Instructions For Form 3520 - Annual Return To Report Transactions With Foreign Trusts And Receipt Of Certain Foreign Gifts - 2003

ADVERTISEMENT

03

2 0

Department of the Treasury

Internal Revenue Service

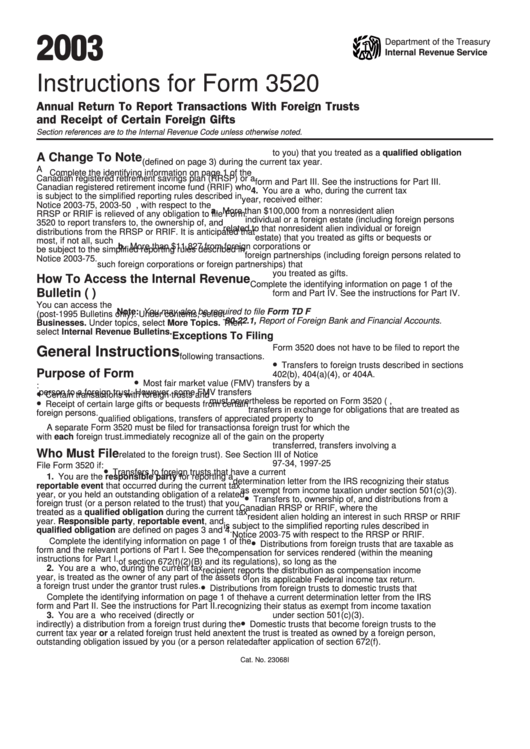

Instructions for Form 3520

Annual Return To Report Transactions With Foreign Trusts

and Receipt of Certain Foreign Gifts

Section references are to the Internal Revenue Code unless otherwise noted.

to you) that you treated as a qualified obligation

A Change To Note

(defined on page 3) during the current tax year.

A U.S. citizen or resident alien holding an interest in a

Complete the identifying information on page 1 of the

Canadian registered retirement savings plan (RRSP) or a

form and Part III. See the instructions for Part III.

Canadian registered retirement income fund (RRIF) who

4. You are a U.S. person who, during the current tax

is subject to the simplified reporting rules described in

year, received either:

Notice 2003-75, 2003-50 I.R.B. 1204, with respect to the

a. More than $100,000 from a nonresident alien

RRSP or RRIF is relieved of any obligation to file Form

individual or a foreign estate (including foreign persons

3520 to report transfers to, the ownership of, and

related to that nonresident alien individual or foreign

distributions from the RRSP or RRIF. It is anticipated that

estate) that you treated as gifts or bequests or

most, if not all, such U.S. citizens or resident aliens will

b. More than $11,827 from foreign corporations or

be subject to the simplified reporting rules described in

foreign partnerships (including foreign persons related to

Notice 2003-75.

such foreign corporations or foreign partnerships) that

you treated as gifts.

How To Access the Internal Revenue

Complete the identifying information on page 1 of the

Bulletin (I.R.B.)

form and Part IV. See the instructions for Part IV.

You can access the I.R.B. on the internet at

Note: You may also be required to file Form TD F

(post-1995 Bulletins only). Under contents, select

90-22.1, Report of Foreign Bank and Financial Accounts.

Businesses. Under topics, select More Topics. Then

select Internal Revenue Bulletins.

Exceptions To Filing

Form 3520 does not have to be filed to report the

General Instructions

following transactions.

•

Transfers to foreign trusts described in sections

Purpose of Form

402(b), 404(a)(4), or 404A.

•

Most fair market value (FMV) transfers by a U.S.

U.S. persons file Form 3520 to report:

•

person to a foreign trust. However, some FMV transfers

Certain transactions with foreign trusts and

•

must nevertheless be reported on Form 3520 (e.g.,

Receipt of certain large gifts or bequests from certain

transfers in exchange for obligations that are treated as

foreign persons.

qualified obligations, transfers of appreciated property to

A separate Form 3520 must be filed for transactions

a foreign trust for which the U.S. transferor does not

with each foreign trust.

immediately recognize all of the gain on the property

transferred, transfers involving a U.S. transferor that is

Who Must File

related to the foreign trust). See Section III of Notice

97-34, 1997-25 I.R.B. 22.

File Form 3520 if:

•

Transfers to foreign trusts that have a current

1. You are the responsible party for reporting a

determination letter from the IRS recognizing their status

reportable event that occurred during the current tax

as exempt from income taxation under section 501(c)(3).

year, or you held an outstanding obligation of a related

•

Transfers to, ownership of, and distributions from a

foreign trust (or a person related to the trust) that you

Canadian RRSP or RRIF, where the U.S. citizen or

treated as a qualified obligation during the current tax

resident alien holding an interest in such RRSP or RRIF

year. Responsible party, reportable event, and

is subject to the simplified reporting rules described in

qualified obligation are defined on pages 3 and 4.

Notice 2003-75 with respect to the RRSP or RRIF.

•

Complete the identifying information on page 1 of the

Distributions from foreign trusts that are taxable as

form and the relevant portions of Part I. See the

compensation for services rendered (within the meaning

instructions for Part I.

of section 672(f)(2)(B) and its regulations), so long as the

2. You are a U.S. person who, during the current tax

recipient reports the distribution as compensation income

year, is treated as the owner of any part of the assets of

on its applicable Federal income tax return.

•

a foreign trust under the grantor trust rules.

Distributions from foreign trusts to domestic trusts that

Complete the identifying information on page 1 of the

have a current determination letter from the IRS

form and Part II. See the instructions for Part II.

recognizing their status as exempt from income taxation

3. You are a U.S. person who received (directly or

under section 501(c)(3).

•

indirectly) a distribution from a foreign trust during the

Domestic trusts that become foreign trusts to the

current tax year or a related foreign trust held an

extent the trust is treated as owned by a foreign person,

outstanding obligation issued by you (or a person related

after application of section 672(f).

Cat. No. 23068I

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12