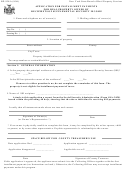

Form Rp-305-B - Application For Exception From Minimum Average Sales Value Requirement Page 2

ADVERTISEMENT

RP-305-b (01/02)

2

8.

Specify gross sales value of agricultural production initiated in year for

$______________________

which application for exemption is made (add totals from section 5 and 7).

_________________________________________________________________________________________________

PART II. To be completed by COUNTY COOPERATIVE EXTENSION

I, _______________________________________________, being a duly authorized agent of the Cooperative Extension Service in

_____________________________ County, hereby certify that to the best of my knowledge the following constitutes a true statement of facts

relating to the application filed by ________________________________________.

1. That the lands described by the applicant in Part I of this application were affected by a natural disaster, act of God or continued adverse

weather conditions as follows:

2. That, due to conditions described in (1) above, the agricultural production initiated on such land described by the applicant in Part I,

Section 4 was destroyed.

3. That the total normal gross sales value of the production described in Part I, Section 5, reflects a reasonable selling price for such

production.

______________________________

___________________

Signature of Agent

Date

__________________________________________________________________________________________________

PART III. To be completed by APPLICANT

CERTIFICATION: I hereby certify that the above information on this application constitutes a true statement of facts to the

best of my knowledge.

PENALTY FOR FALSE STATEMENTS:

A person making false statements on an application

for an exemption is guilty of an offense punishable by law.

______________________________________________

_____________________________

Signature of Owner

Date

__________________________________________________________________________________________________

FILING INSTRUCTIONS

Filing

Applicant must complete Parts I and III, have the county extension agent complete Part II, and attach the completed application to the

application(s) being filed for an agricultural assessment (Form RP-305 or RP-305-r). If agricultural production was destroyed for the

two calendar years preceding date of application, a separate application for each year must be filed.

Place and Time of Filing

This application should be filed with the city, town or village assessor on or before taxable status date, together with Form

RP-305 or RP-305-r.

__________________________________________________________________________________________________

GENERAL INFORMATION

PART I

assessment.

1.

Description of property should be obtained from the application(s) being filed for an agricultural

2.

If less than the total acreage was affected by an act of God, etc. enter the number of acres affected.

3.

When computing the total gross sales value that the affected acreage would have produced, the applicant may obtain

information for c(2) and c(4) from the county extension service or from his personal records (specify in Section 6).

4.

Applicant is required to use actual gross sales receipts derived from the unaffected acreage, if any.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2