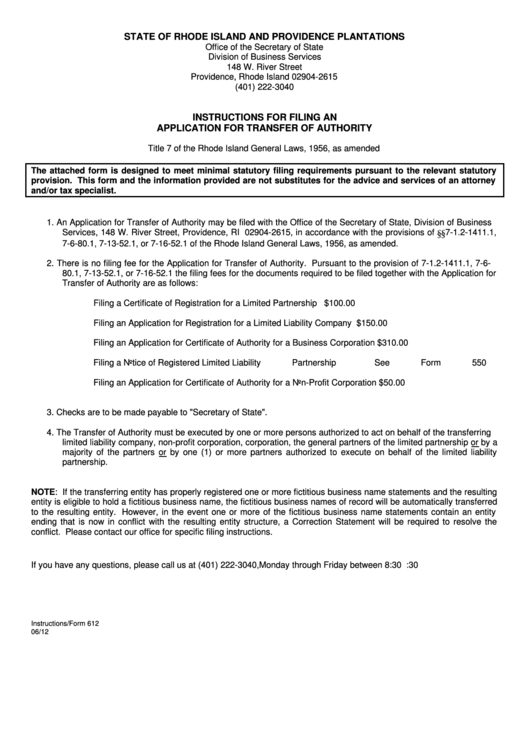

STATE OF RHODE ISLAND AND PROVIDENCE PLANTATIONS

Office of the Secretary of State

Division of Business Services

148 W. River Street

Providence, Rhode Island 02904-2615

(401) 222-3040

INSTRUCTIONS FOR FILING AN

APPLICATION FOR TRANSFER OF AUTHORITY

Title 7 of the Rhode Island General Laws, 1956, as amended

The attached form is designed to meet minimal statutory filing requirements pursuant to the relevant statutory

provision. This form and the information provided are not substitutes for the advice and services of an attorney

and/or tax specialist.

1. An Application for Transfer of Authority may be filed with the Office of the Secretary of State, Division of Business

Services, 148 W. River Street, Providence, RI 02904-2615, in accordance with the provisions of §§7-1.2-1411.1,

7-6-80.1, 7-13-52.1, or 7-16-52.1 of the Rhode Island General Laws, 1956, as amended.

2. There is no filing fee for the Application for Transfer of Authority. Pursuant to the provision of 7-1.2-1411.1, 7-6-

80.1, 7-13-52.1, or 7-16-52.1 the filing fees for the documents required to be filed together with the Application for

Transfer of Authority are as follows:

Filing a Certificate of Registration for a Limited Partnership

$100.00

Filing an Application for Registration for a Limited Liability Company

$150.00

Filing an Application for Certificate of Authority for a Business Corporation

$310.00

Filing a Notice of Registered Limited Liability Partnership

See Form 550

Filing an Application for Certificate of Authority for a Non-Profit Corporation

$50.00

3. Checks are to be made payable to "Secretary of State".

4. The Transfer of Authority must be executed by one or more persons authorized to act on behalf of the transferring

limited liability company, non-profit corporation, corporation, the general partners of the limited partnership or by a

majority of the partners or by one (1) or more partners authorized to execute on behalf of the limited liability

partnership.

NOTE: If the transferring entity has properly registered one or more fictitious business name statements and the resulting

entity is eligible to hold a fictitious business name, the fictitious business names of record will be automatically transferred

to the resulting entity. However, in the event one or more of the fictitious business name statements contain an entity

ending that is now in conflict with the resulting entity structure, a Correction Statement will be required to resolve the

conflict. Please contact our office for specific filing instructions.

If you have any questions, please call us at (401) 222-3040, Monday through Friday between 8:30 a.m. and 4:30 p.m.

Instructions/Form 612

06/12

1

1 2

2 3

3