Form Rtet - Retail Telecommunication Excise Tax - Montana

ADVERTISEMENT

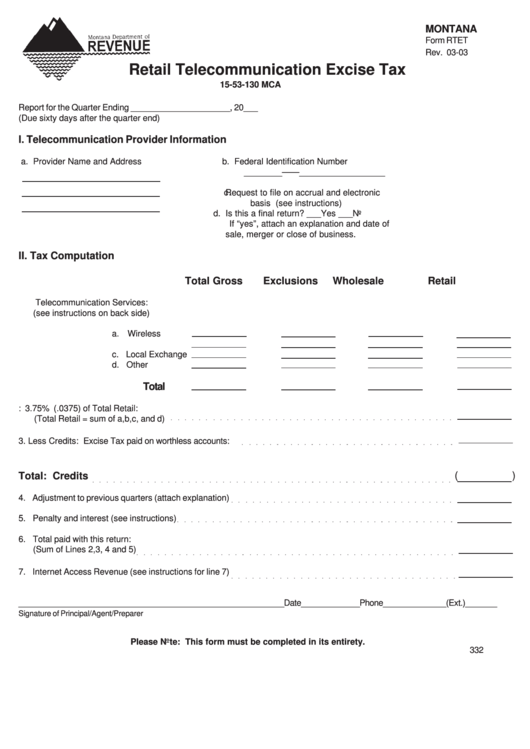

MONTANA

Form RTET

Rev. 03-03

Retail Telecommunication Excise Tax

15-53-130 MCA

Report for the Quarter Ending _____________________, 20___

(Due sixty days after the quarter end)

I. Telecommunication Provider Information

a. Provider Name and Address

b. Federal Identification Number

________——__________________

c.

Request to file on accrual and electronic

basis (see instructions)

d. Is this a final return? ___Yes ___No

If “yes”, attach an explanation and date of

sale, merger or close of business.

II. Tax Computation

Total Gross

Exclusions

Wholesale

Retail

1. Revenue attributable to Montana

Telecommunication Services:

(see instructions on back side)

a. Wireless

b. Long Distance

c. Local Exchange

d. Other

Total

2. Tax: 3.75% (.0375) of Total Retail:

(Total Retail = sum of a,b,c, and d)

3.

Less Credits: Excise Tax paid on worthless accounts:

(

)

Total: Credits

4. Adjustment to previous quarters (attach explanation)

5. Penalty and interest (see instructions)

6. Total paid with this return:

(Sum of Lines 2,3, 4 and 5)

7. Internet Access Revenue (see instructions for line 7)

___________________________________________________________Date_____________Phone______________(Ext.)_______

Signature of Principal/Agent/Preparer

Please Note: This form must be completed in its entirety.

332

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1