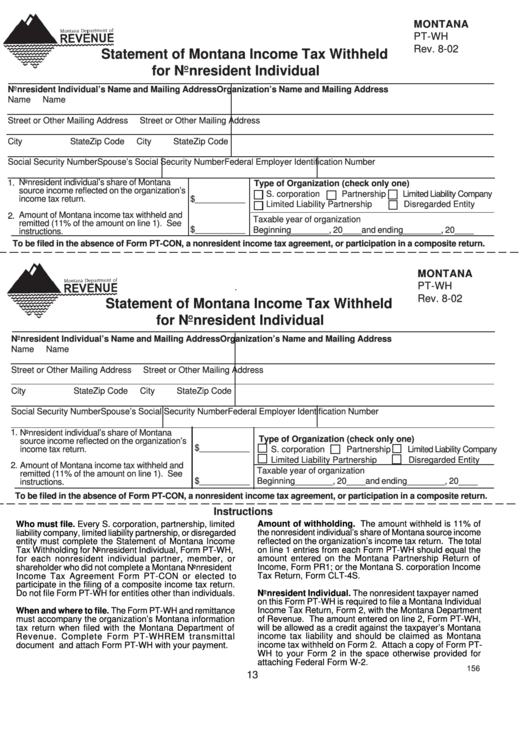

Form Pt-Wh - Statement Of Montana Income Tax Withheld For Nonresident Individual

ADVERTISEMENT

MONTANA

PT-WH

Rev. 8-02

Statement of Montana Income Tax Withheld

for Nonresident Individual

Nonresident Individual’s Name and Mailing Address

Organization’s Name and Mailing Address

Name

Name

Street or Other Mailing Address

Street or Other Mailing Address

City

State

Zip Code

City

State

Zip Code

Social Security Number

Spouse’s Social Security Number

Federal Employer Identification Number

Nonresident individual’s share of Montana

1.

Type of Organization (check only one)

source income reflected on the organization’s

S. corporation

Partnership

Limited Liability Company

income tax return.

$___________

Limited Liability Partnership

Disregarded Entity

Amount of Montana income tax withheld and

2.

Taxable year of organization

remitted (11% of the amount on line 1). See

$___________

Beginning________, 20____and ending________, 20____

instructions.

To be filed in the absence of Form PT-CON, a nonresident income tax agreement, or participation in a composite return.

MONTANA

PT-WH

.

Rev. 8-02

Statement of Montana Income Tax Withheld

for Nonresident Individual

Nonresident Individual’s Name and Mailing Address

Organization’s Name and Mailing Address

Name

Name

Street or Other Mailing Address

Street or Other Mailing Address

City

State

Zip Code

City

State

Zip Code

Social Security Number

Spouse’s Social Security Number

Federal Employer Identification Number

1.

Nonresident individual’s share of Montana

Type of Organization (check only one)

source income reflected on the organization’s

$___________

income tax return.

S. corporation

Partnership

Limited Liability Company

Limited Liability Partnership

Disregarded Entity

2.

Amount of Montana income tax withheld and

Taxable year of organization

remitted (11% of the amount on line 1). See

$___________

Beginning________, 20____and ending________, 20____

instructions.

To be filed in the absence of Form PT-CON, a nonresident income tax agreement, or participation in a composite return.

Instructions

Amount of withholding. The amount withheld is 11% of

Who must file. Every S. corporation, partnership, limited

liability company, limited liability partnership, or disregarded

the nonresident individual’s share of Montana source income

reflected on the organization’s income tax return. The total

entity must complete the Statement of Montana Income

Tax Withholding for Nonresident Individual, Form PT-WH,

on line 1 entries from each Form PT-WH should equal the

amount entered on the Montana Partnership Return of

for each nonresident individual partner, member, or

shareholder who did not complete a Montana Nonresident

Income, Form PR1; or the Montana S. corporation Income

Tax Return, Form CLT-4S.

Income Tax Agreement Form PT-CON or elected to

participate in the filing of a composite income tax return.

Do not file Form PT-WH for entities other than individuals.

Nonresident Individual. The nonresident taxpayer named

on this Form PT-WH is required to file a Montana Individual

Income Tax Return, Form 2, with the Montana Department

When and where to file. The Form PT-WH and remittance

must accompany the organization’s Montana information

of Revenue. The amount entered on line 2, Form PT-WH,

tax return when filed with the Montana Department of

will be allowed as a credit against the taxpayer’s Montana

income tax liability and should be claimed as Montana

Revenue. Complete Form PT-WHREM transmittal

document and attach Form PT-WH with your payment.

income tax withheld on Form 2. Attach a copy of Form PT-

WH to your Form 2 in the space otherwise provided for

attaching Federal Form W-2.

156

13

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1