Cca Form 202es - Estimate Tax Form - Cca Municipal Income Tax - 2002

ADVERTISEMENT

O

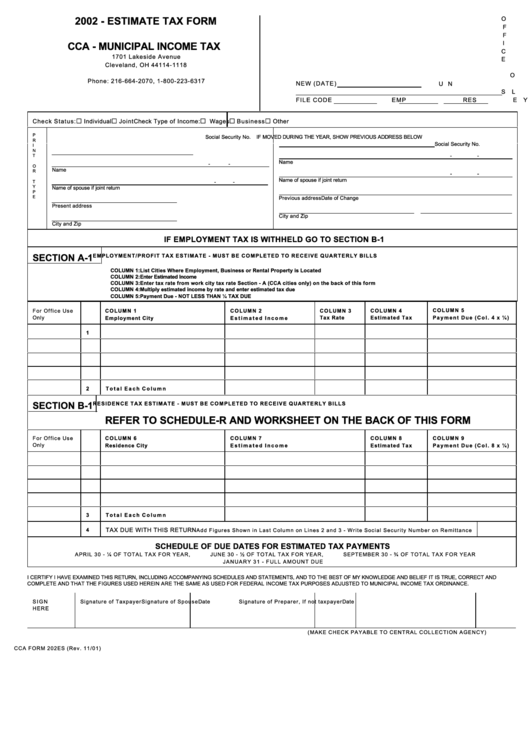

2002 - ESTIMATE TAX FORM

F

F

I

CCA - MUNICIPAL INCOME TAX

C

1701 Lakeside Avenue

E

Cleveland, OH 44114-1118

O

Phone: 216-664-2070, 1-800-223-6317

NEW (DATE)

U N

S L

FILE CODE

EMP

RES

E Y

G

G

G

G

G

Check Status:

Individual

Joint

Ch eck T ype of Inc ome:

W ages

Business

O ther

P

Social Security No.

IF MOVED DURING THE YEAR, SHOW PREVIOUS ADDRESS BELOW

R

Social Security No.

I

N

-

-

T

Name

-

-

O

Name

R

-

-

Name of spous e if joint return

T

-

-

Y

Name of spous e if joint return

P

E

Previous address

Date of Change

Present address

City and Zip

City and Zip

IF EMPLOYMENT TAX IS WITHHELD GO TO SECTION B-1

E M P L O Y M E N T / PR O F I T T AX E S T IM A T E - M U S T B E C O M P L E T E D T O R E C E IV E Q U AR T E R L Y B IL L S

SECTION A-1

COLUMN 1: List Cities Where Employment, Business or Rental Property is Located

COLUMN 2: Enter Estimated Income

COLUMN 3: Enter tax rate from work city tax rate Section - A (CCA cities only) on the back of this form

COLUMN 4: Multiply estimated income by rate and enter estimated tax due

COLUMN 5: Payment Due - NOT LESS THAN ¼ TAX DUE

Fo r O ffi ce U se

C O L U M N 1

C O L U M N 2

C O L U M N 3

C O L U M N 4

C O L U M N 5

On ly

Tax R ate

Estimated Tax

P a ym e n t D u e ( C ol. 4 x ¼ )

Em ploym ent C ity

E stim ate d In co m e

1

2

T ota l E ac h C olu m n

R E S ID E N C E T AX E S T IM A T E - M U S T B E C O M P L E T E D T O R E C E IV E Q U AR T E R L Y B IL L S

SECTION B-1

REFER TO SCHEDULE-R AND WORKSHEET ON THE BACK OF THIS FORM

F or O f fi ce U se

C O L U M N 6

C O L U M N 7

C O L U M N 8

C O L U M N 9

On ly

Resid ence C ity

E stim ate d In co m e

Estimated Tax

P a ym e n t D u e ( C ol. 8 x ¼ )

3

T ota l E ac h C olu m n

TAX DUE W ITH THIS RETURN

4

Ad d Figur es Shown i n Las t C ol um n on L ines 2 and 3 - W r i te S oc ial S ecu r ity N um be r on Re m i t ta n ce

SCHEDULE OF DUE DATES FOR ESTIMATED TAX PAYMENTS

AP RIL 30 - ¼ OF T OT AL TAX FOR YEA R,

JUNE 30 - ½ O F TO T AL T A X F O R Y EA R ,

S E PT EM BE R 30 - ¾ O F T O T A L T A X F O R Y E AR

J A N U A R Y 3 1 - F U LL A MO U N T D U E

I CERTIFY I HAVE EXAMINED THIS RETURN, INCLUDING ACCOMPANYING SCHEDULES AND STATEMENTS, AND TO THE BEST OF MY KNOWLEDGE AND BELIEF IT IS TRUE, CORRECT AND

COMPLETE AND THAT THE FIGURES USED HEREIN ARE THE SAME AS USED FOR FEDERAL INCOME TAX PURPOSES ADJUSTED TO MUNICIPAL INCOME TAX ORDINANCE.

S IG N

Signature of Taxpayer

Sign atu re of Spous e

Da te

Signature of Preparer, If not taxpayer

Da te

H E R E

( M A KE C H EC K P AY A B LE T O C E N T R A L C O LL EC T I O N AG E N C Y)

CCA FO RM 202ES (Rev. 11/01)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1