Form Rpd-41243 - Rural Job Tax Credit Claim Form

ADVERTISEMENT

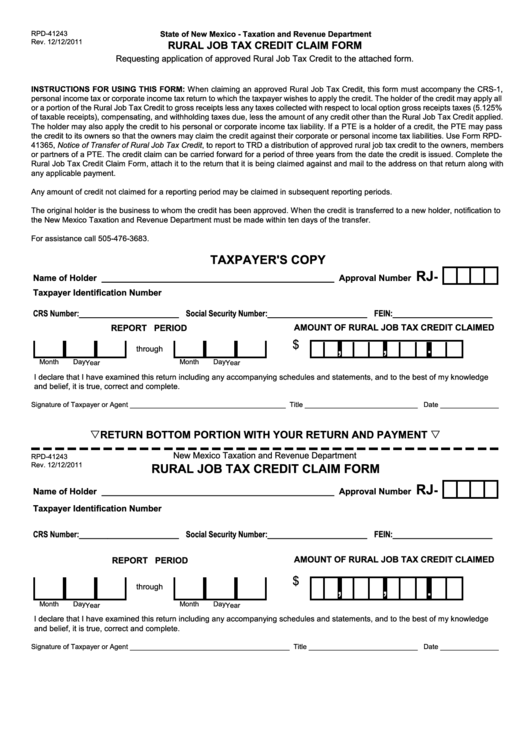

State of New Mexico - Taxation and Revenue Department

RPD-41243

Rev. 12/12/2011

RURAL JOB TAX CREDIT CLAIM FORM

Requesting application of approved Rural Job Tax Credit to the attached form.

INSTRUCTIONS FOR USING THIS FORM: When claiming an approved Rural Job Tax Credit, this form must accompany the CRS-1,

personal income tax or corporate income tax return to which the taxpayer wishes to apply the credit. The holder of the credit may apply all

or a portion of the Rural Job Tax Credit to gross receipts less any taxes collected with respect to local option gross receipts taxes (5.125%

of taxable receipts), compensating, and withholding taxes due, less the amount of any credit other than the Rural Job Tax Credit applied.

The holder may also apply the credit to his personal or corporate income tax liability. If a PTE is a holder of a credit, the PTE may pass

the credit to its owners so that the owners may claim the credit against their corporate or personal income tax liabilities. Use Form RPD-

41365, Notice of Transfer of Rural Job Tax Credit, to report to TRD a distribution of approved rural job tax credit to the owners, members

or partners of a PTE. The credit claim can be carried forward for a period of three years from the date the credit is issued. Complete the

Rural Job Tax Credit Claim Form, attach it to the return that it is being claimed against and mail to the address on that return along with

any applicable payment.

Any amount of credit not claimed for a reporting period may be claimed in subsequent reporting periods.

The original holder is the business to whom the credit has been approved. When the credit is transferred to a new holder, notification to

the New Mexico Taxation and Revenue Department must be made within ten days of the transfer.

For assistance call 505-476-3683.

TAXPAYER'S COPY

RJ

-

Name of Holder _________________________________________________ Approval Number

Taxpayer Identification Number

CRS Number:_____________________ Social Security Number:_____________________ FEIN:_____________________

AMOUNT OF RURAL JOB TAX CREDIT CLAIMED

REPORT PERIOD

,

.

,

$

through

Month

Day

Month

Day

Year

Year

I declare that I have examined this return including any accompanying schedules and statements, and to the best of my knowledge

and belief, it is true, correct and complete.

Signature of Taxpayer or Agent ________________________________________ Title _____________________________ Date _______________

RETURN BOTTOM PORTION WITH YOUR RETURN AND PAYMENT

New Mexico Taxation and Revenue Department

RPD-41243

Rev. 12/12/2011

RURAL JOB TAX CREDIT CLAIM FORM

RJ

-

Name of Holder _________________________________________________ Approval Number

Taxpayer Identification Number

CRS Number:_____________________ Social Security Number:_____________________ FEIN:_____________________

AMOUNT OF RURAL JOB TAX CREDIT CLAIMED

REPORT PERIOD

$

,

,

.

through

Month

Day

Month

Day

Year

Year

I declare that I have examined this return including any accompanying schedules and statements, and to the best of my knowledge

and belief, it is true, correct and complete.

Signature of Taxpayer or Agent _________________________________________ Title ____________________________ Date _______________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1