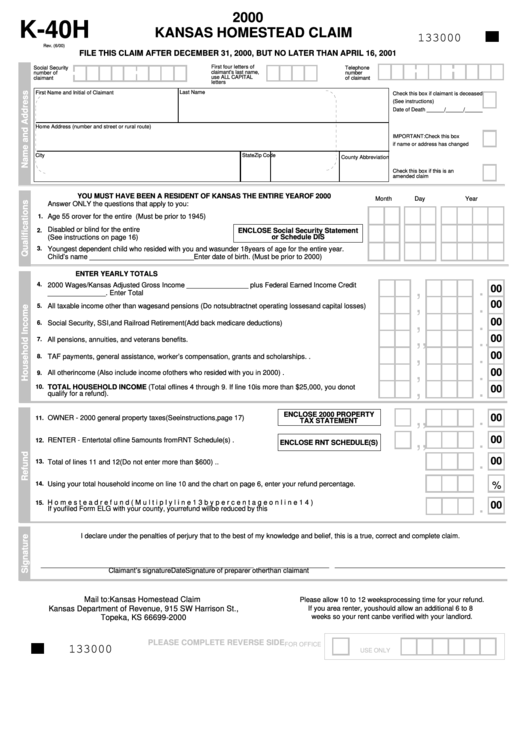

Form K-40h - Kansas Homestead Claim - 2000

ADVERTISEMENT

2000

K-40H

KANSAS HOMESTEAD CLAIM

133000

Rev. (6/00)

FILE THIS CLAIM AFTER DECEMBER 31, 2000, BUT NO LATER THAN APRIL 16, 2001

- -

-

-

First four letters of

Social Security

Telephone

claimant’s last name,

number of

number

use ALL CAPITAL

claimant

of claimant

letters

Last Name

First Name and Initial of Claimant

Check this box if claimant is deceased

(See instructions)

Date of Death ______/______/______

Home Address (number and street or rural route)

IMPORTANT: Check this box

if name or address has changed

City

State

Zip Code

County Abbreviation

Check this box if this is an

amended claim

YOU MUST HAVE BEEN A RESIDENT OF KANSAS THE ENTIRE YEAR OF 2000

Month

Day

Year

Answer ONLY the questions that apply to you:

Age 55 or over for the entire year. Enter date of birth. (Must be prior to 1945). . . . . . . . . . . . . . . . . . .

1.

Disabled or blind for the entire year. Enter date of disability.

2.

ENCLOSE Social Security Statement

or Schedule DIS

(See instructions on page 16)

3.

Youngest dependent child who resided with you and was under 18 years of age for the entire year.

Child’s name ___________________________ Enter date of birth. (Must be prior to 2000)

ENTER YEARLY TOTALS ONLY. SEE INSTRUCTIONS BEGINNING ON PAGE 16

,

.

4.

2000 Wages/Kansas Adjusted Gross Income ________________ plus Federal Earned Income Credit

00

_______________. Enter Total. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

,

.

00

5.

All taxable income other than wages and pensions (Do not subtract net operating losses and capital losses)

,

.

00

6.

Social Security, SSI, and Railroad Retirement (Add back medicare deductions). . . . . . . . . . . . . . . . . . . . . .

, ,

. .

00

7.

All pensions, annuities, and veterans benefits. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

,

,

.

00

8.

TAF payments, general assistance, worker’s compensation, grants and scholarships. . . . . . . . . . . . . . . . .

,

.

00

All other income (Also include income of others who resided with you in 2000) . . . . . . . . . . . . . . . . . . . . . .

9.

,

,

.

10.

TOTAL HOUSEHOLD INCOME (Total of lines 4 through 9. If line 10 is more than $25,000, you do not

00

qualify for a refund). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

, ,

.

ENCLOSE 2000 PROPERTY

00

OWNER - 2000 general property taxes (See instructions, page 17)

11.

TAX STATEMENT

, ,

.

00

RENTER - Enter total of line 5 amounts from RNT Schedule(s) . . . . . . . . .

12.

ENCLOSE RNT SCHEDULE(S)

.

00

13.

Total of lines 11 and 12 (Do not enter more than $600) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

14.

Using your total household income on line 10 and the chart on page 6, enter your refund percentage. . . . . . . . . . . . . . . .

%

.

Homestead refund (Multiply line 13 by percentage on line 14). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

15.

00

If you filed Form ELG with your county, your refund will be reduced by this amount. See page 19.

I declare under the penalties of perjury that to the best of my knowledge and belief, this is a true, correct and complete claim.

_______________________________________________________ __________________ ____________________________________________

Claimant’s signature

Date

Signature of preparer other than claimant

Mail to: Kansas Homestead Claim

Please allow 10 to 12 weeks processing time for your refund.

Kansas Department of Revenue, 915 SW Harrison St.,

If you are a renter, you should allow an additional 6 to 8

weeks so your rent can be verified with your landlord.

Topeka, KS 66699-2000

PLEASE COMPLETE REVERSE SIDE

FOR OFFICE

133000

USE ONLY

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2