Instructions For Filing Form 531 - Local Earned Income Tax (Eit) Return - Pennsylvania - 2014

ADVERTISEMENT

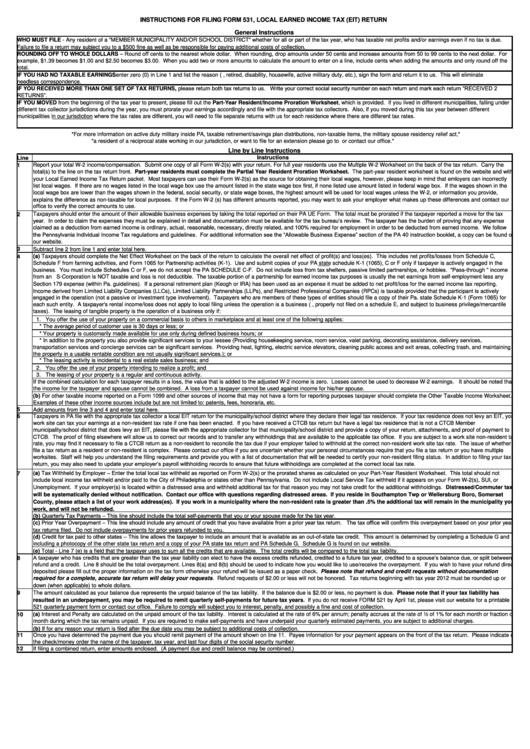

INSTRUCTIONS FOR FILING FORM 531, LOCAL EARNED INCOME TAX (EIT) RETURN

General Instructions

WHO MUST FILE - Any resident of a "MEMBER MUNICIPALITY AND/OR SCHOOL DISTRICT" whether for all or part of the tax year, who has taxable net profits and/or earnings even if no tax is due.

Failure to file a return may subject you to a $500 fine as well as be responsible for paying additional costs of collection.

ROUNDING OFF TO WHOLE DOLLARS – Round off cents to the nearest whole dollar. When rounding, drop amounts under 50 cents and increase amounts from 50 to 99 cents to the next dollar. For

example, $1.39 becomes $1.00 and $2.50 becomes $3.00. When you add two or more amounts to calculate the amount to enter on a line, include cents when adding the amounts and only round off the

total.

IF YOU HAD NO TAXABLE EARNINGS enter zero (0) in Line 1 and list the reason (e.g., retired, disability, housewife, active military duty, etc.), sign the form and return it to us. This will eliminate

needless correspondence.

IF YOU RECEIVED MORE THAN ONE SET OF TAX RETURNS, please return both tax returns to us. Write your correct social security number on each return and mark each return “RECEIVED 2

RETURNS”.

IF YOU MOVED from the beginning of the tax year to present, please fill out the Part-Year Resident/Income Proration Worksheet, which is

provided.

If you lived in different municipalities, falling under

different tax collector jurisdictions during the year, you must prorate your earnings accordingly and file with the appropriate tax collectors. Also, if you moved during this tax year between different

municipalities in our jurisdiction where the tax rates are different, you will need to file separate returns with us for each residence where there are different tax rates.

*For more information on active duty military inside PA, taxable retirement/savings plan distributions, non-taxable items, the military spouse residency relief act,*

*a resident of a reciprocal state working in our jurisdiction, or want to file for an extension please go to or contact our office.*

Line by Line Instructions

Line

Instructions

Report your total W-2 income/compensation. Submit one copy of all Form W-2(s) with your return. For full year residents use the Multiple W-2 Worksheet on the back of the tax return. Carry the

1

total(s) to the line on the tax return front. Part-year residents must complete the Partial Year Resident Proration Worksheet. The part-year resident worksheet is found on the website and with

your Local Earned Income Tax Return packet. Most taxpayers can use their Form W-2(s) as the source for obtaining their local wages, however, please keep in mind that emloyers can incorrectly

list local wages. If there are no wages listed in the local wage box use the amount listed in the state wage box first, if none listed use amount listed in federal wage box. If the wages shown in the

local wage box are lower than the wages shown in the federal, social security, or state wage boxes, the highest amount will be used for local wages unless the W-2, or information you provide,

explains the difference as non-taxable for local purposes. If the Form W-2 (s) has different amounts reported, you may want to ask your employer what makes up these differences and contact our

office to verify the correct amounts to use.

