Instructions For Preparing The Village Of Centerburg Income Tax Return Mandatory Filing

ADVERTISEMENT

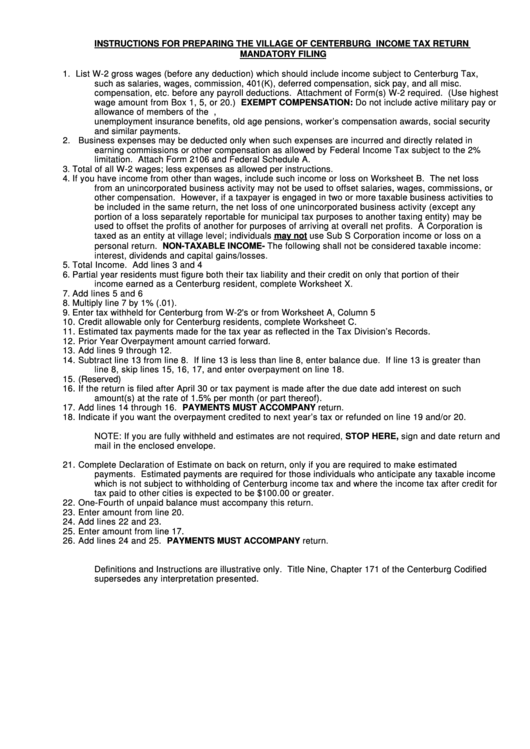

INSTRUCTIONS FOR PREPARING THE VILLAGE OF CENTERBURG INCOME TAX RETURN

MANDATORY FILING

1.

List W-2 gross wages (before any deduction) which should include income subject to Centerburg Tax,

such as salaries, wages, commission, 401(K), deferred compensation, sick pay, and all misc.

compensation, etc. before any payroll deductions. Attachment of Form(s) W-2 required. (Use highest

wage amount from Box 1, 5, or 20.) EXEMPT COMPENSATION: Do not include active military pay or

allowance of members of the U.S. armed forces. Do not include payments from poor relief,

unemployment insurance benefits, old age pensions, worker’s compensation awards, social security

and similar payments.

2.

Business expenses may be deducted only when such expenses are incurred and directly related in

earning commissions or other compensation as allowed by Federal Income Tax subject to the 2%

limitation. Attach Form 2106 and Federal Schedule A.

3.

Total of all W-2 wages; less expenses as allowed per instructions.

4.

If you have income from other than wages, include such income or loss on Worksheet B. The net loss

from an unincorporated business activity may not be used to offset salaries, wages, commissions, or

other compensation. However, if a taxpayer is engaged in two or more taxable business activities to

be included in the same return, the net loss of one unincorporated business activity (except any

portion of a loss separately reportable for municipal tax purposes to another taxing entity) may be

used to offset the profits of another for purposes of arriving at overall net profits. A Corporation is

taxed as an entity at village level; individuals may not use Sub S Corporation income or loss on a

personal return. NON-TAXABLE INCOME- The following shall not be considered taxable income:

interest, dividends and capital gains/losses.

5.

Total Income. Add lines 3 and 4

6.

Partial year residents must figure both their tax liability and their credit on only that portion of their

income earned as a Centerburg resident, complete Worksheet X.

7.

Add lines 5 and 6

8.

Multiply line 7 by 1% (.01).

9.

Enter tax withheld for Centerburg from W-2's or from Worksheet A, Column 5

10.

Credit allowable only for Centerburg residents, complete Worksheet C.

11.

Estimated tax payments made for the tax year as reflected in the Tax Division’s Records.

12.

Prior Year Overpayment amount carried forward.

13.

Add lines 9 through 12.

14.

Subtract line 13 from line 8. If line 13 is less than line 8, enter balance due. If line 13 is greater than

line 8, skip lines 15, 16, 17, and enter overpayment on line 18.

15.

(Reserved)

16.

If the return is filed after April 30 or tax payment is made after the due date add interest on such

amount(s) at the rate of 1.5% per month (or part thereof).

17.

Add lines 14 through 16. PAYMENTS MUST ACCOMPANY return.

18.

Indicate if you want the overpayment credited to next year’s tax or refunded on line 19 and/or 20.

NOTE: If you are fully withheld and estimates are not required, STOP HERE, sign and date return and

mail in the enclosed envelope.

21.

Complete Declaration of Estimate on back on return, only if you are required to make estimated

payments. Estimated payments are required for those individuals who anticipate any taxable income

which is not subject to withholding of Centerburg income tax and where the income tax after credit for

tax paid to other cities is expected to be $100.00 or greater.

22.

One-Fourth of unpaid balance must accompany this return.

23.

Enter amount from line 20.

24.

Add lines 22 and 23.

25.

Enter amount from line 17.

26.

Add lines 24 and 25. PAYMENTS MUST ACCOMPANY return.

Definitions and Instructions are illustrative only. Title Nine, Chapter 171 of the Centerburg Codified

supersedes any interpretation presented.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1