Form Mo 4191524 - New/expanded Business Facility And Enterprise Zone: Employees And Investment Credits

ADVERTISEMENT

8

/

-

-8 ENDING

_, 19-

w

p-v 19- p-9 19- p-9 19-

__, 19-

I

I

I

I

8

I

I

I

I

-~-1

8

9

(

I 12

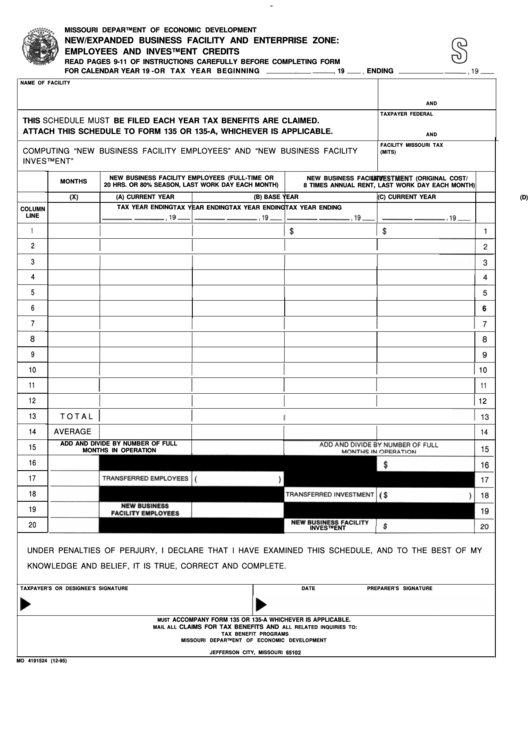

MISSOURI DEPARTMENT OF ECONOMIC DEVELOPMENT

MISSOURI SCHEDULE

NEW/EXPANDED BUSINESS FACILITY AND ENTERPRISE ZONE:

EMPLOYEES AND INVESTMENT CREDITS

READ PAGES 9-11 OF INSTRUCTIONS CAREFULLY BEFORE COMPLETING FORM

FOR CALENDAR YEAR 19 -OR TAX YEAR BEGINNING

19

NAME OF FACILITY

FACILITY FEDERAL I.D. NO.

AND

TAXPAYER FEDERAL I.D. NO.

THIS SCHEDULE MUST BE FILED EACH YEAR TAX BENEFITS ARE CLAIMED.

ATTACH THIS SCHEDULE TO FORM 135 OR 135-A, WHICHEVER IS APPLICABLE.

AND

FACILITY MISSOURI TAX I.D. NO.

COMPUTING “ NEW BUSINESS FACILITY EMPLOYEES” AND “ NEW BUSINESS FACILITY

(MITS)

INVESTMENT”

NEW BUSINESS FACILITY EMPLOYEES (FULL-TIME OR

NEW BUSINESS FACILITY INVESTRhENT (ORIGINAL COST/

MONTHS

20 HRS. OR 80% SEASON, LAST WORK DAY EACH MONTH)

8 TIMES ANNUAL RENT, LAST WORK DAY EACH MONTH)

(A) CURRENT YEAR

(B) BASE YEAR

(C) CURRENT YEAR

(D) BASE YEAR

TAX YEAR ENDING

TAX YEAR ENDING

TAX YEAR ENDING

TAX YEAR ENDING

COLUMN

LINE

1

2

3

4

5

6

6

7

9

10

10

11

11

12

13

T O T A L 1

I

I

14

AVERAGE

14

ADD AND DIVIDE BY NUMBER OF FULL

15

MONTHS IN OPERATION

16

17

18

19

20

INVESTMENT

UNDER PENALTIES OF PERJURY, I DECLARE THAT I HAVE EXAMINED THIS SCHEDULE, AND TO THE BEST OF MY

KNOWLEDGE AND BELIEF, IT IS TRUE, CORRECT AND COMPLETE.

TAXPAYER’ S OR DESIGNEE’ S SIGNATURE

DATE

PREPARER’ S SIGNATURE

DATE

ACCOMPANY FORM 135 OR 135-A WHICHEVER IS APPLICABLE.

MUST

CLAIMS FOR TAX BENEFITS AND

MAIL ALL

ALL RELATED INQUIRIES TO:

TAX BENEFIT PROGRAMS

MISSOURI DEPARTMENT OF ECONOMIC DEVELOPMENT

P.O. BOX 118

JEFFERSON CITY, MISSOURI 65102

MO 4191524 (12-95)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1