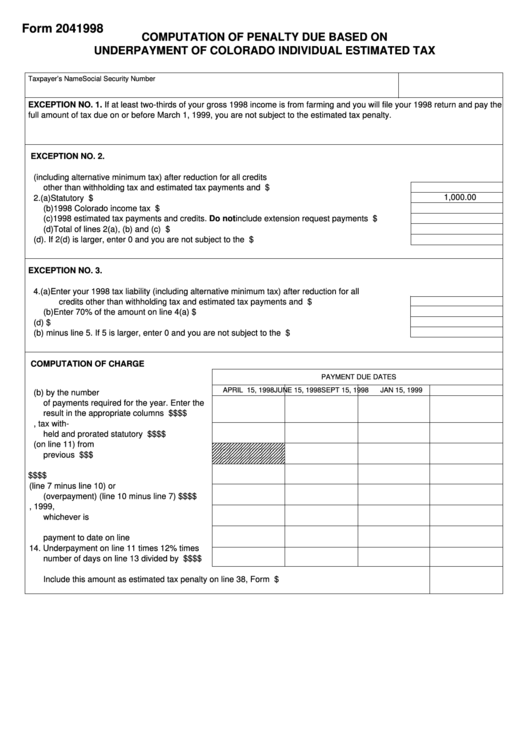

Form 204

1998

COMPUTATION OF PENALTY DUE BASED ON

UNDERPAYMENT OF COLORADO INDIVIDUAL ESTIMATED TAX

Taxpayer’s Name

Social Security Number

EXCEPTION NO. 1. If at least two-thirds of your gross 1998 income is from farming and you will file your 1998 return and pay the

full amount of tax due on or before March 1, 1999, you are not subject to the estimated tax penalty.

EXCEPTION NO. 2.

1. Enter your 1997 tax liability (including alternative minimum tax) after reduction for all credits

other than withholding tax and estimated tax payments and credits ....................................................

$

1,000.00

2. (a) Statutory exemption ......................................................................................................................

$

(b) 1998 Colorado income tax withheld ............................................................................................. . $

(c) 1998 estimated tax payments and credits. Do not include extension request payments .............

$

(d) Total of lines 2(a), (b) and (c) ........................................................................................................

$

3. Line 1 minus line 2(d). If 2(d) is larger, enter 0 and you are not subject to the penalty .......................

$

EXCEPTION NO. 3.

4. (a) Enter your 1998 tax liability (including alternative minimum tax) after reduction for all

credits other than withholding tax and estimated tax payments and credits .................................

$

(b) Enter 70% of the amount on line 4(a) ............................................................................................

$

5. Enter amount from line 2(d) .................................................................................................................

$

6. Line 4(b) minus line 5. If 5 is larger, enter 0 and you are not subject to the penalty ............................

$

COMPUTATION OF CHARGE

PAYMENT DUE DATES

APRIL 15, 1998

JUNE 15, 1998

SEPT 15, 1998

JAN 15, 1999

7. Divide the amount on line 4(b) by the number

of payments required for the year. Enter the

result in the appropriate columns ..................

$

$

$

$

8. Amounts paid on estimated tax, tax with-

held and prorated statutory exemption ..........

$

$

$

$

9. Overpayment (on line 11) from

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5

previous period ..............................................

$

$

$

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5

10. Total lines 8 and 9 .........................................

$

$

$

$

11. Underpayment (line 7 minus line 10) or

(overpayment) (line 10 minus line 7) .............

$

$

$

$

12. Date of payment or April 15, 1999,

whichever is earlier .......................................

13. Number of days from due date of

payment to date on line 12 ............................

14. Underpayment on line 11 times 12% times

number of days on line 13 divided by 365 .....

$

$

$

$

15. Total penalty. Add all amounts on lines 14

Include this amount as estimated tax penalty on line 38, Form 104 ............................................................

$

1

1