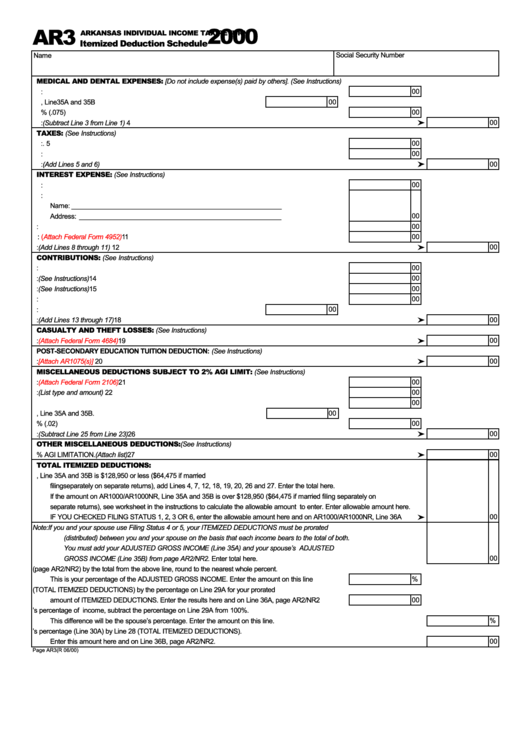

Form Ar3 - Arkansas Individual Income Tax Return - Itemized Deduction Schedule - 2000

ADVERTISEMENT

2000

AR3

ARKANSAS INDIVIDUAL INCOME TAX RETURN

Itemized Deduction Schedule

Social Security Number

Name

MEDICAL AND DENTAL EXPENSES: [Do not include expense(s) paid by others]. (See Instructions)

1. Medical and dental expenses: ........................................................................................................... 1

00

00

2. Enter amount from AR1000/AR1000NR, Line35A and 35B .................... 2

3. Multiply Line 2 by 7.5% (.075) ........................................................................................................... 3

00

4. TOTAL MEDICAL EXPENSE: (Subtract Line 3 from Line 1) .................................................................................................... 4

00

TAXES: (See Instructions)

5. Real estate tax: ................................................................................................................................ 5

00

6. Personal property tax: ....................................................................................................................... 6

00

00

7. TOTAL TAXES: (Add Lines 5 and 6) ....................................................................................................................................... 7

INTEREST EXPENSE: (See Instructions)

8. Home mortgage interest paid to financial institutions: ......................................................................... 8

00

9. Home mortgage interest paid to an individual:

Name: ______________________________________________________

Address: ____________________________________________________ . ............................. 9

00

10. Deductible points: ........................................................................................................................... 10

00

00

11. Investment interest:

(Attach Federal Form 4952)

.............................................................................. 11

12. TOTAL INTEREST EXPENSE: (Add Lines 8 through 11) ...................................................................................................... 12

00

CONTRIBUTIONS: (See Instructions)

00

13. Cash contributions: ......................................................................................................................... 13

14. Art and literary contributions: (See Instructions) ................................................................................ 14

00

15. Check-off contributions: (See Instructions) ....................................................................................... 15

00

00

16. Other: ............................................................................................................................................ 16

00

17. Carryover contributions from prior years: .............................................. 17

18. TOTAL CONTRIBUTIONS: (Add Lines 13 through 17) ......................................................................................................... 18

00

CASUALTY AND THEFT LOSSES: (See Instructions)

00

19. TOTAL CASUALTY AND THEFT LOSSES:

(Attach Federal Form 4684)

.............................................................................. 19

POST-SECONDARY EDUCATION TUITION DEDUCTION: (See Instructions)

20. TOTAL POST-SECONDARY EDUCATION TUITION DEDUCTION:

[Attach AR1075(s)]

....................................................... 20

00

MISCELLANEOUS DEDUCTIONS SUBJECT TO 2% AGI LIMIT: (See Instructions)

21. Unreimbursed employment business expenses:

(Attach Federal Form 2106)

................................... 21

00

22. Other Expenses: (List type and amount) .......................................................................................... 22

00

00

23. Add the amounts on Lines 21 and 22. Enter the total. ...................................................................... 23

00

24. Enter the amount from AR1000/AR1000NR, Line 35A and 35B. ........... 24

25. Multiple Line 24 above by 2% (.02) .................................................................................................. 25

00

26. TOTAL MISCELLANEOUS DEDUCTIONS: (Subtract Line 25 from Line 23) .......................................................................... 26

00

OTHER MISCELLANEOUS DEDUCTIONS: (See Instructions)

27. TOTAL MISCELLANEOUS DEDUCTIONS NOT SUBJECT TO THE 2% AGI LIMITATION. (Attach list) ................................ 27

00

TOTAL ITEMIZED DEDUCTIONS:

28. If the amount on AR1000/AR1000NR, Line 35A and 35B is $128,950 or less ($64,475 if married

filingseparately on separate returns), add Lines 4, 7, 12, 18, 19, 20, 26 and 27. Enter the total here.

If the amount on AR1000/AR1000NR, Line 35A and 35B is over $128,950 ($64,475 if married filing separately on

separate returns), see worksheet in the instructions to calculate the allowable amount to enter. Enter allowable amount here.

00

IF YOU CHECKED FILING STATUS 1, 2, 3 OR 6, enter the allowable amount here and on AR1000/AR1000NR, Line 36A .... 28

Note:

If you and your spouse use Filing Status 4 or 5, your ITEMIZED DEDUCTIONS must be prorated

(distributed) between you and your spouse on the basis that each income bears to the total of both.

You must add your ADJUSTED GROSS INCOME (Line 35A) and your spouse’s ADJUSTED

GROSS INCOME (Line 35B) from page AR2/NR2. Enter total here. .....................................................................................

00

29A. Divide Line 35A (page AR2/NR2) by the total from the above line, round to the nearest whole percent.

%

This is your percentage of the ADJUSTED GROSS INCOME. Enter the amount on this line ........... 29A

29B. Multiple Line 28 (TOTAL ITEMIZED DEDUCTIONS) by the percentage on Line 29A for your prorated

amount of ITEMIZED DEDUCTIONS. Enter the results here and on Line 36A, page AR2/NR2 ....... 29B

00

30A. For spouse’s percentage of income, subtract the percentage on Line 29A from 100%.

This difference will be the spouse’s percentage. Enter the amount on this line. ......................................................................... 30A

%

30B. Multiple spouse’s percentage (Line 30A) by Line 28 (TOTAL ITEMIZED DEDUCTIONS).

00

Enter this amount here and on Line 36B, page AR2/NR2. ....................................................................................................... 30B

Page AR3 (R 06/00)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1