2

Taxpayers should enter the amount of their allowable business expenses by taking the total reported on their PA UE Form. The total must be prorated if the taxpayer reported a move for the tax

year. In order to claim the expenses they must be explained in detail and documentation must be available for the tax bureau’s review. The taxpayer has the burden of proving that any expense

claimed as a deduction from earned income is ordinary, actual, reasonable, necessary, directly related, and 100% required for employment in order to be deducted from earned income. We follow

the Pennsylvania Individual Income Tax regulations and guidelines. For additional information see the “Allowable Business Expense” section of the PA 40 instruction booklet, a copy can be found on

our website.

Subtract line 2 from line 1 and enter total here.

3

4

(a) Taxpayers should complete the Net Effect Worksheet on the back of the return to calculate the overall net effect of profit(s) and loss(es). This includes net profits/losses from Schedule C,

Schedule F from farming activities, and Form 1065 for Partnership activities (K-1). Use and submit copies of your PA state schedule K-1 (1065), C or F only if taxpayer is actively engaged in the

business. You must include Schedules C or F, we do not accept the PA SCHEDULE C-F. Do not include loss from tax shelters, passive limited partnerships, or hobbies. “Pass-through “ income

from an S-Corporation is NOT taxable and loss is not deductible. The taxable portion of a partnership for earned income tax purposes is usually the net earnings from self-employment less any

Section 179 expense (within Pa. guidelines). If a personal retirement plan (Keogh or IRA) has been used as an expense it must be added to net profit/loss for the earned income tax reporting.

Income derived from Limited Liability Companies (LLCs), Limited Liability Partnerships (LLPs), and Restricted Professional Companies (RPCs) is taxable provided that the participant is actively

engaged in the operation (not a passive or investment type involvement). Taxpayers who are members of these types of entities should file a copy of their Pa. state Schedule K-1 (Form 1065) for

each such entity. A taxpayer's rental income/loss does not apply to local filing unless the operation is a business (i.e., properly not filed on a schedule E, and subject to business privilege/mercantile

taxes). The leasing of tangible property is the operation of a business only if:

1. You offer the use of your property on a commercial basis to others in marketplace and at least one of the following applies:

* The average period of customer use is 30 days or less; or

* Your property is customarily made available for use only during defined business hours; or

* In addition to the property you also provide significant services to your lessee (Providing housekeeping service, room service, valet parking, decorating assistance, delivery services,

transportation services and concierge services can be significant services. Providing heat, lighting, electric service elevators, cleaning public access and exit areas, collecting trash, and maintaining

the property in a usable rentable condition are not usually significant services.); or

* The leasing activity is incidental to a real estate sales business; and

2. You offer the use of your property intending to realize a profit; and

3. The leasing of your property is a regular and continuous activity.

If the combined calculation for each taxpayer results in a loss, the value that is added to the adjusted W-2 income is zero. Losses cannot be used to decrease W-2 earnings. It should be noted that

the income for the taxpayer and spouse cannot be combined. A loss from a taxpayer cannot be used against income for his/her spouse.

(b) For other taxable income reported on a Form 1099 and other sources of income that may not have a form for reporting purposes taxpayer should complete the Other Taxable Income Worksheet.

Examples of these other income sources include but are not limited to: patents, fees, honoraria, etc.

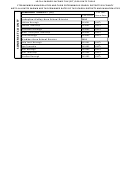

5

Add amounts from line 3 and 4 and enter total here.

