Instructions For Filing Form 531 - Local Earned Income Tax (Eit) Return - Pennsylvania - 2014 Page 9

ADVERTISEMENT

3. The leasing of your property is a regular and continuous activity.

If the combined calculation for each taxpayer results in a loss, the value that is added to the adjusted W-2 income is zero. Losses

cannot be used to decrease W-2 earnings. It should be noted that the income for the taxpayer and spouse cannot be combined. A

loss from a taxpayer cannot be used against income for his/her spouse.

(b) For other taxable income reported on a Form 1099 and other sources of income that may not have a form for reporting purposes

taxpayer should complete the Other Taxable Income Worksheet. Examples of these other income sources include but are not limited

to: patents, fees, honoraria, etc.

5

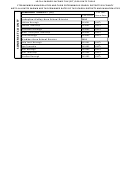

Add amounts from line 3 and 4 and enter total here.

6

Taxpayers in PA file with the appropriate tax collector a local EIT return for the municipality/school district where they declare their

legal tax residence. If your tax residence does not levy an EIT, your work site can tax your earnings at a non-resident tax rate if one

has been enacted. If you have received a CTCB tax return but have a legal tax residence that is not a CTCB Member

municipality/school district that does levy an EIT, please file with the appropriate collector for that municipality/school district and

provide a copy of your return, attachments, and proof of payment to CTCB. The proof of filing elsewhere will allow us to correct our

records and to transfer any withholdings that are available to the applicable tax office. If you are subject to a work site non-resident

tax rate, you may find it necessary to file a CTCB return as a non-resident to reconcile the tax due if your employer failed to withhold

at the correct non-resident work site tax rate. The issue of whether to file a tax return as a resident or non-resident is complex.

Please contact our office if you are uncertain whether your personal circumstances require that you file a tax return or you have

multiple worksites. Staff will help you understand the filing requirements and provide you with a list of documentation that will be

needed to certify your non-resident filing status. In addition to filing your tax return, you may also need to update your employer’s

payroll withholding records to ensure that future withholdings are completed at the correct local tax rate.

(a) Tax Withheld by Employer – Enter the total local tax withheld as reported on Form W-2(s) or the prorated shares as calculated on

7

your Part-Year Resident Worksheet. This total should not include local income tax withheld and/or paid to the City of Philadelphia or

states other than Pennsylvania. Do not include Local Service Tax withheld if it appears on your Form W-2(s), SUI, or Unemployment.

If your employer(s) is located within a distressed area and withheld additional tax for that reason please contact our office for filing

instructions. Distressed/Commuter tax will be systematically denied without notification. Contact our office with questions

regarding distressed areas. If you reside in Southampton Twp or Wellersburg Boro, Somerset County, please attach a list of

your work address(es). If you work in a municipality where the non-resident rate is greater than .5% the additional tax will

remain in the municipality you work, and will not be refunded.

(b) Quarterly Tax Payments – This line should include the total self-payments that you or your spouse made for the tax year.

(c) Prior Year Overpayment – This line should include any amount of credit that you have available from a prior year tax return. The

tax office will confirm this overpayment based on your prior years’ tax returns filed. Do not include overpayments for prior years

refunded to you.

(d) Credit for tax paid to other states – This line allows the taxpayer to include an amount that is available as an out-of-state tax

credit. This amount is determined by completing a Schedule G and including a photocopy of the other state tax return and a copy of

your PA state tax return and PA Schedule G. Schedule G is found on our website.

(e) Total - Line 7 (e) is a field that the taxpayer uses to sum all the credits that are available. The total credits will be compared to the

total tax liability.

A taxpayer who has credits that are greater than the tax year liability can elect to have the excess credits refunded, credited to a

8

future tax year, or split between a refund and a credit. Line 8 should be the total overpayment. Lines 8(a) and 8(b) should be used to

indicate how you would like to use/receive the overpayment. If you wish to have your refund direct deposited please fill out the

proper information on the tax form otherwise your refund will be issued as a paper check. Please note that refund and credit

requests without documentation required for a complete, accurate tax return will delay your requests . Refund requests of

$2.00 or less will not be honored. Tax returns beginning with tax year 2012 must be rounded up or down (when applicable) to whole

dollars.

9

The amount calculated as your balance due represents the unpaid balance of the tax liability. If the balance due is $2.00 or less, no

payment is due. Please note that if your tax liability has resulted in an underpayment, you may be required to remit quarterly

self-payments for future tax years. If you do not receive FORM 521 by April 1st, please visit our website for a printable 521

quarterly payment form or contact our office. Failure to comply will subject you to interest, penalty, and possibly a fine and cost of

collection.

10

(a) Interest and Penalty are calculated on the unpaid amount of the tax liability. Interest is calculated at the rate of 6% per annum;

penalty accrues at the rate of ½ of 1% for each month or fraction of month during which the tax remains unpaid. If you are required

to make self-payments and have underpaid your quarterly estimated payments, you are subject to additional charges.

(b) If for any reason your return is filed after the due date you may be subject to additional costs of collection.

Once you have determined the payment due you should remit payment of the amount shown on line 11. Payee information for your

11

payment appears on the front of the tax return. Please indicate on the check/money order the name of the taxpayer, tax year, and

last four digits of the social security number.

12

Enter amount enclosed.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9