68 O.S. § 2877(A)(B)(C)(D) Appeal from action by county assessor to county board of equaliza-

tion – Hearing procedure – Record – Time and form of appeal.

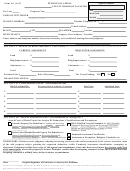

A. Upon receipt of an appeal from action by the county assessor on the form prescribed by the Oklahoma Tax Com-

mission, the secretary of the county board of equalization shall fix a date of hearing, at which time said board shall

be authorized and empowered to take evidence pertinent to said appeal; and for that purpose, is authorized to

compel the attendance of witnesses and the production of books, records, and papers by subpoena, and to con-

firm, correct, or adjust the valuation of real or personal property or to cancel an assessment of personal property

added by the assessor not listed by the taxpayer if the personal property is not subject to taxation or if the tax-

payer is not responsible for payment of ad valorem taxes upon such property. The secretary of the board shall fix

the dates of the hearings provided for in this section in such a manner as to ensure that the board is able to hear

all complaints within the time provided for by law. In any county with a population less than three hundred thou-

sand (300,000) according to the latest Federal Decennial Census, the county board of equalization shall provide

at least three dates on which a taxpayer may personally appear and make a presentation of evidence. At least ten

(10) days shall intervene between each such date. No final determination regarding valuation protests shall be

made by a county board of equalization until the taxpayer shall have failed to appear for all three such dates. The

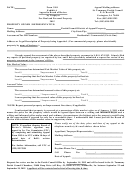

county board of equalization shall be required to follow the procedures prescribed by the Ad Valorem Tax Code

or administrative rules and regulations promulgated pursuant to such Code governing the valuation of real and

personal property. The county board of equalization shall not modify a valuation of real or personal property as

established by the county assessor unless such modification is explained in writing upon a form prescribed by the

Oklahoma Tax Commission. Each decision of the county board of equalization shall be explained in writing upon a

form prescribed by the Oklahoma Tax Commission. The county board of equalization shall make a record of each

proceeding involving an appeal from action by the county assessor either in transcribed or tape recorded form.

B. In all cases where the county assessor has, without giving the notice required by law, increased the valuation of

property as listed by the taxpayer, and the taxpayer has knowledge of such adjustment or addition, the taxpayer

may at any time prior to the adjournment of the board, file an appeal in the form and manner provided for in Sec-

tion 2876 of this title. Thereafter, the board shall fix a date of hearing, notify the taxpayer, and conduct the hearing

as required by this section.

C. The taxpayer or agent may appear at the scheduled hearing either in person, by telephone or other electronic

means, or by affidavit.

D. If the taxpayer or agent fails to appear before the county board of equalization at the scheduled hearing, unless

advance notification is given for the reason of absence, the county shall be authorized to assess against the

taxpayer the costs incurred by the county in preparation for the scheduled hearing. If such costs are assessed,

payment of the costs shall be a prerequisite to the filing of an appeal to the district court. A taxpayer that gives

advance notification of their absence shall be given the opportunity to reschedule the hearing date.

1

1 2

2