Form Nc-30 - Income Tax Withholding Tables And Instructions For Employers - North Carolina - 2017

ADVERTISEMENT

NC - 30

2017 Income Tax Withholding

Web

11-16

Tables and Instructions

for Employers

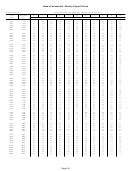

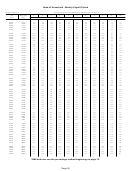

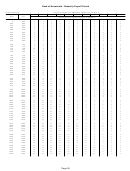

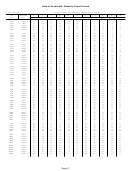

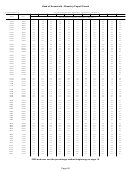

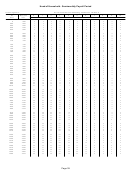

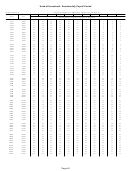

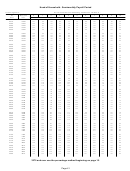

New for 2017

• This publication has been revised to reflect legislative

changes which increase the standard deduction

amount and reduce the individual income tax rate.

North Carolina law requires North Carolina income

tax to be withheld from wages at a rate that is 0.1%

higher than the individual income tax rate, which has

been changed to 5.499%. Therefore the withholding

rate on wages paid on or after January 1, 2017,

will be 5.599%. The changes resulted in revisions

to the Formula Tables for the Percentage Method

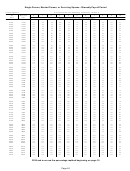

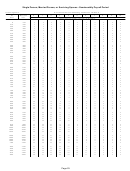

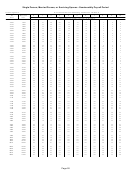

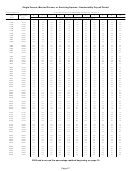

Withholding Computations and Formula Tables for

Annualized Method Withholding Computations on

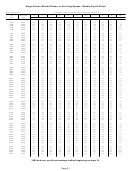

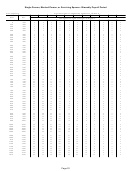

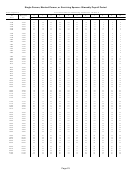

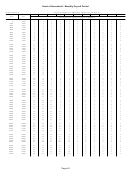

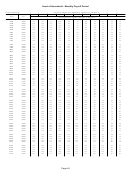

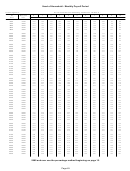

pages 15-17, as well as the Wage Bracket Tables on

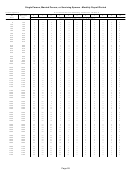

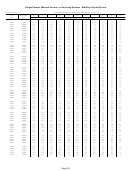

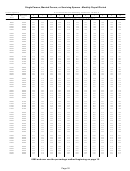

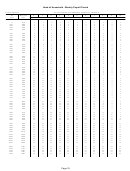

Pages 19-45.

• An increase to the standard deduction required

adjustments to the Multiple Jobs Table and the

allowance worksheets for Forms NC-4, NC-4 NRA, and

NC-4P. The changes are minor and employees are

not required to submit a new NC-4 unless the number

of withholding allowances to which they are entitled

decrease or the employee has claimed exemption

from withholding. Pension and annuity recipients who

have previously elected not to have State income tax

withheld from their payments do not have to submit

a new NC-4P unless they are revoking their previous

election.

• The terminology “Qualifying Widow(er)” has been

replaced with the statutory term of “Surviving Spouse”

which is defined in Section 2 of the Internal Revenue

Code.

The following forms are no longer included in this

publication. They are available from our website at http://

or you may

request the Department to mail you a form by calling

1-877-252-3052.

NC-BR

Business Registration Application for Income Tax Withholding,

Sales and Use Tax, and Machinery and Equipment Tax

Form NC-4 EZ and Form NC-4

Employee’s Withholding Allowance Certificate

Form NC-4 NRA

You can file your return

Nonresident Alien Employee’s Withholding Allowance Certificate

and pay your tax online at

Form NC-4P

Withholding Certificate for Pension or Annuity Payments

Issued by: North Carolina Department of Revenue, P.O. Box 25000, Raleigh, North Carolina 27640-0001

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37 38

38 39

39 40

40 41

41 42

42 43

43 44

44 45

45 46

46