Form Wi-Z Draft - Wisconsin Income Tax - 2011 Page 2

ADVERTISEMENT

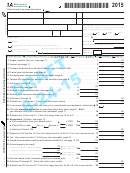

WI-Z

Wisconsin

income tax

2011

Your social security number

Spouse’s social security number

Complete form using

BLACK

INK

Your legal last name

Legal first name

M .I .

Tax district Check below then fill in either the name

of city, village, or town and the county in which you

lived at the end of 2011.

If a joint return, spouse’s legal last name

Spouse’s legal first name

M .I .

City

Village

Town

City, village,

or town

Home address (number and street). If you have a PO Box, see page 6.

Apt. No.

County of

City or post office

State

Zip code

School district number

(see page 23)

Special

Filing status

conditions

(check below)

Single

Print numbers like this

Married filing joint

return (even if only

NO COMMAS; NO CENTS

one had income)

Wisconsin residents working in Minnesota: Was any of your income from personal or

If Yes, enter Minnesota income

Yes

professional services performed in Minnesota while a Wisconsin resident?

.00

(See instructions, page 7)

No

.00

1 Income from line 4 of federal Form 1040EZ . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1

2 If your parent (

) can claim you (

) as a dependent, check here . . . . 2

or someone else

or your spouse

3 Fill in the standard deduction for your filing status from table, page 31. But if you

.00

checked line 2, fill in the amount from worksheet on back . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

.00

4 Subtract line 3 from line 1. If line 3 is larger than line 1, fill in 0 . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4

5 Deduction for exemptions . Fill in $700 ($1,400 if married, or 0 if you checked

.00

line 2 – see instructions on back) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

.00

6 Subtract line 5 from line 4. If line 5 is larger than line 4, fill in 0. This is your taxable income . . . . . 6

.00

7 Tax. Use amount on line 6 to find your tax using table, page 24 . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

8 School property tax credit

}

.00

. . . . .

8a Rent paid in 2011 – heat included

Find credit from

.00

8a

table page 13 . . . . .

.00

. .

Rent paid in 2011 – heat not included

Find credit from

.00

.00

8b Property taxes paid on home in 2011

. . .

8b

table page 14 . . . . .

9 Working families tax credit – if line 1 is less than $10,000

.00

($19,000 if married filing joint), see page 14 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9

.00

10 Married couple credit. Wages 10a Yourself

(see instructions

.00

10b Spouse

on reverse side)

.00

.00

10c Fill in smaller of 10a or 10b but no more than $16,000

x .03 = . . 10c

.

00

11 Add credits on lines 8a, 8b, 9, and 10c . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11

.

00

12 Subtract line 11 from line 7. If line 11 is larger than line 7, fill in 0. This is your net tax . . . . . . . . . . 12

.

00

13 Sales and use tax due on Internet, mail order, or other out-of-state purchases

. . . . 13

(see page 15)

If you certify that no sales or use tax is due, check here . . . . . . . . . . . . . . . . . . . . . . . . . . . .

14 Donations (decreases refund or increases amount owed)

a Endangered resources

.00

f Firefighters memorial

.00

.00

.00

b Packers football stadium

g Prostate cancer research

.00

.00

c Breast cancer research

h Military family relief

.00

.00

d Veterans trust fund

i Feeding America

.00

.00

e Multiple sclerosis

j Red Cross WI Disaster Relief

.00

Total (add lines a through j) . .

14k

.00

15 Add lines 12, 13, and 14k . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3