Form Rp-305-A - Agricultural Assessment - Notice Of Approval Or Denial Of Application

ADVERTISEMENT

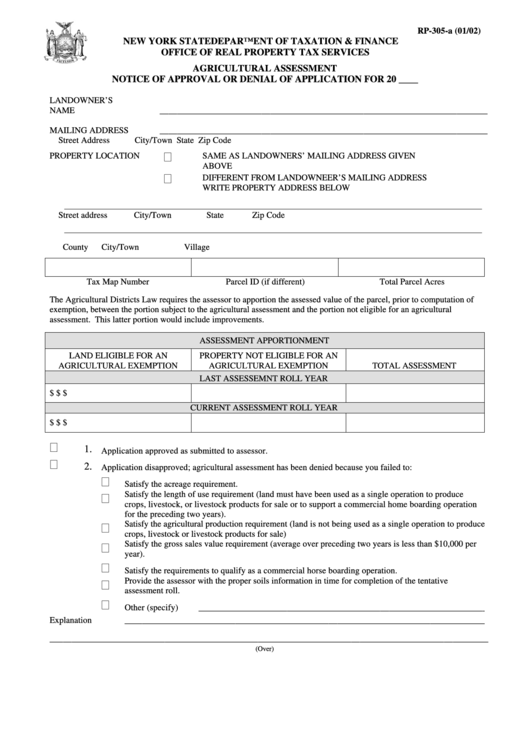

RP-305-a (01/02)

NEW YORK STATE DEPARTMENT OF TAXATION & FINANCE

OFFICE OF REAL PROPERTY TAX SERVICES

AGRICULTURAL ASSESSMENT

NOTICE OF APPROVAL OR DENIAL OF APPLICATION FOR 20 ____

LANDOWNER’S

NAME

__________________________________________________________________________

MAILING ADDRESS

__________________________________________________________________________

Street Address

City/Town

State

Zip Code

PROPERTY LOCATION

SAME AS LANDOWNERS’ MAILING ADDRESS GIVEN

ABOVE

DIFFERENT FROM LANDOWNEER’S MAILING ADDRESS

WRITE PROPERTY ADDRESS BELOW

________________________________________________________________________________________________________________________

Street address

City/Town

State

Zip Code

________________________________________________________________________________________________________________________

County

City/Town

Village

Tax Map Number

Parcel ID (if different)

Total Parcel Acres

The Agricultural Districts Law requires the assessor to apportion the assessed value of the parcel, prior to computation of

exemption, between the portion subject to the agricultural assessment and the portion not eligible for an agricultural

assessment. This latter portion would include improvements.

ASSESSMENT APPORTIONMENT

LAND ELIGIBLE FOR AN

PROPERTY NOT ELIGIBLE FOR AN

AGRICULTURAL EXEMPTION

AGRICULTURAL EXEMPTION

TOTAL ASSESSMENT

LAST ASSESSEMNT ROLL YEAR

$

$

$

CURRENT ASSESSMENT ROLL YEAR

$

$

$

1.

Application approved as submitted to assessor.

2.

Application disapproved; agricultural assessment has been denied because you failed to:

Satisfy the acreage requirement.

Satisfy the length of use requirement (land must have been used as a single operation to produce

crops, livestock, or livestock products for sale or to support a commercial home boarding operation

for the preceding two years).

Satisfy the agricultural production requirement (land is not being used as a single operation to produce

crops, livestock or livestock products for sale)

Satisfy the gross sales value requirement (average over preceding two years is less than $10,000 per

year).

Satisfy the requirements to qualify as a commercial horse boarding operation.

Provide the assessor with the proper soils information in time for completion of the tentative

assessment roll.

Other (specify)

_________________________________________________________________

Explanation

__________________________________________________________________________________

___________________________________________________________________________________________________

(Over)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2