6

Taxpayers in PA file with the appropriate tax collector a local EIT return for the municipality/school district where they declare their legal tax residence. If your tax residence does not levy an EIT, your

work site can tax your earnings at a non-resident tax rate if one has been enacted. If you have received a CTCB tax return but have a legal tax residence that is not a CTCB Member

municipality/school district that does levy an EIT, please file with the appropriate collector for that municipality/school district and provide a copy of your return, attachments, and proof of payment to

CTCB. The proof of filing elsewhere will allow us to correct our records and to transfer any withholdings that are available to the applicable tax office. If you are subject to a work site non-resident tax

rate, you may find it necessary to file a CTCB return as a non-resident to reconcile the tax due if your employer failed to withhold at the correct non-resident work site tax rate. The issue of whether to

file a tax return as a resident or non-resident is complex. Please contact our office if you are uncertain whether your personal circumstances require that you file a tax return or you have multiple

worksites. Staff will help you understand the filing requirements and provide you with a list of documentation that will be needed to certify your non-resident filing status. In addition to filing your tax

return, you may also need to update your employer’s payroll withholding records to ensure that future withholdings are completed at the correct local tax rate.

(a) Tax Withheld by Employer – Enter the total local tax withheld as reported on Form W-2(s) or the prorated shares as calculated on your Part-Year Resident Worksheet. This total should not

7

include local income tax withheld and/or paid to the City of Philadelphia or states other than Pennsylvania. Do not include Local Service Tax withheld if it appears on your Form W-2(s), SUI, or

Unemployment. If your employer(s) is located within a distressed area and withheld additional tax for that reason you may not take credit for the additional withholdings. Distressed/Commuter tax

will be systematically denied without notification. Contact our office with questions regarding distressed areas. If you reside in Southampton Twp or Wellersburg Boro, Somerset

County, please attach a list of your work address(es). If you work in a municipality where the non-resident rate is greater than .5% the additional tax will remain in the municipality you

work, and will not be refunded.

(b) Quarterly Tax Payments – This line should include the total self-payments that you or your spouse made for the tax year.

(c) Prior Year Overpayment – This line should include any amount of credit that you have available from a prior year tax return. The tax office will confirm this overpayment based on your prior years’

tax returns filed. Do not include overpayments for prior years refunded to you.

(d) Credit for tax paid to other states – This line allows the taxpayer to include an amount that is available as an out-of-state tax credit. This amount is determined by completing a Schedule G and

including a photocopy of the other state tax return and a copy of your PA state tax return and PA Schedule G. Schedule G is found on our website.

(e) Total - Line 7 (e) is a field that the taxpayer uses to sum all the credits that are available. The total credits will be compared to the total tax liability.

A taxpayer who has credits that are greater than the tax year liability can elect to have the excess credits refunded, credited to a future tax year, credited to a spouse’s balance due, or split between a

8

refund and a credit. Line 8 should be the total overpayment. Lines 8(a) and 8(b) should be used to indicate how you would like to use/receive the overpayment. If you wish to have your refund direct

deposited please fill out the proper information on the tax form otherwise your refund will be issued as a paper check. Please note that refund and credit requests without documentation

required for a complete, accurate tax return will delay your requests . Refund requests of $2.00 or less will not be honored. Tax returns beginning with tax year 2012 must be rounded up or

down (when applicable) to whole dollars.

9

The amount calculated as your balance due represents the unpaid balance of the tax liability. If the balance due is $2.00 or less, no payment is due. Please note that if your tax liability has

resulted in an underpayment, you may be required to remit quarterly self-payments for future tax years. If you do not receive FORM 521 by April 1st, please visit our website for a printable

521 quarterly payment form or contact our office. Failure to comply will subject you to interest, penalty, and possibly a fine and cost of collection.

10

(a) Interest and Penalty are calculated on the unpaid amount of the tax liability. Interest is calculated at the rate of 6% per annum; penalty accrues at the rate of ½ of 1% for each month or fraction of

month during which the tax remains unpaid. If you are required to make self-payments and have underpaid your quarterly estimated payments, you are subject to additional charges.

(b) If for any reason your return is filed after the due date you may be subject to additional costs of collection.

11

Once you have determined the payment due you should remit payment of the amount shown on line 11. Payee information for your payment appears on the front of the tax return. Please indicate on

the check/money order the name of the taxpayer, tax year, and last four digits of the social security number.

If filing a combined return, enter amounts enclosed. (A payment due and credit balance may be combined.)

12

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9