Form As 2916.1 - Certificate For Exempt Purchases And For Services Subject To The 4% Special-Sut

ADVERTISEMENT

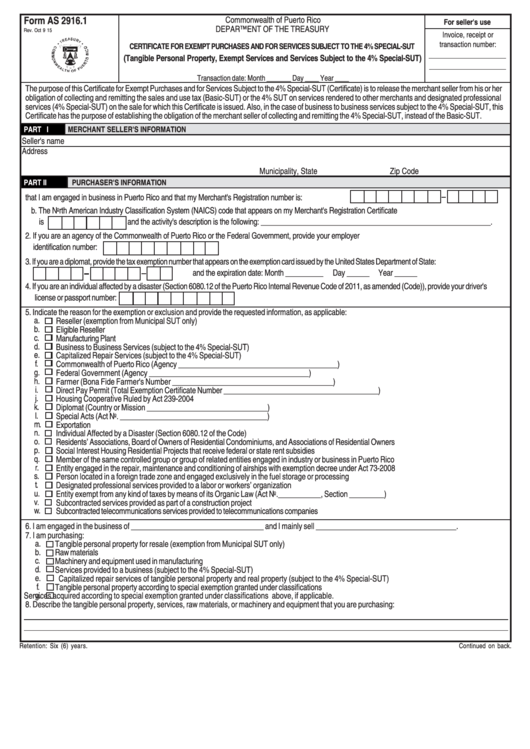

Form AS 2916.1

Commonwealth of Puerto Rico

For seller's use

DEPARTMENT OF THE TREASURY

Rev. Oct 9 15

Invoice, receipt or

transaction number:

CERTIFICATE FOR EXEMPT PURCHASES AND FOR SERVICES SUBJECT TO THE 4% SPECIAL-SUT

(Tangible Personal Property, Exempt Services and Services Subject to the 4% Special-SUT)

Transaction date: Month _______ Day ____ Year ____

The purpose of this Certificate for Exempt Purchases and for Services Subject to the 4% Special-SUT (Certificate) is to release the merchant seller from his or her

obligation of collecting and remitting the sales and use tax (Basic-SUT) or the 4% SUT on services rendered to other merchants and designated professional

services (4% Special-SUT) on the sale for which this Certificate is issued. Also, in the case of business to business services subject to the 4% Special-SUT, this

Certificate has the purpose of establishing the obligation of the merchant seller of collecting and remitting the 4% Special-SUT, instead of the Basic-SUT.

PART I

MERCHANT SELLER'S INFORMATION

Seller's name

Address

Municipality, State

Zip Code

PART II

PURCHASER'S INFORMATION

1.a. I certify that I am engaged in business in Puerto Rico and that my Merchant's Registration number is:

b. The North American Industry Classification System (NAICS) code that appears on my Merchant's Registration Certificate

is

and the activity's description is the following: _____________________________________________________________.

2. If you are an agency of the Commonwealth of Puerto Rico or the Federal Government, provide your employer

identification number:

3. If you are a diplomat, provide the tax exemption number that appears on the exemption card issued by the United States Department of State:

and the expiration date: Month __________ Day ______ Year ______

4. If you are an individual affected by a disaster (Section 6080.12 of the Puerto Rico Internal Revenue Code of 2011, as amended (Code)), provide your driver's

license or passport number:

5. Indicate the reason for the exemption or exclusion and provide the requested information, as applicable:

a.

Reseller (exemption from Municipal SUT only)

b.

Eligible Reseller

c.

Manufacturing Plant

d.

Business to Business Services (subject to the 4% Special-SUT)

e.

Capitalized Repair Services (subject to the 4% Special-SUT)

f.

Commonwealth of Puerto Rico (Agency _________________________________________)

g.

Federal Government (Agency _________________________________________)

h.

Farmer (Bona Fide Farmer's Number _________________________________________)

i.

Direct Pay Permit (Total Exemption Certificate Number ________________________________________)

j.

Housing Cooperative Ruled by Act 239-2004

k.

Diplomat (Country or Mission _______________________________)

l.

Special Acts (Act No. ______________________________________)

m.

Exportation

n.

Individual Affected by a Disaster (Section 6080.12 of the Code)

o.

Residents’ Associations, Board of Owners of Residential Condominiums, and Associations of Residential Owners

p.

Social Interest Housing Residential Projects that receive federal or state rent subsidies

q.

Member of the same controlled group or group of related entities engaged in industry or business in Puerto Rico

r.

Entity engaged in the repair, maintenance and conditioning of airships with exemption decree under Act 73-2008

s.

Person located in a foreign trade zone and engaged exclusively in the fuel storage or processing

t.

Designated professional services provided to a labor or workers’ organization

u.

Entity exempt from any kind of taxes by means of its Organic Law (Act No.___________, Section _________)

v.

Subcontracted services provided as part of a construction project

w.

Subcontracted telecommunications services provided to telecommunications companies

6. I am engaged in the business of __________________________________ and I mainly sell ____________________________________.

7. I am purchasing:

a.

Tangible personal property for resale (exemption from Municipal SUT only)

b.

Raw materials

c.

Machinery and equipment used in manufacturing

d.

Services provided to a business (subject to the 4% Special-SUT)

e.

Capitalized repair services of tangible personal property and real property (subject to the 4% Special-SUT)

f.

Tangible personal property according to special exemption granted under classifications 5.f. through 5.n. indicated above.

g.

Services acquired according to special exemption granted under classifications 5.f. through 5.w. indicated above, if applicable.

8. Describe the tangible personal property, services, raw materials, or machinery and equipment that you are purchasing:

Retention: Six (6) years.

Continued on back.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4