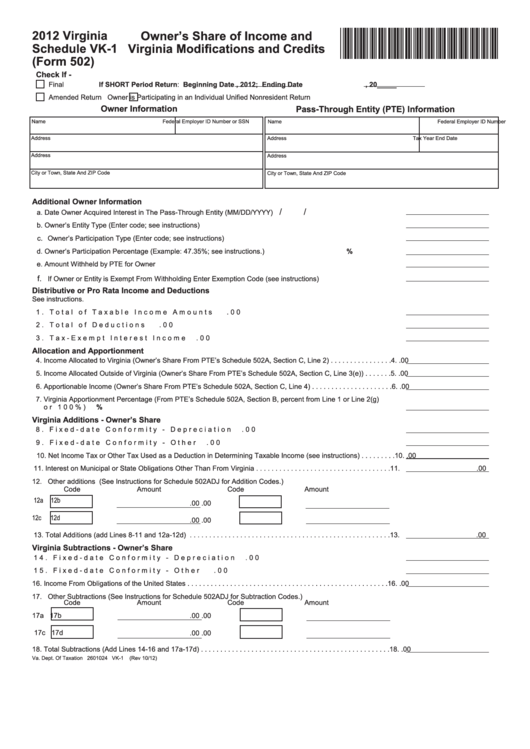

2012 Virginia

Owner’s Share of Income and

*VA0VK1112888*

Schedule VK-1

Virginia Modifications and Credits

(Form 502)

Check If -

Final

If SHORT Period Return: Beginning Date

, 2012; Ending Date

, 20_____

Amended Return

Owner is Participating in an Individual Unified Nonresident Return

Owner Information

Pass-Through Entity (PTE) Information

Name

Federal Employer ID Number or SSN

Name

Federal Employer ID Number

Address

Address

Tax Year End Date

Address

Address

City or Town, State And ZIP Code

City or Town, State And ZIP Code

Additional Owner Information

/ /

a. Date Owner Acquired Interest in The Pass-Through Entity (MM/DD/YYYY) ..................................................................

b. Owner’s Entity Type (Enter code; see instructions) . ........................................................................................................

c. Owner’s Participation Type (Enter code; see instructions) . .............................................................................................

d. Owner’s Participation Percentage (Example: 47.35%; see instructions.) .......................................................................

%

e. Amount Withheld by PTE for Owner ..............................................................................................................................

f.

If Owner or Entity is Exempt From Withholding Enter Exemption Code (see instructions) .........................................

Distributive or Pro Rata Income and Deductions

See instructions.

1. Total of Taxable Income Amounts . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1.

.00

2. Total of Deductions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2.

.00

3. Tax-Exempt Interest Income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3.

.00

Allocation and Apportionment

4. Income Allocated to Virginia (Owner’s Share From PTE’s Schedule 502A, Section C, Line 2) . . . . . . . . . . . . . . . . 4.

.00

5. Income Allocated Outside of Virginia (Owner’s Share From PTE’s Schedule 502A, Section C, Line 3(e)) . . . . . . . 5.

.00

.00

6. Apportionable Income (Owner’s Share From PTE’s Schedule 502A, Section C, Line 4) . . . . . . . . . . . . . . . . . . . . . 6.

7. Virginia Apportionment Percentage (From PTE’s Schedule 502A, Section B, percent from Line 1 or Line 2(g)

or 100%) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7.

%

Virginia Additions - Owner’s Share

8. Fixed-date Conformity - Depreciation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8.

.00

9. Fixed-date Conformity - Other . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9.

.00

1 0. Net Income Tax or Other Tax Used as a Deduction in Determining Taxable Income (see instructions) . . . . . . . . . 10.

.00

1 1. Interest on Municipal or State Obligations Other Than From Virginia . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11.

.00

12. Other additions (See Instructions for Schedule 502ADJ for Addition Codes.)

Code

Amount

Code

Amount

1 2a

12b

.00

.00

12c

12d

.00

.00

1 3. Total Additions (add Lines 8-11 and 12a-12d) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13.

.00

Virginia Subtractions - Owner’s Share

1 4. Fixed-date Conformity - Depreciation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14.

.00

1 5. Fixed-date Conformity - Other . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15.

.00

16. Income From Obligations of the United States . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16.

.00

17. Other Subtractions (See Instructions for Schedule 502ADJ for Subtraction Codes.)

Code

Amount

Code

Amount

17a

17b

.00

.00

1 7c

17d

.00

.00

18. Total Subtractions (Add Lines 14-16 and 17a-17d) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 18.

.00

Va. Dept. Of Taxation 2601024 VK-1 (Rev 10/12)

1

1 2

2 3

3 4

4