Annual Arkansas Limited Liability Company Franchise Tax Report - Arkansas Secretary Of State

ADVERTISEMENT

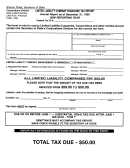

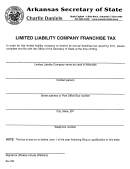

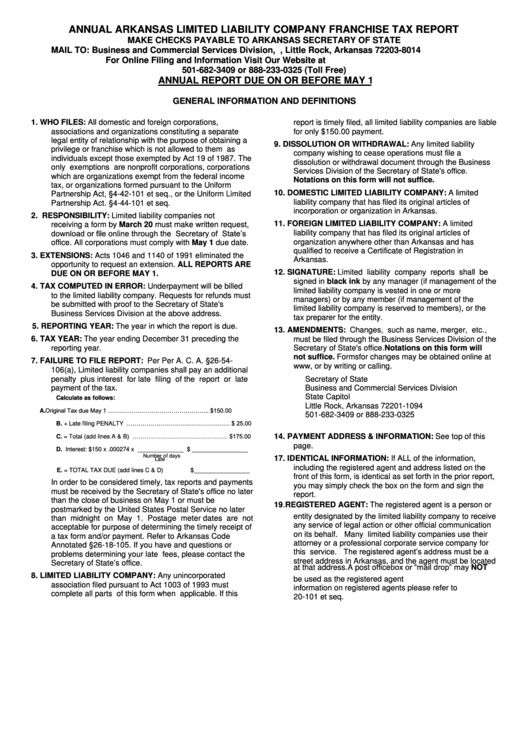

ANNUAL ARKANSAS LIMITED LIABILITY COMPANY FRANCHISE TAX REPORT

MAKE CHECKS PAYABLE TO ARKANSAS SECRETARY OF STATE

MAIL TO: Business and Commercial Services Division, P.O. Box 8014, Little Rock, Arkansas 72203-8014

For Online Filing and Information Visit Our Website at

501-682-3409 or 888-233-0325 (Toll Free)

ANNUAL REPORT DUE ON OR BEFORE MAY 1

GENERAL INFORMATION AND DEFINITIONS

1.

WHO FILES: All domestic and foreign corporations,

report is timely filed, all limited liability companies are liable

associations and organizations constituting a separate

for only $150.00 payment.

legal entity of relationship with the purpose of obtaining a

9.

DISSOLUTION OR WITHDRAWAL: Any limited liability

privilege or franchise which is not allowed to them as

company wishing to cease operations must file a

individuals except those exempted by Act 19 of 1987. The

dissolution or withdrawal document through the Business

only exemptions are nonprofit corporations, corporations

Services Division of the Secretary of State's office.

which are organizations exempt from the federal income

Notations on this form will not suffice.

tax, or organizations formed pursuant to the Uniform

10.

DOMESTIC LIMITED LIABILITY COMPANY: A limited

Partnership Act, §4-42-101 et seq., or the Uniform Limited

liability company that has filed its original articles of

Partnership Act. §4-44-101 et seq.

incorporation or organization in Arkansas.

2.

RESPONSIBILITY:

Limited

liability

companies

not

11.

FOREIGN LIMITED LIABILITY COMPANY: A limited

receiving a form by March 20 must make written request,

download or file online through the Secretary of State’s

liability company that has filed its original articles of

organization anywhere other than Arkansas and has

office. All corporations must comply with May 1 due date.

qualified to receive a Certificate of Registration in

3.

EXTENSIONS: Acts 1046 and 1140 of 1991 eliminated the

Arkansas.

opportunity to request an extension. ALL REPORTS ARE

12.

SIGNATURE: Limited liability company reports shall be

DUE ON OR BEFORE MAY 1.

signed in black ink by any manager (if management of the

4.

TAX COMPUTED IN ERROR: Underpayment will be billed

limited liability company is vested in one or more

to the limited liability company. Requests for refunds must

managers) or by any member (if management of the

be submitted with proof to the Secretary of State's

limited liability company is reserved to members), or the

Business Services Division at the above address.

tax preparer for the entity.

5.

REPORTING YEAR: The year in which the report is due.

13.

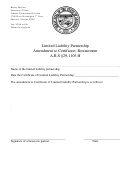

AMENDMENTS: Changes, such as name, merger, etc.,

6.

TAX YEAR: The year ending December 31 preceding the

must be filed through the Business Services Division of the

reporting year.

Secretary of State's office. Notations on this form will

not suffice. Forms for changes may be obtained online at

7.

FAILURE TO FILE REPORT: Per Per A. C. A. §26-54-

, or by writing or calling.

106(a), Limited liability companies shall pay an additional

penalty plus interest for late filing of the report or late

Secretary of State

payment of the tax.

Business and Commercial Services Division

State Capitol

Calculate as follows:

Little Rock, Arkansas 72201-1094

A. Original Tax due May 1 …………………………………………... $150.00

501-682-3409 or 888-233-0325

B. + Late filing PENALTY ….………………………………………… $ 25.00

C. = Total (add lines A & B) ………………………………………… $175.00

14.

PAYMENT ADDRESS & INFORMATION: See top of this

page.

D. Interest: $150 x .000274 x ______________ $ _________________

Number of days

17.

IDENTICAL INFORMATION: If ALL of the information,

Late

including the registered agent and address listed on the

E. = TOTAL TAX DUE (add lines C & D)

$_________________

front of this form, is identical as set forth in the prior report,

In order to be considered timely, tax reports and payments

you may simply check the box on the form and sign the

must be received by the Secretary of State's office no later

report.

than the close of business on May 1 or must be

19. REGISTERED AGENT: The registered agent is a person or

postmarked by the United States Postal Service no later

entity designated by the limited liability company to receive

than midnight on May 1. Postage meter dates are not

any service of legal action or other official communication

acceptable for purpose of determining the timely receipt of

on its behalf. Many limited liability companies use their

a tax form and/or payment. Refer to Arkansas Code

attorney or a professional corporate service company for

Annotated §26-18-105. If you have and questions or

this service. The registered agent’s address must be a

problems determining your late fees, please contact the

street address in Arkansas, and the agent must be located

Secretary of State’s office.

at that address. A post office box or “mail drop” may NOT

8.

LIMITED LIABILITY COMPANY: Any unincorporated

be used as the registered agent address. For more

association filed pursuant to Act 1003 of 1993 must

information on registered agents please refer to

complete all parts of this form when applicable. If this

A.C.A.4-20-101 et seq.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1