Application For Refund Of Sales Or Use Tax - Maine Revenue Services

ADVERTISEMENT

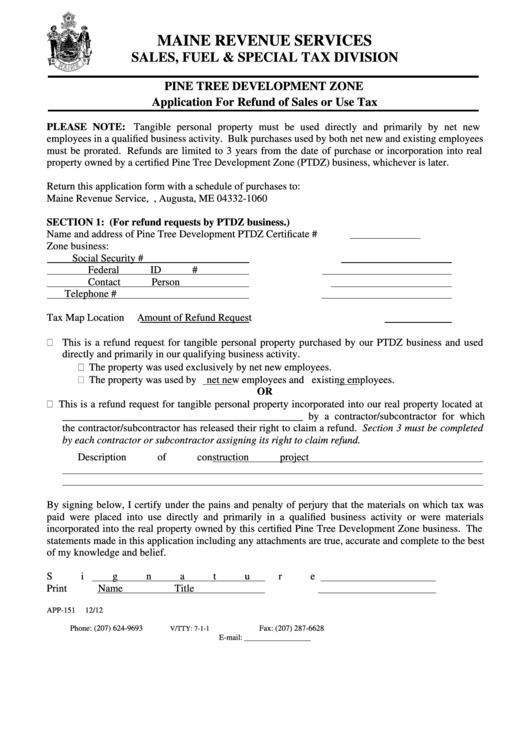

MAINE REVENUE SERVICES

SALES, FUEL & SPECIAL TAX DIVISION

PINE TREE DEVELOPMENT ZONE

Application For Refund of Sales or Use Tax

PLEASE NOTE:

Tangible personal property must be used directly and primarily by net new

employees in a qualified business activity. Bulk purchases used by both net new and existing employees

must be prorated. Refunds are limited to 3 years from the date of purchase or incorporation into real

property owned by a certified Pine Tree Development Zone (PTDZ) business, whichever is later.

Return this application form with a schedule of purchases to:

Maine Revenue Service, P.O. Box 1060, Augusta, ME 04332-1060

SECTION 1: (For refund requests by PTDZ business.)

Name and address of Pine Tree Development

PTDZ Certificate #

Zone business:

Social Security #

Federal ID #

Contact Person

Telephone #

Tax Map Location

Amount of Refund Request

This is a refund request for tangible personal property purchased by our PTDZ business and used

directly and primarily in our qualifying business activity.

The property was used exclusively by net new employees.

The property was used by

net new employees and

existing employees.

OR

This is a refund request for tangible personal property incorporated into our real property located at

______________________________________________ by a contractor/subcontractor for which

the contractor/subcontractor has released their right to claim a refund. Section 3 must be completed

by each contractor or subcontractor assigning its right to claim refund.

Description of construction project

By signing below, I certify under the pains and penalty of perjury that the materials on which tax was

paid were placed into use directly and primarily in a qualified business activity or were materials

incorporated into the real property owned by this certified Pine Tree Development Zone business. The

statements made in this application including any attachments are true, accurate and complete to the best

of my knowledge and belief.

Signature

Date

Print Name

Title

APP-151

12/12

Phone: (207) 624-9693

Fax: (207) 287-6628

V/TTY: 7-1-1

E-mail: sales.tax@maine.gov

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2