Fs Form 3600 - Values For U.s. Savings Bonds

ADVERTISEMENT

FS FORM 3600

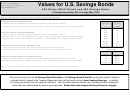

Values for U.S. Savings Bonds

DEPT. OF THE TREASURY

BUR. OF THE FISCAL SERVICE

[REV. JUNE 2015]

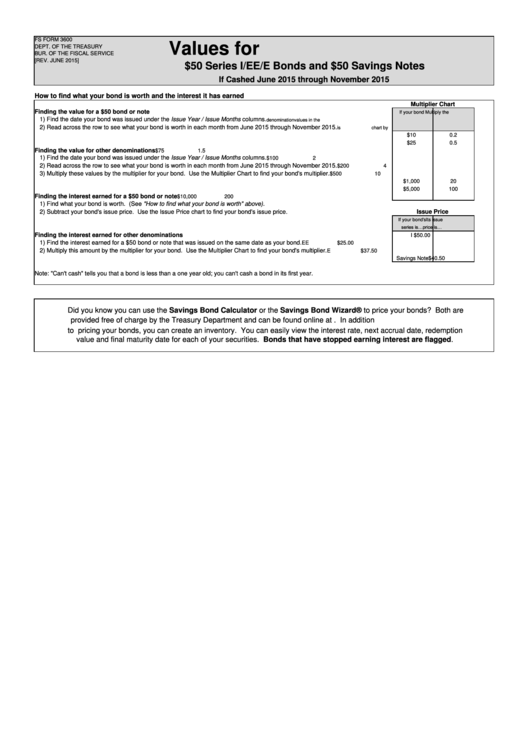

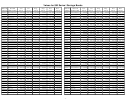

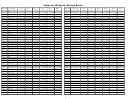

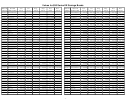

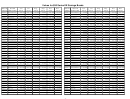

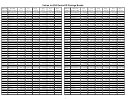

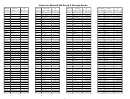

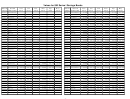

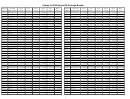

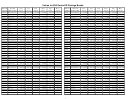

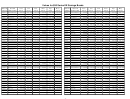

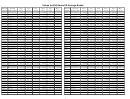

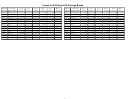

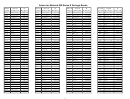

$50 Series I/EE/E Bonds and $50 Savings Notes

If Cashed June 2015 through November 2015

How to find what your bond is worth and the interest it has earned

Multiplier Chart

Finding the value for a $50 bond or note

If your bond

Multiply the

1) Find the date your bond was issued under the Issue Year / Issue Months columns.

denomination

values in the

2) Read across the row to see what your bond is worth in each month from June 2015 through November 2015.

is

chart by

$10

0.2

$25

0.5

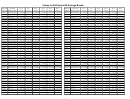

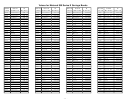

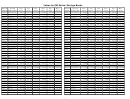

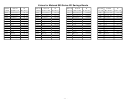

Finding the value for other denominations

$75

1.5

1) Find the date your bond was issued under the Issue Year / Issue Months columns.

$100

2

2) Read across the row to see what your bond is worth in each month from June 2015 through November 2015.

$200

4

3) Multiply these values by the multiplier for your bond. Use the Multiplier Chart to find your bond's multiplier.

$500

10

$1,000

20

$5,000

100

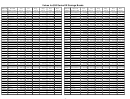

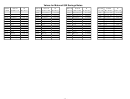

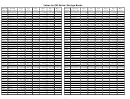

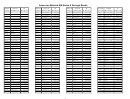

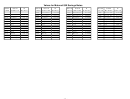

Finding the interest earned for a $50 bond or note

$10,000

200

1) Find what your bond is worth. (See "How to find what your bond is worth" above).

2) Subtract your bond's issue price. Use the Issue Price chart to find your bond's issue price.

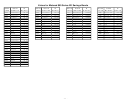

Issue Price

If your bond's

Its issue

series is…

price is…

Finding the interest earned for other denominations

I

$50.00

1) Find the interest earned for a $50 bond or note that was issued on the same date as your bond.

EE

$25.00

2) Multiply this amount by the multiplier for your bond. Use the Multiplier Chart to find your bond's multiplier.

E

$37.50

Savings Note

$40.50

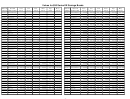

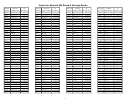

Note: "Can't cash" tells you that a bond is less than a one year old; you can't cash a bond in its first year.

Did you know you can use the Savings Bond Calculator or the Savings Bond Wizard® to price your bonds? Both are

provided free of charge by the Treasury Department and can be found online at In addition

to pricing your bonds, you can create an inventory. You can easily view the interest rate, next accrual date, redemption

value and final maturity date for each of your securities. Bonds that have stopped earning interest are flagged.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32