Line-By-Line Instructions For Schedule X

ADVERTISEMENT

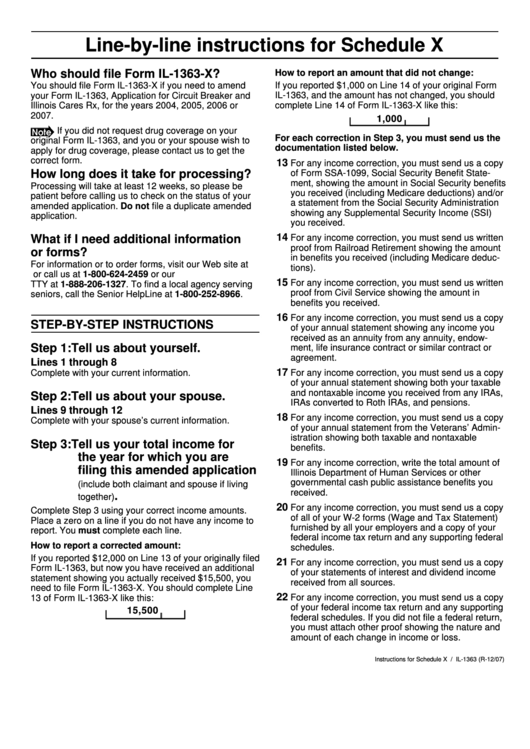

Line-by-line instructions for Schedule X

Who should file Form IL-1363-X?

How to report an amount that did not change:

You should file Form IL-1363-X if you need to amend

If you reported $1,000 on Line 14 of your original Form

IL-1363, and the amount has not changed, you should

your Form IL-1363, Application for Circuit Breaker and

complete Line 14 of Form IL-1363-X like this:

Illinois Cares Rx, for the years 2004, 2005, 2006 or

2007.

1,000

If you did not request drug coverage on your

For each correction in Step 3, you must send us the

original Form IL-1363, and you or your spouse wish to

documentation listed below.

apply for drug coverage, please contact us to get the

correct form.

13

For any income correction, you must send us a copy

How long does it take for processing?

of Form SSA-1099, Social Security Benefit State-

ment, showing the amount in Social Security benefits

Processing will take at least 12 weeks, so please be

you received (including Medicare deductions) and/or

patient before calling us to check on the status of your

a statement from the Social Security Administration

amended application. Do not file a duplicate amended

showing any Supplemental Security Income (SSI)

application.

you received.

14

For any income correction, you must send us written

What if I need additional information

proof from Railroad Retirement showing the amount

or forms?

in benefits you received (including Medicare deduc-

For information or to order forms, visit our Web site at

tions).

or call us at 1-800-624-2459 or our

15

For any income correction, you must send us written

TTY at 1-888-206-1327. To find a local agency serving

proof from Civil Service showing the amount in

seniors, call the Senior HelpLine at 1-800-252-8966.

benefits you received.

16

For any income correction, you must send us a copy

STEP-BY-STEP INSTRUCTIONS

of your annual statement showing any income you

received as an annuity from any annuity, endow-

Step 1: Tell us about yourself.

ment, life insurance contract or similar contract or

agreement.

Lines 1 through 8

17

Complete with your current information.

For any income correction, you must send us a copy

of your annual statement showing both your taxable

and nontaxable income you received from any IRAs,

Step 2: Tell us about your spouse.

IRAs converted to Roth IRAs, and pensions.

Lines 9 through 12

18

For any income correction, you must send us a copy

Complete with your spouse’s current information.

of your annual statement from the Veterans’ Admin-

istration showing both taxable and nontaxable

Step 3: Tell us your total income for

benefits.

the year for which you are

19

For any income correction, write the total amount of

filing this amended application

Illinois Department of Human Services or other

governmental cash public assistance benefits you

(include both claimant and spouse if living

received.

.

together)

20

For any income correction, you must send us a copy

Complete Step 3 using your correct income amounts.

of all of your W-2 forms (Wage and Tax Statement)

Place a zero on a line if you do not have any income to

furnished by all your employers and a copy of your

report. You must complete each line.

federal income tax return and any supporting federal

How to report a corrected amount:

schedules.

If you reported $12,000 on Line 13 of your originally filed

21

For any income correction, you must send us a copy

Form IL-1363, but now you have received an additional

of your statements of interest and dividend income

statement showing you actually received $15,500, you

received from all sources.

need to file Form IL-1363-X. You should complete Line

22

For any income correction, you must send us a copy

13 of Form IL-1363-X like this:

of your federal income tax return and any supporting

15,500

federal schedules. If you did not file a federal return,

you must attach other proof showing the nature and

amount of each change in income or loss.

Instructions for Schedule X / IL-1363 (R-12/07)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2