Instructions For Filing Form 531 - Local Earned Income Tax (Eit) Return - Pennsylvania - 2014 Page 2

ADVERTISEMENT

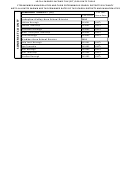

PARTIAL YEAR RESIDENT PRORATION WORKSHEET

This worksheet needs to be completed if you moved from one or more municipalities into another during the tax year. It will help you to determine the amount of earned income and net profits to file with each

municipality that you resided in during the tax year. You will need to file a seperate return for each municipality you resided in. The day an individual's domicile changes is included as the day he/she is in the

new domicile. Determining which municipality to include the taxable local income earned for the month the move occurred should be based on the majority of days in the old or new domicile. If the number of

days in the calendar month in which an individual lived in the old and new domiciles are equal, the entire month should be credited to the new municipality. For each W-2, employee business expense (EBE)

schedule, self-employment schedule, or other income, divide the total on each form by the number of months you worked for that employer. Multiply the result by the number of months you lived in each

location while working for that employer. (Domicile = Residence)

LOCATION/RATE 1

LOCATION/RATE 2

LOCATION/RATE 3

Tax Year:

TAX OFFICE

Name:

MUNICIPALITY

SSN:

STREET ADDRESS

CITY, STATE, ZIP

TAX RATE %

If both municipalities are CTCB Members, then you must fill out

two seperate 531's (Local Earned Income Tax Return). Visit our

DATE RESIDENT FROM

website for additional forms, information, and

DATE RESIDENT THRU

a list of our Member Municipalities.

NUMBER OF MONTHS

DATES EMPLOYED

[C]

[F]

[I]

DURING THIS TAX

PRORATED

PRORATED

PRORATED

YEAR

[A]

[B]

EMPLOYEE

[D]

[E]

EMPLOYEE

[G]

[H]

EMPLOYEE

LOCAL

LOCAL

EBE FOR

TOTAL

PRORATED

PRORATED

BUSINESS

PRORATED

PRORATED

BUSINESS

PRORATED

PRORATED

BUSINESS

EMPLOYER'S NAME

WAGES

TAX W/H

THIS EMP

FROM

THRU

MONTHS

WAGES

TAX W/H'S

EXPENSES

WAGES

TAX W/H'S

EXPENSES

WAGES

TAX W/H'S

EXPENSES

1

2

3

4

Total

Total

Total

Total

Total

Total

Total

Total

Total

W-2 TOTALS & EMPLOYEE BUSINESS EXPENSE (EBE) TOTALS: Report totals to the corresponding line

(Column A)

(Column B)

(Column C)

(Column D)

(Column E)

(Column F)

(Column G)

(Column H)

(Column I)

on the 531 form for only the location in which CTCB is the collector. Report the totals for the other tax agency on

their form.

531 line 1

531 line 6b

531 line 2

531 line 1

531 line 6b

531 line 2

531 line 1

531 line 6b

531 line 2

DATES OPERATED

DURING THIS TAX

NET PROFIT

MONTHS AT

PRORATION

PRORATED

MONTHS AT

PRORATION

PRORATED

MONTHS AT

PRORATION

PRORATED

YEAR

or LOSS

TOTAL

THIS

% THIS

NET PROFIT

THIS

% THIS

NET PROFIT

THIS

% THIS

NET PROFIT

NET PROFIT(S) or LOSS(ES)

AMOUNT

FROM

THRU

MONTHS

LOCALE

LOCALE

or LOSS

LOCALE

LOCALE

or LOSS

LOCALE

LOCALE

or LOSS

5

6

7

8

Total

Total

Total

NET EFFECT OF PROFIT(S) AND LOSS(ES) TOTALS: Report totals to the corresponding line on the 531 form

for only the location in which CTCB is the collector. Report the totals for the other tax agency on their form.

531 LINE 4a

531 LINE 4a

531 LINE 4a

DATES EARNED

DURING THIS TAX

MONTHS

PRORATION

PRORATED

MONTHS

PRORATION

PRORATED

MONTHS

PRORATION

PRORATED

YEAR

TOTAL

TOTAL

THIS

% THIS

OTHER

THIS

% THIS

OTHER

THIS

% THIS

OTHER

FROM

THRU

OTHER INCOME

AMOUNT

MONTHS

LOCALE

LOCALE

INCOME

LOCALE

LOCALE

INCOME

LOCALE

LOCALE

INCOME

9

10

OTHER INCOME TOTALS: Report totals to the corresponding line on the 531 form for only the location in which

Total

Total

Total

CTCB is the collector. Report the totals for the other tax agency on their form.

531 LINE 4b

531 LINE 4b

531 LINE 4b

PLEASE REMIT THIS WORKSHEET IF YOU HAVE FILLED IT OUT TO CTCB WITH THE PRORATED RETURNS.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9