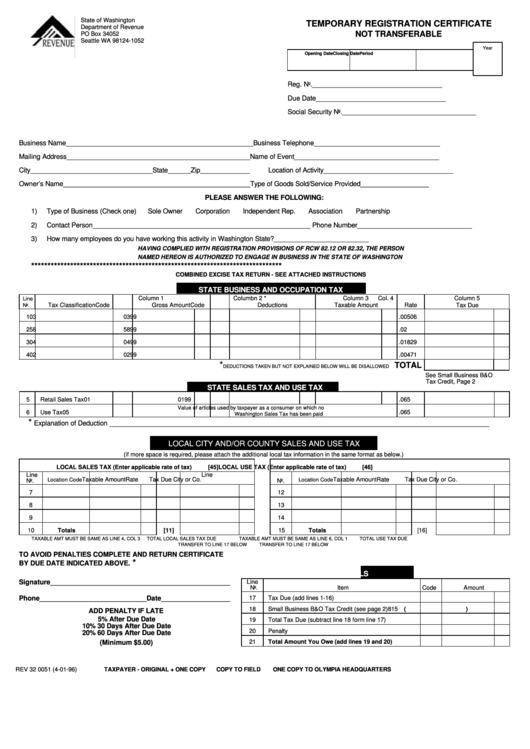

State of Washington

TEMPORARY REGISTRATION CERTIFICATE

Department of Revenue

NOT TRANSFERABLE

PO Box 34052

Seattle WA 98124-1052

Year

Opening Date

Closing Date

Period

Reg. No.__________________________________

Due Date__________________________________

Social Security No.___________________________________

Business Name_________________________________________________

Business Telephone_________________________________

Mailing Address________________________________________________

Name of Event______________________________________

City________________________________State______Zip_____________

Location of Activity__________________________________

Owner’s Name_________________________________________________

Type of Goods Sold/Service Provided__________________

PLEASE ANSWER THE FOLLOWING:

1)

Type of Business (Check one)

Sole Owner

Corporation

Independent Rep.

Association

Partnership

2)

Contact Person_________________________________________________________ Phone Number______________________________

3)

How many employees do you have working this activity in Washington State?_________________________

HAVING COMPLIED WITH REGISTRATION PROVISIONS OF RCW 82.12 OR 82.32, THE PERSON

NAMED HEREON IS AUTHORIZED TO ENGAGE IN BUSINESS IN THE STATE OF WASHINGTON

*****************************************************************************

COMBINED EXCISE TAX RETURN - SEE ATTACHED INSTRUCTIONS

STATE BUSINESS AND OCCUPATION TAX

Column 1

Columbn 2 *

Column 3

Col. 4

Column 5

Line

Tax Classification

Code

Gross Amount

Code

Deductions

Taxable Amount

Rate

Tax Due

No.

1

03

0399

.00506

2

58

5899

.02

3

04

0499

.01829

4

02

0299

.00471

*

TOTAL

DEDUCTIONS TAKEN BUT NOT EXPLAINED BELOW WILL BE DISALLOWED

See Small Business B&O

Tax Credit, Page 2

STATE SALES TAX AND USE TAX

5

Retail Sales Tax

01

0199

.065

Value of articles used by taxpayer as a consumer on which no

6

Use Tax

05

.065

Washington Sales Tax has been paid

*

_____________________________________________________________________________________

Explanation of Deduction

LOCAL CITY AND/OR COUNTY SALES AND USE TAX

(if more space is required, please attach the additional local tax information in the same format as below.)

LOCAL SALES TAX (Enter applicable rate of tax)

[45]

LOCAL USE TAX (Enter applicable rate of tax)

[46]

Line

Line

Taxable Amount

Rate

Tax Due City or Co.

Taxable Amount

Rate

Tax Due City or Co.

Location Code

Location Code

No.

No.

7

12

8

13

9

14

10

Totals

[11]

15

Totals

[16]

TAXABLE AMT MUST BE SAME AS LINE 4, COL 3

TOTAL LOCAL SALES TAX DUE

TAXABLE AMT MUST BE SAME AS LINE 6, COL 1

TOTAL USE TAX DUE

TRANSFER TO LINE 17 BELOW

TRANSFER TO LINE 17 BELOW

TO AVOID PENALTIES COMPLETE AND RETURN CERTIFICATE

*

BY DUE DATE INDICATED ABOVE.

TOTALS

Signature_______________________________________________

Line

No.

Item

Code

Amount

Phone____________________________Date__________________

17

Tax Due (add lines 1-16)

18

Small Business B&O Tax Credit (see page 2)

815 (

)

ADD PENALTY IF LATE

5% After Due Date

19

Total Tax Due (subtract line 18 form line 17)

10% 30 Days After Due Date

20

Penalty

20% 60 Days After Due Date

(Minimum $5.00)

21

Total Amount You Owe (add lines 19 and 20)

REV 32 0051 (4-01-96)

TAXPAYER - ORIGINAL + ONE COPY

COPY TO FIELD

ONE COPY TO OLYMPIA HEADQUARTERS

1

1