Form Br - Business Income Tax Return - 2002

ADVERTISEMENT

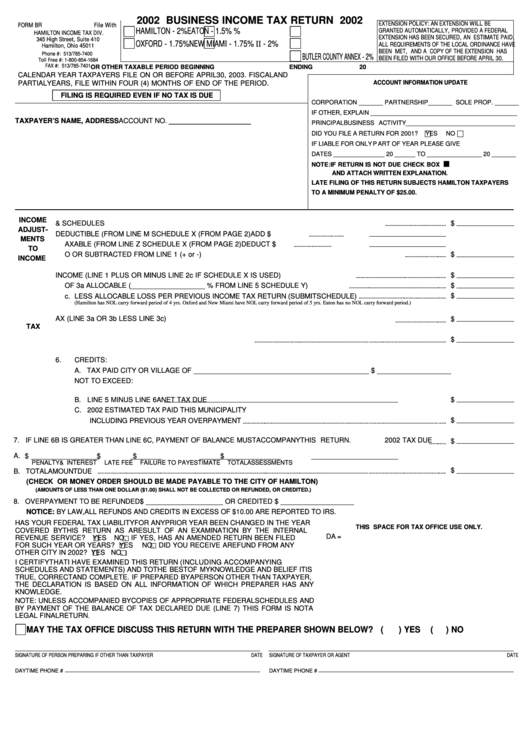

2002 BUSINESS INCOME TAX RETURN 2002

EXTENSION POLICY: AN EXTENSION WILL BE

FORM BR

File With

HAMILTON - 2%

EATON - 1.5%

J.E.D.D. - 2%

GRANTED AUTOMAT I C A L LY, PROVIDED A FEDERAL

HAMILTON INCOME TAX DIV.

EXTENSION HAS BEEN SECURED, AN ESTIMATE PA I D ,

345 High Street, Suite 410

OXFORD - 1.75%

NEW MIAMI - 1.75%

J.E.D.D. II - 2%

ALL REQUIREMENTS OF THE LOCAL ORDINANCE HAV E

Hamilton, Ohio 45011

BEEN MET, AND A COPY OF THE EXTENSION HAS

Phone #: 513/785-7400

BUTLER COUNTY ANNEX - 2%

BEEN FILED WITH OUR OFFICE BEFORE APRIL 30.

Toll Free #: 1-800-854-1684

FAX #: 513/785-7401

OR OTHER TAXABLE PERIOD BEGINNING

ENDING

20

CALENDAR YEAR TAXPAYERS FILE ON OR BEFORE APRIL30, 2003. FISCALAND

ACCOUNT INFORMATION UPDATE

PARTIALYEARS, FILE WITHIN FOUR (4) MONTHS OF END OF THE PERIOD.

FILING IS REQUIRED EVEN IF NO TAX IS DUE

CORPORATION _______ PARTNERSHIP_______ SOLE PROP. _______

IF OTHER, EXPLAIN ___________________________________________

TAXPAYER’S NAME, ADDRESS

ACCOUNT NO. _____________________

PRINCIPALBUSINESS ACTIVITY________________________________

DID YOU FILE A RETURN FOR 2001?

YES

NO

IF LIABLE FOR ONLY PART OF YEAR PLEASE GIVE

DATES _______________ 20 ______ TO ________________ 20 _______

NOTE:IF RETURN IS NOT DUE CHECK BOX

AND ATTACH WRITTEN EXPLANATION.

LATE FILING OF THIS RETURN SUBJECTS HAMILTON TAXPAYERS

TO A MINIMUM PENALTY OF $25.00.

INCOME

1.

