Instructions For Filing Form 531 - Local Earned Income Tax (Eit) Return - Pennsylvania - 2014 Page 5

ADVERTISEMENT

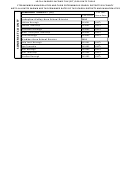

LOCAL EARNED INCOME TAX (EIT) 2014 RATE TABLE

CTCB MEMBER MUNICIPALITIES AND THEIR COTERMINOUS SCHOOL DISTRICTS BY COUNTY

NOTE: ALL RATES SHOWN ARE THE COMBINED RATES OF THE SCHOOL DISTRICTS AND MUNICIPALITIES

PERRY COUNTY

Full Year

(50)

Same Rate

PSD CODE

Greenwood School District

5001

Greenwood Township (Juniata County)

500101

1.75%

Greenwood Township

500102

1.75%

Liverpool Borough

500103

1.75%

Liverpool Township

500104

1.75%

Millerstown Borough

500105

1.75%

Tuscarora Township

500106

1.75%

Newport School District

5002

Buffalo Township

500201

1.60%

Howe Township

500202

1.60%

Juniata Township

500203

1.60%

Miller Township

500204

1.60%

Newport Borough

500205

1.60%

Oliver Township

500206

1.60%

Susquenita School District

5003

Reed Township (Dauphin County)

500301

1.80%

Duncannon Borough

500302

1.80%

Marysville Borough

500303

1.80%

New Buffalo Borough

500304

1.80%

Penn Township

500305

1.80%

Rye Township

500306

1.80%

Watts Township

500307

1.80%

Wheatfield Township

500308

1.80%

West Perry School District

5004

Blain Borough

500401

1.70%

Bloomfield Borough

500402

1.70%

Carroll Township

500403

1.70%

Centre Township

500404

1.70%

Jackson Township

500405

1.70%

Landisburg Borough

500406

1.70%

Northeast Madison Township

500407

1.70%

Saville Township

500408

1.70%

Southwest Madison Township

500409

1.70%

Spring Township

500410

1.70%

Toboyne Township

500411

1.70%

Tyrone Township

500412

1.70%

SOMERSET COUNTY

Full Year

(56)

Same Rate

PSD CODE

Berlin Brothersvalley School District

5601

Allegheny Township

560101

1.00%

Berlin Borough

560102

1.00%

Brothersvalley Township

560103

1.00%

Fairhope Township

560104

1.00%

New Baltimore Borough

560105

1.00%

Northampton Township

560106

1.00%

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9