment Credit — For tax years ending on

or before December 31, 1996, property ceases to qualify if, within 48

employment in Illinois.

• If you did not claim an additional credit for an increase in employment

months of placing it into service, you dispose of the property or move it

on your original Form IL-477, write .005.

outside of Illinois.

• If you reported an increase in employment on Form IL-477 of 1

High Impact Business Investment Credit —For tax years ending on or

percent or more, or if you claimed the credit as a new business in

after January 1, 1997, the disqualification criteria changes for the High

Illinois, write .01.

Impact Business Investment Credit. If you entered into an agreement

• If you reported an increase in employment of less than 1 percent, add

with a taxing district and were granted a tax abatement and you relocate

.005 to the decimal shown on the original Form IL-477, Part II, Line 6,

your entire facility in violation of the terms and length of the contract

and write the total here.

under Section 18-183 of the Property Tax Code, you must recapture the

Lines 5 and 6 — Follow the instructions on the form.

amount of credit previously received under the agreement.

Property is “disposed of” if it is sold, exchanged, traded-in, abandoned,

Line 7 — Columns A and B — Write the income tax shown on the

return for the tax year in which the credit was originally computed.

retired from use, destroyed by casualty, stolen, or transferred as a gift.

Property is not “disposed of” if it is mortgaged or used as security for a

Column C — Write the replacement tax shown on the return for the tax

loan, unless it is converted to a non-qualifying use.

year in which the credit was originally computed.

Parts I, II, and III Specific Instructions

If an eligible credit was carried forward to the succeeding tax

year, you must also include the tax shown on the return for the tax year

Part I — Complete Part I if your now-disqualified property was consid-

to which the credit was carried.

ered in computing the Enterprise Zone Investment Credit on Schedule

1299-A, 1299-C, or 1299-D.

Line 8 — Follow the instructions on the form.

Part II — Complete Part II if your now-disqualified property was consid-

Line 9 — Subtract Line 5 from Line 8. If the result is negative, write “0.”

ered in computing the High Impact Business Investment Credit on

Line 10 — Write the recapture from any other Schedules 4255 (Part IV,

Schedule 1299-C or 1299-D.

Line 12) you completed to recapture any investment credit originating in a

Part III — Complete Part III if your now-disqualified property was

tax year prior to the tax year that corresponds to the date shown in

Column A of Parts I, II, or III.

considered in computing the Replacement Tax Investment Credit on

Form IL-477.

Line 11 — Column A only — Write your distributive share of recapture

of Enterprise Zone Investment Credit from partnerships and S corpora-

Column A — Write the date the now-disqualified property was placed in

service. All entries must be within the same tax year.

tions.

Column B — Write the date the property became disqualified. All entries

Line 12 — Add Lines 9, 10, and 11. Carry this amount to any succeeding

must be within the tax year of the return to which you are attaching this

Schedules 4255, Part IV, Line 10, to be completed for this tax year.

form.

If you do not need to complete a succeeding Schedule 4255, carry this

Column C — Describe the property exactly as it was described when

amount—

you originally computed the investment credit.

from Column A to

from Column B to

from Column C to

Column D — Briefly describe the reason for the disqualification, such as

• IL-1040, Recapture

• IL-1040, Recapture

• IL-1120, Part IV, Line 8b

removed from service, involuntarily converted, etc .

Worksheet, Line 1

Worksheet, Line 2

• IL-1041, Part III, Line 4b

• IL-1120, Part V, Line 2b

• IL-1120, Part V, Line 2b

• IL-1065, Part II, Line 6b

Column E — Write the basis that was shown when the investment credit

• IL-1041, Part IV, Line 2b

• IL-1041, Part IV, Line 2b

• IL-1120-ST, Part II, Line 6b

was originally computed.

• IL-1120-ST, Sch. B, Col. 8 • IL-990-T, Part IV, Line 1b

• IL-990-T, Part III, Line 3b

• IL-990-T, Part IV, Line 1b

Schedule 4255 Back (R-12/96)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1