Instructions For Form Pt-106 - Retailers Of Non-Highway Diesel Motor Fuel Only - New York State

ADVERTISEMENT

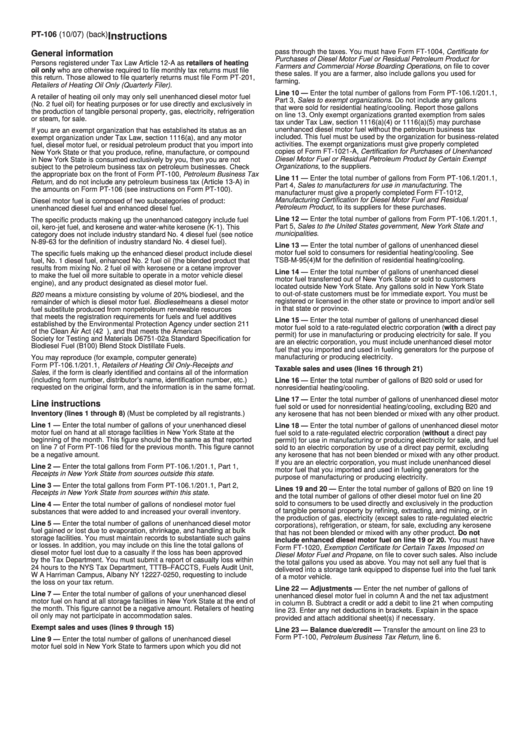

PT-106 (10/07) (back)

Instructions

pass through the taxes. You must have Form FT-1004, Certificate for

General information

Purchases of Diesel Motor Fuel or Residual Petroleum Product for

Persons registered under Tax Law Article 12-A as retailers of heating

Farmers and Commercial Horse Boarding Operations, on file to cover

oil only who are otherwise required to file monthly tax returns must file

these sales. If you are a farmer, also include gallons you used for

this return. Those allowed to file quarterly returns must file Form PT-201,

farming.

Retailers of Heating Oil Only (Quarterly Filer).

Line 10 — Enter the total number of gallons from Form PT-106.1/201.1,

A retailer of heating oil only may only sell unenhanced diesel motor fuel

Part 3, Sales to exempt organizations. Do not include any gallons

(No. 2 fuel oil) for heating purposes or for use directly and exclusively in

that were sold for residential heating/cooling. Report those gallons

the production of tangible personal property, gas, electricity, refrigeration

on line 13. Only exempt organizations granted exemption from sales

or steam, for sale.

tax under Tax Law, section 1116(a)(4) or 1116(a)(5) may purchase

unenhanced diesel motor fuel without the petroleum business tax

If you are an exempt organization that has established its status as an

included. This fuel must be used by the organization for business-related

exempt organization under Tax Law, section 1116(a), and any motor

activities. The exempt organizations must give properly completed

fuel, diesel motor fuel, or residual petroleum product that you import into

copies of Form FT-1021-A, Certification for Purchases of Unenhanced

New York State or that you produce, refine, manufacture, or compound

Diesel Motor Fuel or Residual Petroleum Product by Certain Exempt

in New York State is consumed exclusively by you, then you are not

Organizations, to the suppliers.

subject to the petroleum business tax on petroleum businesses. Check

the appropriate box on the front of Form PT-100, Petroleum Business Tax

Line 11 — Enter the total number of gallons from Form PT-106.1/201.1,

Return, and do not include any petroleum business tax (Article 13-A) in

Part 4, Sales to manufacturers for use in manufacturing. The

the amounts on Form PT-106 (see instructions on Form PT-100).

manufacturer must give a properly completed Form FT-1012,

Manufacturing Certification for Diesel Motor Fuel and Residual

Diesel motor fuel is composed of two subcategories of product:

Petroleum Product, to its suppliers for these purchases.

unenhanced diesel fuel and enhanced diesel fuel.

Line 12 — Enter the total number of gallons from Form PT-106.1/201.1,

The specific products making up the unenhanced category include fuel

Part 5, Sales to the United States government, New York State and

oil, kero-jet fuel, and kerosene and water-white kerosene (K-1). This

municipalities.

category does not include industry standard No. 4 diesel fuel (see notice

N-89-63 for the definition of industry standard No. 4 diesel fuel).

