Form 31-014a - Iowa Sales Tax Exemption Certificate - 2011 , Form 31-014b - Exemption Certificate Instructions - 2012

ADVERTISEMENT

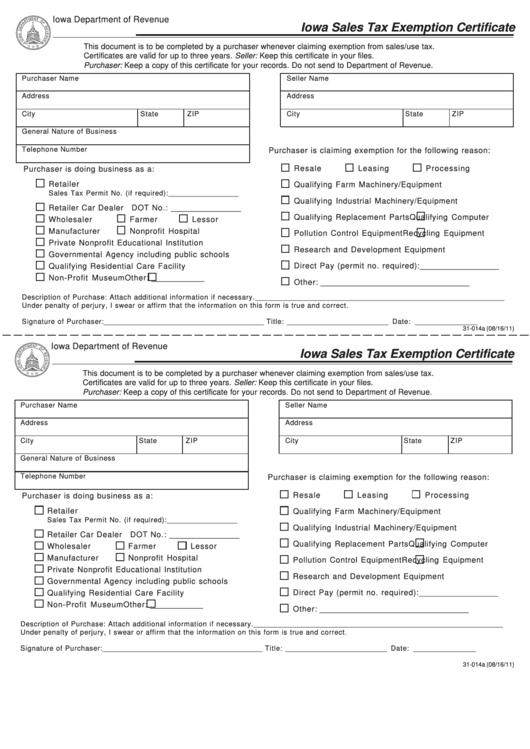

Iowa Department of Revenue

Iowa Sales Tax Exemption Certificate

This document is to be completed by a purchaser whenever claiming exemption from sales/use tax.

Certificates are valid for up to three years. Seller: Keep this certificate in your files.

Purchaser: Keep a copy of this certificate for your records. Do not send to Department of Revenue.

Purchaser Name

Seller Name

Address

Address

City

State

ZIP

City

State

ZIP

General Nature of Business

Telephone Number

Purchaser is claiming exemption for the following reason:

Resale

Leasing

Processing

Purchaser is doing business as a:

Retailer

Qualifying Farm Machinery/Equipment

Sales Tax Permit No. (if required): __________________

Qualifying Industrial Machinery/Equipment

Retailer Car Dealer

DOT No.: ________________

Qualifying Replacement Parts

Qualifying Computer

Wholesaler

Farmer

Lessor

Manufacturer

Nonprofit Hospital

Pollution Control Equipment

Recycling Equipment

Private Nonprofit Educational Institution

Research and Development Equipment

Governmental Agency including public schools

Direct Pay (permit no. required): __________________

Qualifying Residential Care Facility

Non-Profit Museum

Other: ____________

Other: __________________________________

Description of Purchase: Attach additional information if necessary. ________________________________________________________________

Under penalty of perjury, I swear or affirm that the information on this form is true and correct.

Signature of Purchaser: _________________________________________ Title: __________________________ Date: ________________

31-014a (08/16/11)

Iowa Department of Revenue

Iowa Sales Tax Exemption Certificate

This document is to be completed by a purchaser whenever claiming exemption from sales/use tax.

Certificates are valid for up to three years. Seller: Keep this certificate in your files.

Purchaser: Keep a copy of this certificate for your records. Do not send to Department of Revenue.

Purchaser Name

Seller Name

Address

Address

City

State

ZIP

City

State

ZIP

General Nature of Business

Telephone Number

Purchaser is claiming exemption for the following reason:

Resale

Leasing

Processing

Purchaser is doing business as a:

Retailer

Qualifying Farm Machinery/Equipment

Sales Tax Permit No. (if required): __________________

Qualifying Industrial Machinery/Equipment

Retailer Car Dealer

DOT No.: ________________

Qualifying Replacement Parts

Qualifying Computer

Wholesaler

Farmer

Lessor

Manufacturer

Nonprofit Hospital

Pollution Control Equipment

Recycling Equipment

Private Nonprofit Educational Institution

Research and Development Equipment

Governmental Agency including public schools

Direct Pay (permit no. required): __________________

Qualifying Residential Care Facility

Non-Profit Museum

Other: ____________

Other: __________________________________

Description of Purchase: Attach additional information if necessary. ________________________________________________________________

Under penalty of perjury, I swear or affirm that the information on this form is true and correct.

Signature of Purchaser: _________________________________________ Title: __________________________ Date: ________________

31-014a (08/16/11)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2