Montana Form Qec - Qualified Endowment Credit - 2008

ADVERTISEMENT

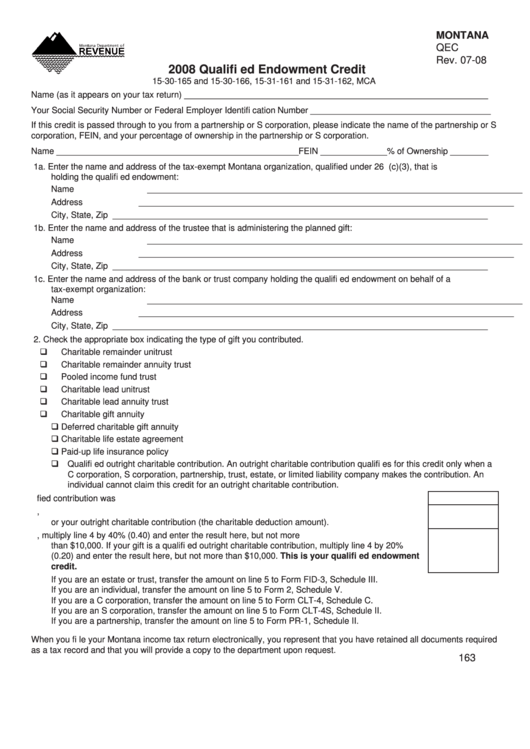

MONTANA

QEC

Rev. 07-08

2008 Qualifi ed Endowment Credit

15-30-165 and 15-30-166, 15-31-161 and 15-31-162, MCA

Name (as it appears on your tax return) ________________________________________________________________

Your Social Security Number or Federal Employer Identifi cation Number ______________________________________

If this credit is passed through to you from a partnership or S corporation, please indicate the name of the partnership or S

corporation, FEIN, and your percentage of ownership in the partnership or S corporation.

Name ___________________________________________________ FEIN ______________ % of Ownership ________

1a. Enter the name and address of the tax-exempt Montana organization, qualifi ed under 26 U.S.C. 501(c)(3), that is

holding the qualifi ed endowment:

Name

_______________________________________________________________________________

Address

_______________________________________________________________________________

City, State, Zip _______________________________________________________________________________

1b. Enter the name and address of the trustee that is administering the planned gift:

Name

_______________________________________________________________________________

Address

_______________________________________________________________________________

City, State, Zip _______________________________________________________________________________

1c. Enter the name and address of the bank or trust company holding the qualifi ed endowment on behalf of a

tax-exempt organization:

Name

_______________________________________________________________________________

Address

_______________________________________________________________________________

City, State, Zip _______________________________________________________________________________

2. Check the appropriate box indicating the type of gift you contributed.

Charitable remainder unitrust

Charitable remainder annuity trust

Pooled income fund trust

Charitable lead unitrust

Charitable lead annuity trust

Charitable gift annuity

Deferred charitable gift annuity

Charitable life estate agreement

Paid-up life insurance policy

Qualifi ed outright charitable contribution. An outright charitable contribution qualifi es for this credit only when a

C corporation, S corporation, partnership, trust, estate, or limited liability company makes the contribution. An

individual cannot claim this credit for an outright charitable contribution.

3. Enter the date the qualifi ed contribution was made.......................................................................3.

4. Enter the present value of the aggregate amount of the charitable gift portion of your planned gift,

or your outright charitable contribution (the charitable deduction amount). ..................................4.

5. If your gift is a planned gift, multiply line 4 by 40% (0.40) and enter the result here, but not more

than $10,000. If your gift is a qualifi ed outright charitable contribution, multiply line 4 by 20%

(0.20) and enter the result here, but not more than $10,000. This is your qualifi ed endowment

credit. ............................................................................................................................................5.

If you are an estate or trust, transfer the amount on line 5 to Form FID-3, Schedule III.

If you are an individual, transfer the amount on line 5 to Form 2, Schedule V.

If you are a C corporation, transfer the amount on line 5 to Form CLT-4, Schedule C.

If you are an S corporation, transfer the amount on line 5 to Form CLT-4S, Schedule II.

If you are a partnership, transfer the amount on line 5 to Form PR-1, Schedule II.

When you fi le your Montana income tax return electronically, you represent that you have retained all documents required

as a tax record and that you will provide a copy to the department upon request.

163

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2