Line 13 — Enter the total number of gallons of unenhanced diesel

motor fuel sold to consumers for residential heating/cooling. See

The specific fuels making up the enhanced diesel product include diesel

TSB-M-95(4)M for the definition of residential heating/cooling.

fuel, No. 1 diesel fuel, enhanced No. 2 fuel oil (the blended product that

results from mixing No. 2 fuel oil with kerosene or a cetane improver

Line 14 — Enter the total number of gallons of unenhanced diesel

to make the fuel oil more suitable to operate in a motor vehicle diesel

motor fuel transferred out of New York State or sold to customers

engine), and any product designated as diesel motor fuel.

located outside New York State. Any gallons sold in New York State

to out-of-state customers must be for immediate export. You must be

B20 means a mixture consisting by volume of 20% biodiesel, and the

registered or licensed in the other state or province to import and/or sell

remainder of which is diesel motor fuel. Biodiesel means a diesel motor

in that state or province.

fuel substitute produced from nonpetroleum renewable resources

that meets the registration requirements for fuels and fuel additives

Line 15 — Enter the total number of gallons of unenhanced diesel

established by the Environmental Protection Agency under section 211

motor fuel sold to a rate-regulated electric corporation (with a direct pay

of the Clean Air Act (42 U.S.C. 7545), and that meets the American

permit) for use in manufacturing or producing electricity for sale. If you

Society for Testing and Materials D6751-02a Standard Specification for

are an electric corporation, you must include unenhanced diesel motor

Biodiesel Fuel (B100) Blend Stock Distillate Fuels.

fuel that you imported and used in fueling generators for the purpose of

manufacturing or producing electricity.

You may reproduce (for example, computer generate)

Form PT-106.1/201.1, Retailers of Heating Oil Only-Receipts and

Taxable sales and uses (lines 16 through 21)

Sales, if the form is clearly identified and contains all of the information

(including form number, distributor’s name, identification number, etc.)

Line 16 — Enter the total number of gallons of B20 sold or used for

requested on the original form, and the information is in the same format.

nonresidential heating/cooling.

Line 17 — Enter the total number of gallons of unenhanced diesel motor

Line instructions

fuel sold or used for nonresidential heating/cooling, excluding B20 and

Inventory (lines 1 through 8) (Must be completed by all registrants.)

any kerosene that has not been blended or mixed with any other product.

Line 1 — Enter the total number of gallons of your unenhanced diesel

Line 18 — Enter the total number of gallons of unenhanced diesel motor

motor fuel on hand at all storage facilities in New York State at the

fuel sold to a rate-regulated electric corporation (without a direct pay

beginning of the month. This figure should be the same as that reported

permit) for use in manufacturing or producing electricity for sale, and fuel

on line 7 of Form PT-106 filed for the previous month. This figure cannot

sold to an electric corporation by use of a direct pay permit, excluding

be a negative amount.

any kerosene that has not been blended or mixed with any other product.

If you are an electric corporation, you must include unenhanced diesel

Line 2 — Enter the total gallons from Form PT-106.1/201.1, Part 1,

motor fuel that you imported and used in fueling generators for the

Receipts in New York State from sources outside this state.

purpose of manufacturing or producing electricity.

Line 3 — Enter the total gallons from Form PT-106.1/201.1, Part 2,

Lines 19 and 20 — Enter the total number of gallons of B20 on line 19

Receipts in New York State from sources within this state.

and the total number of gallons of other diesel motor fuel on line 20

sold to consumers to be used directly and exclusively in the production

Line 4 — Enter the total number of gallons of nondiesel motor fuel

of tangible personal property by refining, extracting, and mining, or in

substances that were added to and increased your overall inventory.

the production of gas, electricity (except sales to rate-regulated electric

Line 5 — Enter the total number of gallons of unenhanced diesel motor

corporations), refrigeration, or steam, for sale, excluding any kerosene

fuel gained or lost due to evaporation, shrinkage, and handling at bulk

that has not been blended or mixed with any other product. Do not

storage facilities. You must maintain records to substantiate such gains

include enhanced diesel motor fuel on line 19 or 20. You must have

or losses. In addition, you may include on this line the total gallons of

Form FT-1020, Exemption Certificate for Certain Taxes Imposed on

diesel motor fuel lost due to a casualty if the loss has been approved

Diesel Motor Fuel and Propane, on file to cover such sales. Also include

by the Tax Department. You must submit a report of casualty loss within

the total gallons you used as above. You may not sell any fuel that is

24 hours to the NYS Tax Department, TTTB–FACCTS, Fuels Audit Unit,

delivered into a storage tank equipped to dispense fuel into the fuel tank

W A Harriman Campus, Albany NY 12227-0250, requesting to include

of a motor vehicle.

the loss on your tax return.

Line 22 — Adjustments — Enter the net number of gallons of

Line 7 — Enter the total number of gallons of your unenhanced diesel

unenhanced diesel motor fuel in column A and the net tax adjustment

motor fuel on hand at all storage facilities in New York State at the end of

in column B. Subtract a credit or add a debit to line 21 when computing

the month. This figure cannot be a negative amount. Retailers of heating

line 23. Enter any net deductions in brackets. Explain in the space

oil only may not participate in accommodation sales.

provided and attach additional sheet(s) if necessary.

Exempt sales and uses (lines 9 through 15)

Line 23 — Balance due/credit — Transfer the amount on line 23 to

Form PT-100, Petroleum Business Tax Return, line 6.

Line 9 — Enter the total number of gallons of unenhanced diesel

motor fuel sold in New York State to farmers upon which you did not

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1