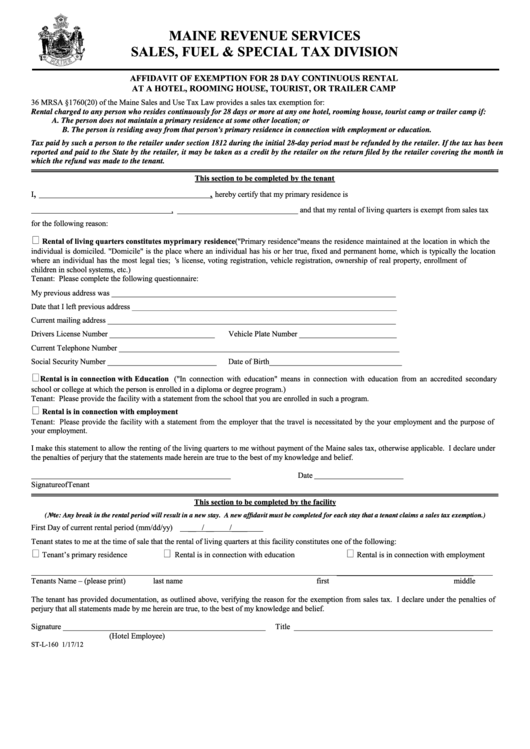

Form St-L-160 - Affidavit Of Exemption For 28 Day Continuous Rental At A Hotel, Rooming House, Tourist, Or Trailer Camp - Maine Revenue Services

ADVERTISEMENT

MAINE REVENUE SERVICES

SALES, FUEL & SPECIAL TAX DIVISION

AFFIDAVIT OF EXEMPTION FOR 28 DAY CONTINUOUS RENTAL

AT A HOTEL, ROOMING HOUSE, TOURIST, OR TRAILER CAMP

36 MRSA §1760(20) of the Maine Sales and Use Tax Law provides a sales tax exemption for:

Rental charged to any person who resides continuously for 28 days or more at any one hotel, rooming house, tourist camp or trailer camp if:

A. The person does not maintain a primary residence at some other location; or

B. The person is residing away from that person's primary residence in connection with employment or education.

Tax paid by such a person to the retailer under section 1812 during the initial 28-day period must be refunded by the retailer. If the tax has been

reported and paid to the State by the retailer, it may be taken as a credit by the retailer on the return filed by the retailer covering the month in

which the refund was made to the tenant.

This section to be completed by the tenant

,

,

I

hereby certify that my primary residence is

, _______________________________ and that my rental of living quarters is exempt from sales tax

for the following reason:

Rental of living quarters constitutes my primary residence ("Primary residence" means the residence maintained at the location in which the

individual is domiciled. "Domicile" is the place where an individual has his or her true, fixed and permanent home, which is typically the location

where an individual has the most legal ties; i.e. driver's license, voting registration, vehicle registration, ownership of real property, enrollment of

children in school systems, etc.)

Tenant: Please complete the following questionnaire:

My previous address was _________________________________________________________________________

Date that I left previous address ____________________________________________________________________

Current mailing address __________________________________________________________________________

Drivers License Number ___________________________

Vehicle Plate Number _________________________

Current Telephone Number ________________________________________________________________________

Social Security Number ____________________________

Date of Birth__________________________________

Rental is in connection with Education ("In connection with education" means in connection with education from an accredited secondary

school or college at which the person is enrolled in a diploma or degree program.)

Tenant: Please provide the facility with a statement from the school that you are enrolled in such a program.

Rental is in connection with employment

Tenant: Please provide the facility with a statement from the employer that the travel is necessitated by the your employment and the purpose of

your employment.

I make this statement to allow the renting of the living quarters to me without payment of the Maine sales tax, otherwise applicable. I declare under

the penalties of perjury that the statements made herein are true to the best of my knowledge and belief.

Date

Signature of Tenant

This section to be completed by the facility

(Note: Any break in the rental period will result in a new stay. A new affidavit must be completed for each stay that a tenant claims a sales tax exemption.)

First Day of current rental period (mm/dd/yy)

__ / __

/____

Tenant states to me at the time of sale that the rental of living quarters at this facility constitutes one of the following:

Tenant’s primary residence

Rental is in connection with education

Rental is in connection with employment

___________________________________

Tenants Name – (please print)

last name

first

middle

The tenant has provided documentation, as outlined above, verifying the reason for the exemption from sales tax. I declare under the penalties of

perjury that all statements made by me herein are true, to the best of my knowledge and belief.

Signature ____________________________________________________ Title ___________________________________________________

(Hotel Employee)

ST-L-160 1/17/12

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1