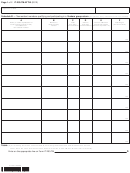

Schedule B-3 (Combined) - Related Entity And Related Member Adjustments

ADVERTISEMENT

Schedule B-3 (Combined) – Related

Line 8 – Enter each corporation’s Ohio appor-

franchise tax report instructions booklet. Also,

Entity and Related Member Adjustments

analyze the related entity gains added to each

tionment ratio from Schedule D (Combined), line

17. Enter in column (1) the sum of the amounts

corporation’s federal taxable income on lines 1

and 2, above. For each related entity gain

Caution: For tax years 1999 and thereafter

in columns (2) through (5).

added, determine the excess related entity gain,

Amended Substitute House Bill 215, 122nd Gen-

if applicable. (Excess related entity gain is the

eral Assembly made the related member adjust-

Lines 12 and 19 – Review the instructions for

ments applicable to all corporations which pay

amount by which the gain actually allocated or

Schedule B-3, line 11 in the Ohio corporation

apportioned to Ohio and to other states which

interest expense or intangible expense to cer-

franchise tax report instructions booklet. Also,

tain related members. Prior law generally lim-

analyze the related entity losses deducted from

impose a tax on or measured by net income

ited the related member adjustments to large

each corporation’s federal taxable income on

exceeds the total gain from the sale or other

disposition of the asset. The excess related

taxpayers because the prior law applied only if

lines 1 and 2, above. For each related entity loss

entity gain adjustment is limited to that portion

the taxpayer or a member of the taxpayer’s af-

deducted, determine the excess related entity

of each gain actually allocated to Ohio on line

filiated group had one or more of the following:

loss, if applicable. (Excess related entity loss is

10 or apportioned to Ohio on line 9.) If an ex-

(1) gross sales of at least fifty million dollars, (2)

the amount by which the loss actually allocated

cess related entity gain is attributable to an ap-

total assets of at least twenty-five million dol-

or apportioned to Ohio and to other states which

lars, or (3) taxable income of at least five hun-

impose a tax on or measured by net income

portionable gain, the excess related entity gain

is apportionable on line 13.

dred thousand dollars. House Bill 215 eliminated

exceeds the total loss from the sale or other dis-

the above three limitations and thereby made

position of the asset. The excess related entity

Enter on line 13 each corporation’s total appor-

the adjustments applicable to small corporations

loss adjustment is limited to that portion of each

tionable excess related entity gain. Enter in col-

as well as to large corporations.

loss actually allocated to Ohio on line 10 or ap-

umn (1) the sum of the amounts in column (2)

portioned to Ohio on line 9.) If an excess related

In addition, House Bill 215 expanded the defini-

entity loss is attributable to a loss which was al-

through (5).

tion of “intangible expenses and costs” to include

located in whole or in part to Ohio, the excess

losses from factoring transactions and discount-

related entity loss is allocable on line 19. If an

Enter on line 20 each corporation’s total allo-

cable excess related entity gain.

ing transactions. Intangible expenses and costs

excess related entity loss is attributable to an

now include expenses, losses, and costs for,

apportionable loss, the excess related entity loss

Line 14 – Follow the Schedule B-3, line 13

related to, or in connection with the direct or in-

is apportionable on line 12.

instructions contained in the Ohio corporation

direct acquisition, use, maintenance, manage-

franchise tax report instructions booklet but do

ment, ownership, or disposition of intangible

Enter on line 12 as a positive number each

property. See ORC section 5733.042(B) as

not determine the ORC section 5733.055 limi-

corporation’s total apportionable excess related

amended by House Bill 215.

entity loss. Enter in column (1) the sum of the

tation on a separate company basis. The ORC

section 5733.055 limitation is determined on a

amounts in columns (2) through (5).

Lines 1, 2, 4, 6, and 10 – Follow the Schedule

combined basis on line 15, Schedule B-3 (Com-

bined). For each corporation included in the

B-3 line instructions in the Ohio corporation fran-

Enter on line 19 as a positive number each

combined report enter the line item amount in

chise tax report instructions booklet. For each

corporation’s total allocable excess related en-

the column for that corporation. Enter in col-

corporation included in the combined report en-

tity loss.

ter the line item amounts in the column for that

umn (1) the sum of the amounts in columns (2)

through (5).

corporation. Enter in column (1) the sum of the

Lines 13 and 20 – Review the instructions for

amounts of columns (2) through (5).

Schedule B-3, line 12, in the Ohio corporation

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2