TOTAL INCOME FROM PAGE 2 OR ATTACHED COPIES OF FEDERAL RETURNS & SCHEDULES

$

ADJUST-

2. a. ITEMS NOT DEDUCTIBLE (FROM LINE M SCHEDULE X (FROM PAGE 2)

ADD $

MENTS

b. ITEMS NOT TAXABLE (FROM LINE Z SCHEDULE X (FROM PAGE 2)

DEDUCT $

TO

c. DIFFERENCE BETWEEN LINES 2a AND 2b TO BE ADDED TO OR SUBTRACTED FROM LINE 1 (+ or -)

$

INCOME

3. a. ADJUSTED NET INCOME (LINE 1 PLUS OR MINUS LINE 2c IF SCHEDULE X IS USED)

$

b. AMOUNT OF 3a ALLOCABLE (___________________ % FROM LINE 5 SCHEDULE Y)

$

c. LESS ALLOCABLE LOSS PER PREVIOUS INCOME TAX RETURN (SUBMIT SCHEDULE)

$

(Hamilton has NOL carry forward period of 4 yrs. Oxford and New Miami have NOL carry forward period of 5 yrs. Eaton has no NOL carry forward period.)

4.

AMOUNT SUBJECT TO _____________________ CITY INCOME TAX (LINE 3a OR 3b LESS LINE 3c)

$

TAX

5.

MUNICIPAL TAX -

$

6.

CREDITS:

A. TAX PAID CITY OR VILLAGE OF _____________________________________________ $ ___________________

NOT TO EXCEED:

B. LINE 5 MINUS LINE 6A

NET TAX DUE

$

C. 2002 ESTIMATED TAX PAID THIS MUNICIPALITY

INCLUDING PREVIOUS YEAR OVERPAYMENT

$

7. IF LINE 6B IS GREATER THAN LINE 6C, PAYMENT OF BALANCE MUSTACCOMPANYTHIS RETURN.

2002 TAX DUE

$

A.

$

$

$

$

PENALTY& INTEREST

LATE FEE

FAILURE TO PAY ESTIMATE

TOTALASSESSMENTS

$

B. TOTALAMOUNT DUE

(CHECK OR MONEY ORDER SHOULD BE MADE PAYABLE TO THE CITY OF HAMILTON)

(AMOUNTS OF LESS THAN ONE DOLLAR ($1.00) SHALL NOT BE COLLECTED OR REFUNDED, OR CREDITED.)

8. OVERPAYMENT TO BE REFUNDED $ ____________________ OR CREDITED $ ___________________

NOTICE: BY LAW, ALL REFUNDS AND CREDITS IN EXCESS OF $10.00 ARE REPORTED TO IRS.

HAS YOUR FEDERAL TAX LIABILITY FOR ANY PRIOR YEAR BEEN CHANGED IN THE YEAR

THIS SPACE FOR TAX OFFICE USE ONLY.

COVERED BY THIS RETURN AS A RESULT OF AN EXAMINATION BY THE INTERNAL

DA =

REVENUE SERVICE?

YES

NO. IF YES, HAS AN AMENDED RETURN BEEN FILED

FOR SUCH YEAR OR YEARS?

YES

NO. DID YOU RECEIVE A REFUND FROM ANY

OTHER CITY IN 2002?

YES

NO.

I CERT I F Y T H AT I HAVE EXAMINED THIS RETURN (INCLUDING A C C O M PA N Y I N G

SCHEDULES AND STATEMENTS) AND TO THE BESTOF MY KNOWLEDGE AND BELIEF ITIS

TRUE, CORRECTAND COMPLETE. IF PREPARED BY A PERSON OTHER THAN TAXPAYER,

THE DECLARATION IS BASED ON ALL INFORMATION OF WHICH PREPARER HAS ANY

KNOWLEDGE.

NOTE: UNLESS ACCOMPANIED BYCOPIES OF APPROPRIATE FEDERALSCHEDULES AND

BY PAYMENT OF THE BALANCE OF TAX DECLARED DUE (LINE 7) THIS FORM IS NOT A

LEGAL FINALRETURN.

MAY THE TAX OFFICE DISCUSS THIS RETURN WITH THE PREPARER SHOWN BELOW? (

) YES

(

) NO

SIGNATURE OF PERSON PREPARING IF OTHER THAN TAXPAYER

DATE

SIGNATURE OF TAXPAYER OR AGENT

DATE

DAYTIME PHONE #

DAYTIME PHONE #

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2