Form Nyc-203 - City Of New York Nonresident Earnings Tax Return - 1999

ADVERTISEMENT

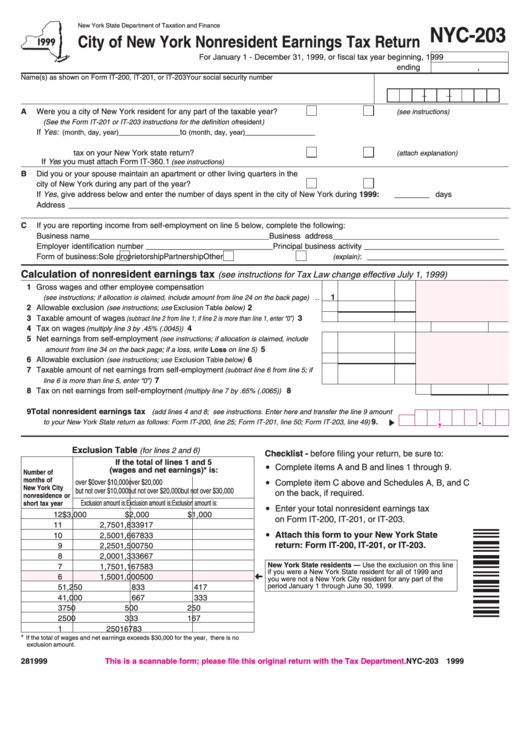

New York State Department of Taxation and Finance

NYC-203

City of New York Nonresident Earnings Tax Return

For January 1 - December 31, 1999, or fiscal tax year beginning

, 1999

ending

,

Name(s) as shown on Form IT-200, IT-201, or IT-203

Your social security number

A

Were you a city of New York resident for any part of the taxable year? ...........

Yes

No

(see instructions)

(See the Form IT-201 or IT-203 instructions for the definition of resident )

If Yes: 1. Give period of city of New York residence. From

______________ to

(month, day, year)

(month, day, year) __________________

2. Are you reporting the city of New York resident

tax on your New York state return? .................................................

Yes

No

(attach explanation)

If Yes you must attach Form IT-360.1

(see instructions)

B

Did you or your spouse maintain an apartment or other living quarters in the

city of New York during any part of the year? ...................................................

Yes

No

If Yes, give address below and enter the number of days spent in the city of New York during 1999:

________ days

Address _____________________________________________________________________________________________________

C

If you are reporting income from self-employment on line 5 below, complete the following:

Business name _________________________________________ Business address ______________________________________

Employer identification number _____________________________ Principal business activity ________________________________

Form of business:

Sole proprietorship

Partnership

Other

: ________________________________

(explain)

Calculation of nonresident earnings tax

(see instructions for Tax Law change effective July 1, 1999)

1 Gross wages and other employee compensation

..

1

(see instructions; if allocation is claimed, include amount from line 24 on the back page)

2 Allowable exclusion

.................................

2

(see instructions; use Exclusion Table below)

3 Taxable amount of wages

..........

3

(subtract line 2 from line 1; if line 2 is more than line 1, enter “0”)

4 Tax on wages

.......................................................................................................

4

(multiply line 3 by .45% (.0045))

5 Net earnings from self-employment

(see instructions; if allocation is claimed, include

...........................

5

amount from line 34 on the back page; if a loss, write Loss on line 5)

6 Allowable exclusion

.................................

6

(see instructions; use Exclusion Table below)

7 Taxable amount of net earnings from self-employment

(subtract line 6 from line 5; if

............................................................................

7

line 6 is more than line 5, enter “0”)

8 Tax on net earnings from self-employment

.........................................................

8

(multiply line 7 by .65% (.0065))

9 Total nonresident earnings tax

(add lines 4 and 8; see instructions. Enter here and transfer the line 9 amount

,

........

9.

to your New York State return as follows: Form IT-200, line 25; Form IT-201, line 50; Form IT-203, line 49)

Exclusion Table

(for lines 2 and 6)

Checklist - before filing your return, be sure to:

If the total of lines 1 and 5

$

Complete items A and B and lines 1 through 9.

(wages and net earnings)* is:

Number of

$

months of

over $0

over $10,000

over $20,000

Complete item C above and Schedules A, B, and C

New York City

but not over $10,000 but not over $20,000

but not over $30,000

on the back, if required.

nonresidence or

Exclusion amount is:

Exclusion amount is:

Exclusion amount is:

short tax year

$

Enter your total nonresident earnings tax

12

$3,000

$2,000

$1,000

on Form IT-200, IT-201, or IT-203.

11

2,750

1,833

917

$

Attach this form to your New York State

10

2,500

1,667

833

return: Form IT-200, IT-201, or IT-203.

9

2,250

1,500

750

8

2,000

1,333

667

New York State residents — Use the exclusion on this line

7

1,750

1,167

583

if you were a New York State resident for all of 1999 and

6

1,500

1,000

500

you were not a New York City resident for any part of the

period January 1 through June 30, 1999.

5

1,250

833

417

4

1,000

667

333

3

750

500

250

2

500

333

167

1

250

167

83

*

If the total of wages and net earnings exceeds $30,000 for the year, there is no

exclusion amount.

281999

This is a scannable form; please file this original return with the Tax Department.

NYC-203 1999

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2