Request For An Extension Of Time To File 1999 Tax Return Form - City Of Cleveland Heights, Ohio

ADVERTISEMENT

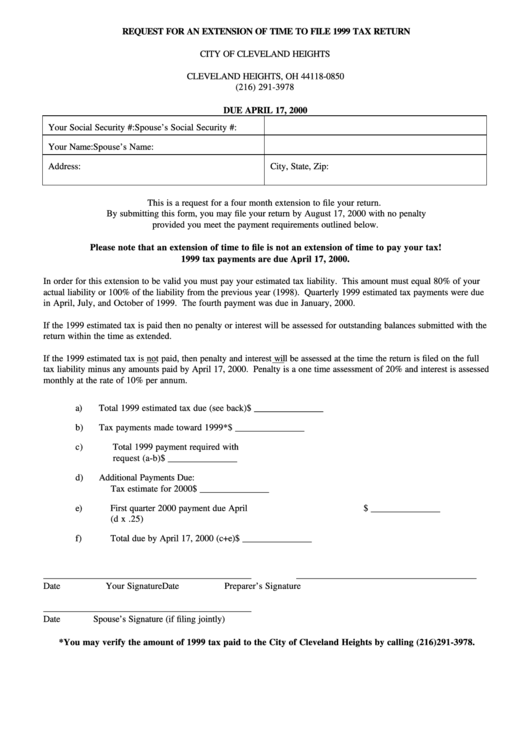

REQUEST FOR AN EXTENSION OF TIME TO FILE 1999 TAX RETURN

CITY OF CLEVELAND HEIGHTS

P.O. BOX 18850

CLEVELAND HEIGHTS, OH 44118-0850

(216) 291-3978

DUE APRIL 17, 2000

Your Social Security #:

Spouse’s Social Security #:

Your Name:

Spouse’s Name:

Address:

City, State, Zip:

This is a request for a four month extension to file your return.

By submitting this form, you may file your return by August 17, 2000 with no penalty

provided you meet the payment requirements outlined below.

Please note that an extension of time to file is not an extension of time to pay your tax!

1999 tax payments are due April 17, 2000.

In order for this extension to be valid you must pay your estimated tax liability. This amount must equal 80% of your

actual liability or 100% of the liability from the previous year (1998). Quarterly 1999 estimated tax payments were due

in April, July, and October of 1999. The fourth payment was due in January, 2000.

If the 1999 estimated tax is paid then no penalty or interest will be assessed for outstanding balances submitted with the

return within the time as extended.

If the 1999 estimated tax is not paid, then penalty and interest will be assessed at the time the return is filed on the full

tax liability minus any amounts paid by April 17, 2000. Penalty is a one time assessment of 20% and interest is assessed

monthly at the rate of 10% per annum.

a)

Total 1999 estimated tax due (see back)

$ _______________

b)

Tax payments made toward 1999*

$ _______________

c)

Total 1999 payment required with

request (a-b)

$ _______________

d)

Additional Payments Due:

Tax estimate for 2000

$ _______________

e)

First quarter 2000 payment due April

$ _______________

(d x .25)

f)

Total due by April 17, 2000 (c+e)

$ _______________

_____________________________________________

_______________________________________

Date

Your Signature

Date

Preparer’s Signature

_____________________________________________

Date

Spouse’s Signature (if filing jointly)

*You may verify the amount of 1999 tax paid to the City of Cleveland Heights by calling (216)291-3978.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2