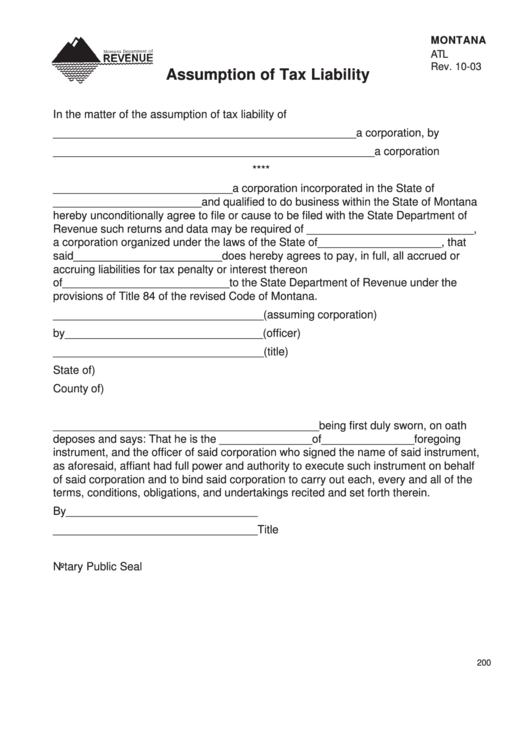

MONTANA

ATL

Rev. 10-03

Assumption of Tax Liability

In the matter of the assumption of tax liability of

_________________________________________________a corporation, by

____________________________________________________a corporation

****

_____________________________a corporation incorporated in the State of

________________________and qualified to do business within the State of Montana

hereby unconditionally agree to file or cause to be filed with the State Department of

Revenue such returns and data may be required of ___________________________,

a corporation organized under the laws of the State of____________________, that

said________________________does hereby agrees to pay, in full, all accrued or

accruing liabilities for tax penalty or interest thereon

of___________________________to the State Department of Revenue under the

provisions of Title 84 of the revised Code of Montana.

__________________________________(assuming corporation)

by________________________________(officer)

__________________________________(title)

State of

)

County of

)

___________________________________________being first duly sworn, on oath

deposes and says: That he is the _______________of_______________foregoing

instrument, and the officer of said corporation who signed the name of said instrument,

as aforesaid, affiant had full power and authority to execute such instrument on behalf

of said corporation and to bind said corporation to carry out each, every and all of the

terms, conditions, obligations, and undertakings recited and set forth therein.

By_______________________________

_________________________________Title

Notary Public Seal

200

1

1