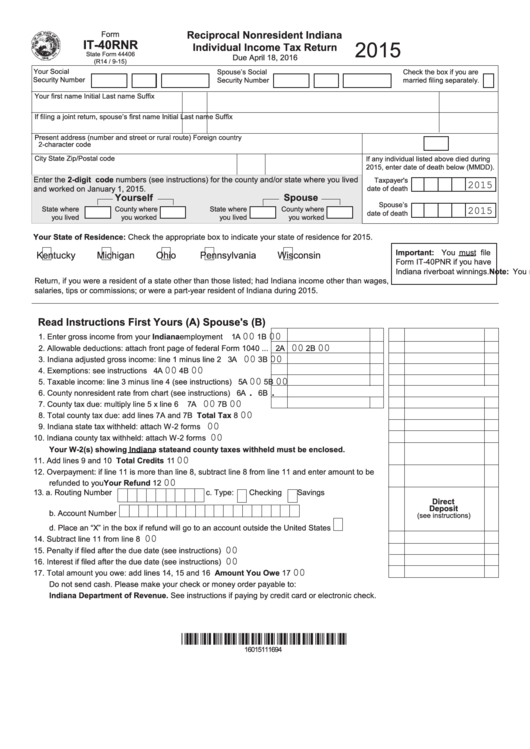

Reciprocal Nonresident Indiana

Form

IT-40RNR

2015

Individual Income Tax Return

State Form 44406

Due April 18, 2016

(R14 / 9-15)

Your Social

Spouse’s Social

Check the box if you are

Security Number

Security Number

married filing separately.

Your first name

Initial

Last name

Suffix

If filing a joint return, spouse’s first name

Initial

Last name

Suffix

Present address (number and street or rural route)

Foreign country

2-character code

City

State

Zip/Postal code

If any individual listed above died during

2015, enter date of death below (MMDD).

Enter the 2-digit code numbers (see instructions) for the county and/or state where you lived

Taxpayer's

2015

and worked on January 1, 2015.

date of death

Yourself

Spouse

Spouse’s

2015

State where

County where

State where

County where

date of death

you lived

you lived

you worked

you worked

Your State of Residence: Check the appropriate box to indicate your state of residence for 2015.

Important: You must file

Kentucky

Michigan

Ohio

Pennsylvania

Wisconsin

Form IT-40PNR if you have

Note: You must file Form IT-40PNR, Part-Year Resident or Nonresident Indiana Individual Income Tax

Indiana riverboat winnings.

Return, if you were a resident of a state other than those listed; had Indiana income other than wages,

salaries, tips or commissions; or were a part-year resident of Indiana during 2015.

Read Instructions First

Yours (A)

Spouse's (B)

00

00

1. Enter gross income from your Indiana employment .................. 1A

1B

00

00

2. Allowable deductions: attach front page of federal Form 1040 ... 2A

2B

00

00

3. Indiana adjusted gross income: line 1 minus line 2 ..................... 3A

3B

00

00

4. Exemptions: see instructions ...................................................... 4A

4B

00

00

5. Taxable income: line 3 minus line 4 (see instructions) ................ 5A

5B

.

.

6. County nonresident rate from chart (see instructions) ................ 6A

6B

00

00

7. County tax due: multiply line 5 x line 6 ....................................... 7A

7B

00

8. Total county tax due: add lines 7A and 7B ......................................................................... Total Tax

8

00

9. Indiana state tax withheld: attach W-2 forms ....................................................................................

9

00

10. Indiana county tax withheld: attach W-2 forms ................................................................................... 10

Your W-2(s) showing Indiana state and county taxes withheld must be enclosed.

00

11. Add lines 9 and 10 .......................................................................................................Total Credits 11

12. Overpayment: if line 11 is more than line 8, subtract line 8 from line 11 and enter amount to be

00

refunded to you ............................................................................................................ Your Refund 12

13. a. Routing Number

c. Type:

Checking

Savings

Direct

Deposit

b. Account Number

(see instructions)

d. Place an “X” in the box if refund will go to an account outside the United States

00

14. Subtract line 11 from line 8 ................................................................................................................. 14

00

15. Penalty if filed after the due date (see instructions) ........................................................................... 15

00

16. Interest if filed after the due date (see instructions) ........................................................................... 16

00

17. Total amount you owe: add lines 14, 15 and 16 ................................................... Amount You Owe 17

Do not send cash. Please make your check or money order payable to:

Indiana Department of Revenue. See instructions if paying by credit card or electronic check.

*16015111694*

16015111694

1

1 2

2