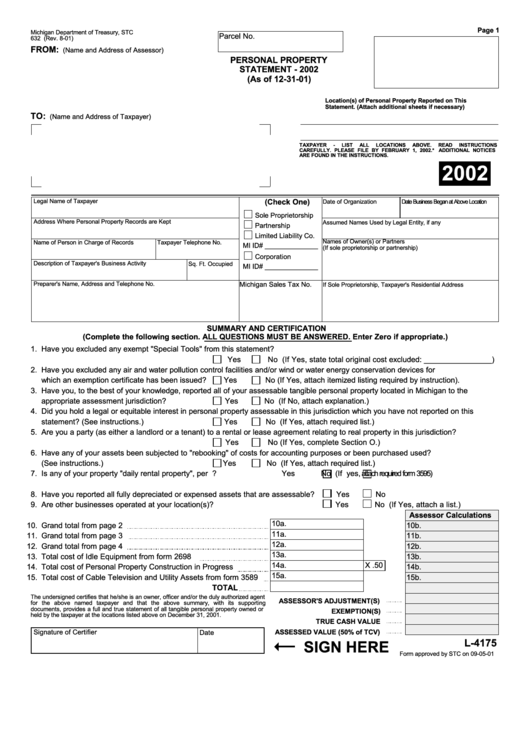

Form L-4175 - Personal Property Statement - 2002

ADVERTISEMENT

Page 1

Michigan Department of Treasury, STC

Parcel No.

632 (Rev. 8-01)

FROM:

(Name and Address of Assessor)

PERSONAL PROPERTY

STATEMENT - 2002

(As of 12-31-01)

Location(s) of Personal Property Reported on This

Statement. (Attach additional sheets if necessary)

TO:

(Name and Address of Taxpayer)

TAXPAYER

-

LIST

ALL

LOCATIONS

ABOVE.

READ

INSTRUCTIONS

CAREFULLY. PLEASE FILE BY FEBRUARY 1, 2002.*

ADDITIONAL NOTICES

ARE FOUND IN THE INSTRUCTIONS.

2002

Legal Name of Taxpayer

(Check One)

Date of Organization

Date Business Began at Above Location

Sole Proprietorship

Address Where Personal Property Records are Kept

Assumed Names Used by Legal Entity, if any

Partnership

Limited Liability Co.

Names of Owner(s) or Partners

Name of Person in Charge of Records

Taxpayer Telephone No.

MI ID# ______________

(If sole proprietorship or partnership)

Corporation

Description of Taxpayer's Business Activity

Sq. Ft. Occupied

MI ID# ______________

Preparer's Name, Address and Telephone No.

Michigan Sales Tax No.

If Sole Proprietorship, Taxpayer's Residential Address

SUMMARY AND CERTIFICATION

(Complete the following section. ALL QUESTIONS MUST BE ANSWERED. Enter Zero if appropriate.)

1.

Have you excluded any exempt "Special Tools" from this statement?

Yes

No (If Yes, state total original cost excluded: ________________)

2.

Have you excluded any air and water pollution control facilities and/or wind or water energy conservation devices for

which an exemption certificate has been issued?

Yes

No (If Yes, attach itemized listing required by instruction).

3.

Have you, to the best of your knowledge, reported all of your assessable tangible personal property located in Michigan to the

appropriate assessment jurisdiction?

Yes

No (If No, attach explanation.)

4.

Did you hold a legal or equitable interest in personal property assessable in this jurisdiction which you have not reported on this

statement? (See instructions.)

Yes

No (If Yes, attach required list.)

5.

Are you a party (as either a landlord or a tenant) to a rental or lease agreement relating to real property in this jurisdiction?

Yes

No (If Yes, complete Section O.)

6.

Have any of your assets been subjected to "rebooking" of costs for accounting purposes or been purchased used?

(See instructions.)

Yes

No (If Yes, attach required list.)

7.

Is any of your property "daily rental property", per P.A. 537 of 1998?

Yes

No (If yes, attach required form 3595)

8.

Have you reported all fully depreciated or expensed assets that are assessable?

Yes

No

9.

Are other businesses operated at your location(s)?

Yes

No (If Yes, attach a list.)

Assessor Calculations

10a.

10.

Grand total from page 2

10b.

11a.

11.

Grand total from page 3

11b.

12a.

12.

Grand total from page 4

12b.

13a.

13.

Total cost of Idle Equipment from form 2698

13b.

14a.

X .50

14.

Total cost of Personal Property Construction in Progress

14b.

15a.

15.

Total cost of Cable Television and Utility Assets from form 3589

15b.

TOTAL

The undersigned certifies that he/she is an owner, officer and/or the duly authorized agent

ASSESSOR'S ADJUSTMENT(S)

for the above named taxpayer and that the above summary, with its supporting

documents, provides a full and true statement of all tangible personal property owned or

EXEMPTION(S)

held by the taxpayer at the locations listed above on December 31, 2001.

TRUE CASH VALUE

Signature of Certifier

ASSESSED VALUE (50% of TCV)

Date

L-4175

SIGN HERE

Form approved by STC on 09-05-01

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4