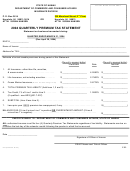

Form 314 - Annual Premium Tax Statement - 2013 Page 5

ADVERTISEMENT

Name of Insurer

SUPPLEMENTAL SCHEDULE A – FILE ONLY IF APPLICABLE

IF NONE, DO NOT FILE

Round All Amounts to Nearest Dollar

EXHIBIT NO.:

SCHEDULE A – Part I

INFORMATION:

Premium Tax Statement for the Year Ended December 31, 2013

APPLICABLE TO:

ALL INSURANCE (EXCEPT OCEAN MARINE AND LIFE INSURANCE)

INCLUDE ACCIDENT AND HEALTH PREMIUMS UNDER THIS EXHIBIT

FILE ONLY IF APPLICABLE – IF NONE, DO NOT FILE SCHEDULE A

State amount of premiums written, procured or received in Hawaii from risks or property resident, situated or located

A.

within Hawaii allocated or apportioned and reported as taxable premium of another state or other appropriate taxing

authority.

Premiums: $_________________

Reason:

$_________________

B.

State amount of premiums written, procured or received in Hawaii from risks or property resident, situated or located

within Hawaii considered not taxable in Hawaii. $__________________________.

Details of coverages

(group similar risks)

Premiums

Reason

$

$

$

EXHIBIT NO.:

SCHEDULE A – Part II

INFORMATION:

Premium Tax Statement for the Year Ended December 31, 2013

APPLICABLE TO:

LIFE PREMIUMS ONLY

FILE ONLY IF APPLICABLE – IF NONE, DO NOT FILE SCHEDULE A

C.

State amount of premiums for insurance written in Hawaii on individuals residing outside Hawaii on which tax is NOT

being paid to Hawaii or to another taxing authority.

Premiums: $_________________

Reason:

$_________________

[Reference for items A, B and C: Section 431:7-202, Hawaii Revised Statutes]

IF PAGE 5 IS NONE, PLEASE DO NOT FILE THIS PAGE

Page 5

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4 5

5