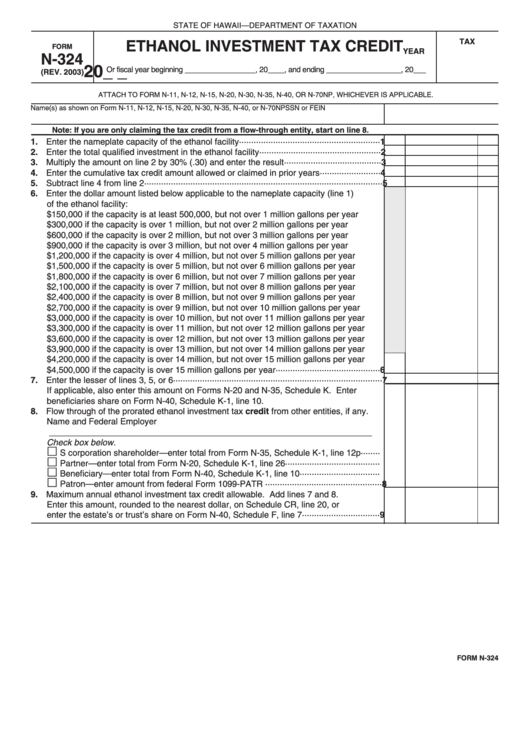

Form N-324 - Ethanol Investment Tax Credit

ADVERTISEMENT

STATE OF HAWAII—DEPARTMENT OF TAXATION

TAX

ETHANOL INVESTMENT TAX CREDIT

FORM

YEAR

N-324

20_ _

Or fiscal year beginning _________________, 20____, and ending __________________, 20___

(REV. 2003)

ATTACH TO FORM N-11, N-12, N-15, N-20, N-30, N-35, N-40, OR N-70NP, WHICHEVER IS APPLICABLE.

Name(s) as shown on Form N-11, N-12, N-15, N-20, N-30, N-35, N-40, or N-70NP

SSN or FEIN

Note: If you are only claiming the tax credit from a flow-through entity, start on line 8.

1. Enter the nameplate capacity of the ethanol facility ··························································

1

2. Enter the total qualified investment in the ethanol facility ··················································

2

3. Multiply the amount on line 2 by 30% (.30) and enter the result········································

3

4. Enter the cumulative tax credit amount allowed or claimed in prior years·························

4

5. Subtract line 4 from line 2 ··································································································

5

6. Enter the dollar amount listed below applicable to the nameplate capacity (line 1)

of the ethanol facility:

$150,000 if the capacity is at least 500,000, but not over 1 million gallons per year

$300,000 if the capacity is over 1 million, but not over 2 million gallons per year

$600,000 if the capacity is over 2 million, but not over 3 million gallons per year

$900,000 if the capacity is over 3 million, but not over 4 million gallons per year

$1,200,000 if the capacity is over 4 million, but not over 5 million gallons per year

$1,500,000 if the capacity is over 5 million, but not over 6 million gallons per year

$1,800,000 if the capacity is over 6 million, but not over 7 million gallons per year

$2,100,000 if the capacity is over 7 million, but not over 8 million gallons per year

$2,400,000 if the capacity is over 8 million, but not over 9 million gallons per year

$2,700,000 if the capacity is over 9 million, but not over 10 million gallons per year

$3,000,000 if the capacity is over 10 million, but not over 11 million gallons per year

$3,300,000 if the capacity is over 11 million, but not over 12 million gallons per year

$3,600,000 if the capacity is over 12 million, but not over 13 million gallons per year

$3,900,000 if the capacity is over 13 million, but not over 14 million gallons per year

$4,200,000 if the capacity is over 14 million, but not over 15 million gallons per year

$4,500,000 if the capacity is over 15 million gallons per year ···········································

6

7. Enter the lesser of lines 3, 5, or 6 ······················································································

7

If applicable, also enter this amount on Forms N-20 and N-35, Schedule K. Enter

beneficiaries share on Form N-40, Schedule K-1, line 10.

8. Flow through of the prorated ethanol investment tax credit from other entities, if any.

Name and Federal Employer I.D. number of the entity

____________________________________________________________________

Check box below.

£

S corporation shareholder—enter total from Form N-35, Schedule K-1, line 12p········

£

Partner—enter total from Form N-20, Schedule K-1, line 26 ·······································

£

Beneficiary—enter total from Form N-40, Schedule K-1, line 10 ·································

£

Patron—enter amount from federal Form 1099-PATR ················································

8

9. Maximum annual ethanol investment tax credit allowable. Add lines 7 and 8.

Enter this amount, rounded to the nearest dollar, on Schedule CR, line 20, or

enter the estate’s or trust’s share on Form N-40, Schedule F, line 7 ································

9

FORM N-324

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1