Instructions For Claiming The Solid Waste Management Credit

ADVERTISEMENT

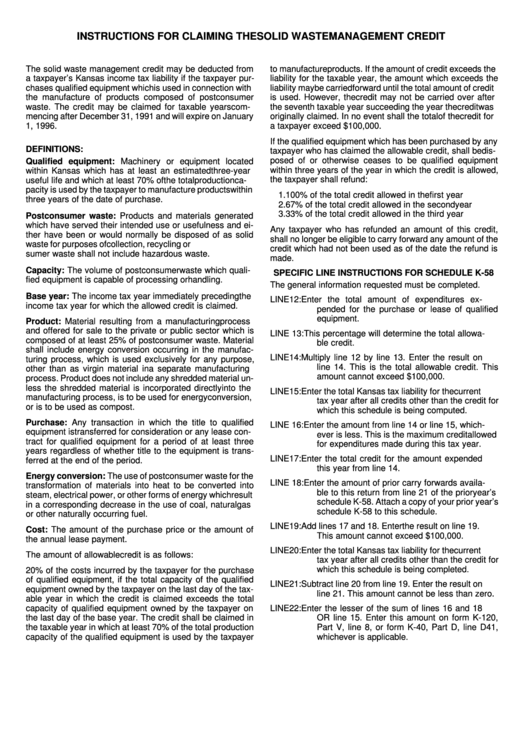

INSTRUCTIONS FOR CLAIMING THE SOLID WASTE MANAGEMENT CREDIT

The solid waste management credit may be deducted from

to manufacture products. If the amount of credit exceeds the

a taxpayer’s Kansas income tax liability if the taxpayer pur-

liability for the taxable year, the amount which exceeds the

chases qualified equipment which is used in connection with

liability may be carried forward until the total amount of credit

the manufacture of products composed of postconsumer

is used. However, the credit may not be carried over after

waste. The credit may be claimed for taxable years com-

the seventh taxable year succeeding the year the credit was

mencing after December 31, 1991 and will expire on January

originally claimed. In no event shall the total of the credit for

1, 1996.

a taxpayer exceed $100,000.

If the qualified equipment which has been purchased by any

DEFINITIONS:

taxpayer who has claimed the allowable credit, shall be dis-

posed of or otherwise ceases to be qualified equipment

Qualified equipment: Machinery or equipment located

within three years of the year in which the credit is allowed,

within Kansas which has at least an estimated three-year

the taxpayer shall refund:

useful life and which at least 70% of the total production ca-

pacity is used by the taxpayer to manufacture products within

1. 100% of the total credit allowed in the first year

three years of the date of purchase.

2. 67% of the total credit allowed in the second year

3. 33% of the total credit allowed in the third year

Postconsumer waste: Products and materials generated

which have served their intended use or usefulness and ei-

Any taxpayer who has refunded an amount of this credit,

ther have been or would normally be disposed of as solid

shall no longer be eligible to carry forward any amount of the

waste for purposes of collection, recycling or reuse. Postcon-

credit which had not been used as of the date the refund is

sumer waste shall not include hazardous waste.

made.

Capacity: The volume of postconsumer waste which quali-

SPECIFIC LINE INSTRUCTIONS FOR SCHEDULE K-58

fied equipment is capable of processing or handling.

The general information requested must be completed.

Base year: The income tax year immediately preceding the

LINE 12:

Enter the total amount of expenditures ex-

income tax year for which the allowed credit is claimed.

pended for the purchase or lease of qualified

equipment.

Product: Material resulting from a manufacturing process

and offered for sale to the private or public sector which is

LINE 13:

This percentage will determine the total allowa-

composed of at least 25% of postconsumer waste. Material

ble credit.

shall include energy conversion occurring in the manufac-

LINE 14:

Multiply line 12 by line 13. Enter the result on

turing process, which is used exclusively for any purpose,

line 14. This is the total allowable credit. This

other than as virgin material in a separate manufacturing

amount cannot exceed $100,000.

process. Product does not include any shredded material un-

less the shredded material is incorporated directly into the

LINE 15:

Enter the total Kansas tax liability for the current

manufacturing process, is to be used for energy conversion,

tax year after all credits other than the credit for

or is to be used as compost.

which this schedule is being computed.

Purchase: Any transaction in which the title to qualified

LINE 16:

Enter the amount from line 14 or line 15, which-

equipment is transferred for consideration or any lease con-

ever is less. This is the maximum credit allowed

tract for qualified equipment for a period of at least three

for expenditures made during this tax year.

years regardless of whether title to the equipment is trans-

LINE 17:

Enter the total credit for the amount expended

ferred at the end of the period.

this year from line 14.

Energy conversion: The use of postconsumer waste for the

LINE 18:

Enter the amount of prior carry forwards availa-

transformation of materials into heat to be converted into

ble to this return from line 21 of the prior year’s

steam, electrical power, or other forms of energy which result

schedule K-58. Attach a copy of your prior year’s

in a corresponding decrease in the use of coal, natural gas

schedule K-58 to this schedule.

or other naturally occurring fuel.

LINE 19:

Add lines 17 and 18. Enter the result on line 19.

Cost: The amount of the purchase price or the amount of

This amount cannot exceed $100,000.

the annual lease payment.

LINE 20:

Enter the total Kansas tax liability for the current

The amount of allowable credit is as follows:

tax year after all credits other than the credit for

which this schedule is being completed.

20% of the costs incurred by the taxpayer for the purchase

of qualified equipment, if the total capacity of the qualified

LINE 21:

Subtract line 20 from line 19. Enter the result on

equipment owned by the taxpayer on the last day of the tax-

line 21. This amount cannot be less than zero.

able year in which the credit is claimed exceeds the total

capacity of qualified equipment owned by the taxpayer on

LINE 22:

Enter the lesser of the sum of lines 16 and 18

the last day of the base year. The credit shall be claimed in

OR line 15. Enter this amount on form K-120,

the taxable year in which at least 70% of the total production

Part V, line 8, or form K-40, Part D, line D41,

capacity of the qualified equipment is used by the taxpayer

whichever is applicable.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1